Josh Bivens, EPI’s Research and Policy Director, testified before the House Financial Services Committee Subcommittee on Monetary Policy and Trade, at a hearing on “Federal Reserve Oversight: Examining the Central Bank’s Role in Credit Allocation,” Rayburn Office Building Room 2128 , Washington, D.C., March 12, 2014.

The question that today’s hearing aims to address is whether or not unconventional monetary policies undertaken by the Federal Reserve since the beginning of the Great Recession (particularly “quantitative easing” (QE) or the purchase of long-term securities) have led to the Fed playing too large a role in economy-wide credit allocation, and if this role in credit allocation constitutes a threat to the Fed’s independence.

Specifically, the introductory memorandum for this hearing raises three particular concerns. First, has quantitative easing enabled (presumably excessive) federal spending? Second, has the Fed’s purchase of mortgage-backed securities (MBS) constituted an inappropriate favoring of the housing finance sector of the economy, and would any such bias towards this sector constitute a threat to the Fed’s independence? Third, will banking regulations promulgated since the crisis lead to an unwarranted increase in demand for certain specific asset classes relative to others?

In my testimony I will argue that too many observers seem eager to define central bank “independence” as either putting no weight at all on the “maximum employment” target of the Fed’s dual mandate, or as mechanically leaning against whatever is being done with fiscal policy. Neither of these are good guideposts to Federal Reserve independence, and in fact the Fed’s conduct in recent years – including the QE actions – is entirely consistent with its attempt to satisfy the dual mandate of price stability and maximum employment. It is true that the Fed’s conduct since 2008 is quite different than its conduct over much of the preceding decades, but that is simply a reflection of the extraordinary economic environment created by the Great Recession and resulting financial crisis.

Lastly, I will offer answers to each of three specific questions posed in the preparatory memorandum to this hearing. To preview these answers:

Have the Fed’s QE actions enabled higher levels of federal spending?

I argue that they have not, and that’s actually too bad. The economy remains deeply depressed and a large and persistent shortfall between aggregate demand and potential supply is the main reason why. Further, very slow rates of federal spending are the primary reason why at this stage in the recovery demand remains so muffled. Clearly nothing – not the Fed’s actions or anything else – have led to a sustained, atypically large rise in federal government spending because such an increase just has not happened. Just as clearly, such a sustained rise would actually be beneficial to the economy right now.

Have the Fed’s purchase of Agency bonds and MBS disproportionately aided the housing finance sector of the economy?

I argue that such purchases have indeed helped this sector, but because this sector was disproportionately damaged by the burst housing bubble, this was an appropriate thing to do. Focusing QE on particularly impaired financial markets – like housing – increases its impact in generating economic activity and employment.

Have regulations promulgated since 2008 encouraged financial institutions to hold a higher share of U.S. debt in their portfolios?

I argue that these regulations are likely to provide such an incentive, but that’s an appropriate response to the financial crisis of 2008. That crisis was driven in large part by assets held by banks turning out to be far less liquid than expected following adverse market shocks. U.S. government debt is highly liquid, even (or especially) in financial panics.

Central bank independence in inflationary versus deflationary economic environments

In the decades before the Great Recession, a growing majority of macroeconomists and policymakers agreed that the task of macroeconomic stabilization (that is, boosting the economy after negative shocks to aggregate demand and reining in a potentially overheating economy before accelerating inflation broke loose) should be left almost entirely to central bankers. Additionally, it was generally assumed that the main tool used for this purpose by central bankers – the control of short-term “policy” interest rates (like the effective federal funds rate and the discount rate controlled by the Federal Reserve) – would be sufficient to assure that such stabilization efforts would be successful.

This stance seemed to be based on an overarching assumption: that the main challenge faced by central bankers would be to rein in overheating economies and guard against inflation. If this was the primary challenge faced by central bankers, than short-term policy rates are indeed a powerful tool. In inflationary economies, central banks can raise short-term rates to discourage borrowing (and hence economic activity overall) from households and firms. This reduced borrowing and economic activity slows demand growth and hence puts downward pressure on inflation. Crucially, there is no ceiling to interest rates, so central bankers were free to push on this policy tool until it had its desired effect.

Another key assumption often embedded in this view is that fiscal policymakers, being often more subject to political constraints (the need to win elections in the short term), are perpetually prone to imparting an inflationary bias to the economy by borrowing too much, both to provide as many services as possible to voters without raising their taxes as well as to boost economic activity and lower unemployment. The fear is that short-sighted politicians would give no weight at all to the longer-run costs of overheating the economy – costs like high interest rates that could crowd-out productive investment and lower future productivity growth and the embedding of inflationary expectations in the economy that could accelerate over time. This assumption has led too many to believe that it is always and everywhere the Fed’s job to simply do the opposite of what fiscal policymakers are doing, and to label monetary policies that amplify, rather than muffle, fiscal policies’ impact on macroeconomic activity, as a de facto surrendering of monetary policy independence in the name of pleasing elected fiscal policymakers.

However, the last decade has seen this assurance that conventional monetary policy alone could ensure macroeconomic stabilization largely abandoned – and rightly so. In recent years, the primary problem faced by developed economies has not been persistent inflationary pressures in the system, but has instead been relentless deflationary pressures. This relentless deflationary pressure has been caused largely by the bursting of the house price bubble in the United States that has led spending by households, businesses, and governments to fall far too low to employ the economy’s productive resources. This gap between aggregate demand (desired spending by household, firms, and government) and the economy’s productive potential (or, the “output gap,” in economists’ jargon) has led to rising unemployment and intense downward pressure on both interest rates and inflation.

This means the primary challenge faced by all macroeconomic policymakers – including the Fed – is to engineer a restoration of domestic spending to close this “output gap.” But conventional monetary policy alone cannot do it – not least because while there is no ceiling to interest rates that will be hit when the main problem is fighting inflationary pressures, there is indeed a floor to interest rates that can (and has been) hit when central banks attempt to fight deflationary pressures. Nominal interest rates cannot fall below zero. When they do hit zero and large output gaps persist, the economy is often said to have entered a “liquidity trap.”

So, with conventional monetary policy largely defanged, this means unconventional monetary policy, along with fiscal policy (and, I’d argue, exchange rate policy as well), were needed to stem the crisis. Further, the sheer size of the negative demand shock that led to the Great Recession required a coordinated, not cross-cutting, response from all levers of macroeconomic stabilization policy to counter. So, from 2008 to the end of 2011, monetary policy was made extraordinarily accommodative and fiscal policy boosted aggregate demand significantly.

As monetary policymakers have since correctly stressed, the simple fact that both monetary and fiscal policy were pushing in the same direction during this time was not a surrender of central bank independence in any reasonable interpretation. As Ben Bernanke said:

[T]he role of an independent central bank is different in inflationary and deflationary environments. In the face of inflation, which is often associated with excessive [government borrowing and] monetization of government debt, the virtue of an independent central bank is its ability to say “no” to the government. [In a liquidity trap], however, excessive [government borrowing] and money creation is unlikely to be the problem, and a more cooperative stance on the part of central banks may be needed.

Another way to put this is that the problem faced by macroeconomic policymakers in normal times is to trade off declines in unemployment against rising inflation. When facing this trade-off from a starting point of roughly full employment, if fiscal policymakers provide stimulus that pushes down unemployment and boosts inflation, then one could indeed argue that central independence would require that they raise interest rates to push down inflationary pressures and to keep unemployment from falling.

But, over the past six years, as the economy has remained stuck in a liquidity trap with large output gaps persisting even as conventional policy interest rates remain at zero, there has been no trade-off between inflation stability and maximum employment. Instead, inflation has fallen even as joblessness has remained far above normal levels. Until this pattern changes, all levers of macroeconomic policy can (and should) be oriented to boost economic activity and arrest the downward drift of price growth. This means that the Fed’s effort to keep interest rates low in the face of fiscal stimulus was not an inappropriate surrendering of independence, rather it was a completely appropriate response to the economic environment at hand.

Monetary policy has actually been learning hard against fiscal policy since 2011

Further, it’s worth noting that even if one adhered to the incorrect view that monetary policy independence somehow required that monetary policy always and everywhere “lean against the wind” of fiscal policy, the last two years actually have seen such a leaning against the wind on the part of the Fed.

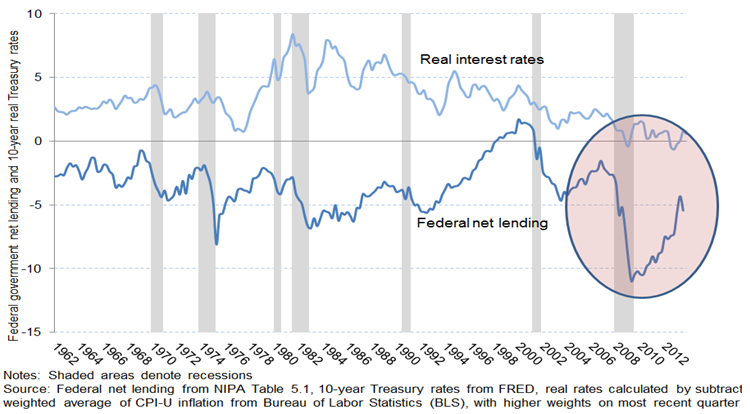

Federal fiscal policy has become extraordinarily contractionary in recent years, with the budget deficit seeing its largest three-year fall in history between 2009 and 2012, as shown in Figure 1.

Over this same time period the Federal Reserve has indeed leaned against this pronounced fiscal contraction by continuing its accommodative monetary policy. But if one believed that the Federal Reserve should simply set monetary policy to do the reverse of fiscal policy, this prescription has actually been fulfilled since the end of 2011. And this insight – that fiscal policy, particularly spending, has become extraordinarily contractionary in recent years – bears directly on the first of the specific questions identified in the introductory memorandum to this hearing.

Three concerns raised in the introductory memo for this hearing

Has QE been enabling higher federal spending?

The first issue of concern raised in this memorandum was that accommodative monetary policy – and quantitative easing specifically – could be somehow enabling higher levels of federal spending by artificially keeping one implicit price of this spending (higher interest rates) from materializing.

This is clearly not a cause for concern, for a number of reasons.

First, as noted above, both fiscal and monetary policy should have been extraordinarily expansionary since the beginning of the Great Recession. So if expansionary monetary policy had managed to keep fiscal policy expansionary as well, that would have been an entirely useful thing for the economy. And even today there remains an extraordinary degree of productive slack in the economy, and inflation is not just low but falling. So even if accommodative monetary policy were making fiscal policy more expansionary, that would be nothing but useful and appropriate given today’s economic environment.

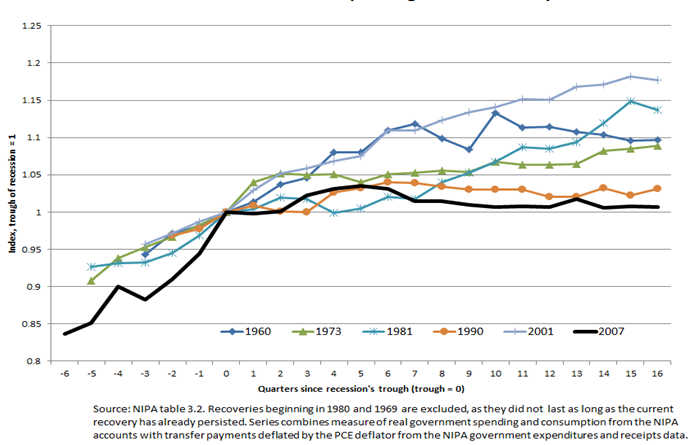

Second, as an empirical matter, it just is not the case that the accommodative monetary policy of recent years has led to rapid federal spending growth. On the contrary, federal spending has been extraordinarily austere in recent years, with the slowest growth of federal spending during any recovery (of comparable length to the current recovery) since World War II (see Figure 2 below). Again, it should be stressed that this fiscal austerity on the spending side has been quite damaging to the economic recovery, but it has happened, hence it is hard to argue that more rapid spending cuts would have occurred absent the Fed’s accommodative monetary policy.

As a side note, while spending growth has been historically slow in recent years, it is also the case that federal taxes as a share of GDP have been low as well. Part of this reflects cyclical weakness in tax collections, and part of this has reflected temporary efforts to boost growth in the aftermath of the Great Recession (for example, the Making Work Pay tax credits included as part of the American Recovery and Reinvestment Act (ARRA) and the payroll tax cuts negotiated at the end of 2010 as part of the deal to delay the expiration of the 2001 and 2003 tax cuts aimed at higher-income households). Given that tax cuts are much less efficient forms of fiscal stimulus per dollar added to the deficit, this low tax share of GDP doesn’t materially change the story about fiscal policy as a whole imposing a large drag on growth in recent years. However, it does illustrate the point that if one is determined to be worried about the enabling effect of accommodative monetary policy on overall fiscal policy, one should take taxes into account as well. And while the case that federal spending has grown too rapidly in recent years does not fit the facts of recent years at all, there is some evidence that the federal tax share of GDP has fallen over the course of the Great Recession and recovery – even after accounting for cyclical effects. The Congressional Budget Office (CBO), for example, has estimated that federal revenue after accounting for cyclical effects was 18.5 percent of GDP in 2007 (the last prerecession year), yet has averaged just 17.0 percent since 2007 (although it had risen to 18.2 percent by 2013).

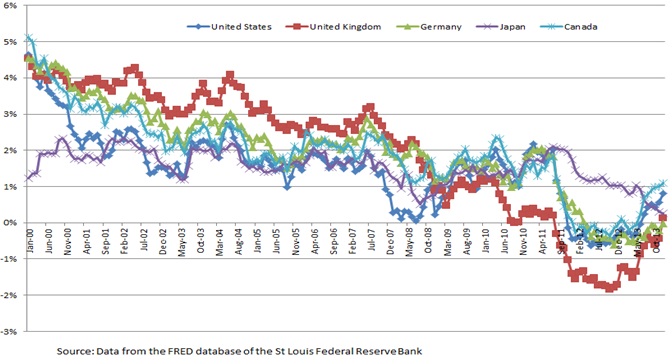

Lastly, we should put the empirical effect of QE on long-term Treasury rates into perspective. Long-term interest rates would surely still be historically low even without the impact of QE. For example, Bernanke (2012) has shown that inflation-indexed yields on government bonds have collapsed in recent years to historic lows across a range of countries with quite different monetary policy approaches to the crisis. Figure 3 looks at a cruder version of the evidence Bernanke cited, charting 10-year nominal yields on government debt minus the 3-year average of growth in consumer prices for each of the countries (a very rough approximation of real interest rates). The rapid downward drift of interest rates – particularly in recent years, is apparent.

This collapse of interest rates should not be a huge surprise. Long-term interest rates essentially reflect three components: expected inflation, the expected path of short-term rates, and the “term premium”. The first component, expected inflation, has declined significantly since the start of the Great Recession, driven largely by the gap between aggregate demand and the economy’s productive potential. The most closely-watched measure of inflationary pressures in the U.S. economy – the “market-based” core deflator for personal consumption expenditures – rose at just 1.1 percent year-over-year in all 4 quarters of 2013. So this component of long-term interest rates is clearly placing great downward pressure on them.

The second component – the expected path of short-term rates – has also put downward pressure on long-term rates in recent years. This is also due to pronounced economic weakness that has led the Fed (and other central banks throughout the world) to keep short-term policy rates low, and to signal clearly that these shall remain low so long as large unemployment remains elevated, output gaps persist, and inflation remains low.

The third component – the term premium – is the one most directly affected by QE. The term premium is the amount that holders of long-term debt must be compensated to take on the higher risk of swings in the return of this debt relative to shorter duration assets. By buying Treasuries, the Federal Reserve has reduced this term premium through its QE activities. These effects are detectable in statistical tests, and the lower long-term rates resulting from QE do provide a modest boost to the economy, but they are not the primary reason why interest rates have fallen in recent years to historic lows. For example, some of the larger estimated effects of QE on long-term Treasury interest rates come from Gagnon et al. (2011). They find that “the overall size of the reduction in the ten-year term premium appears to be somewhere between 30 and 100 basis points, with most of the estimates in the lower and middle-thirds of this range.” Take a look again at the interest rates in either Figure 1 or 3 above – 30 to 100 basis points (or 0.3 to 1 percent) just would not change the general story that interest rates in recent years have been pushed to extraordinarily low levels relative to historic norms.

Finally, it is worth noting two countervailing effects of QE on long-term interest rates, running through the inflation and term structure components described above. If QE leads the economy to run closer to potential, this can increase inflationary expectations and shorten the period over which investors believe the Fed will need to keep short-term policy interest rates very low. Both of these expectations-based channels can actually mildly boost long-term rates.1

So, to conclude this section, it seems quite hard to make the empirical case that the Fed’s QE activities have led to such economically large declines in long-term interest rates that would materially change the cost/benefit analysis of federal spending. And, it just is not the case that federal spending has reliably risen as QE has continued – in fact the past two years have seen some of the slowest spending growth in history, and enormous declines in federal budget deficits. In an important sense, this is all to the bad for the recovery. The large drag from fiscal policy is by now the primary reason why growth in the current recovery lags so badly relative to historic norms. If the QE activities had managed to keep this fiscal drag from occurring, we would have a much healthier economy today.

Has the Fed’s purchase of MBS been bad for the economy or for the Fed’s independence?

The second issue raised in the introductory memorandum concerns the Fed’s purchase of mortgage-backed securities. The memo expresses concerns that these purchases constitute the Fed “favoring certain sectors of the economy over others.”

In regards to this concern, the broad premise that focusing much of QE on housing-related finance (both by buying the debt of the federal housing agencies and by buying MBS) has provided disproportionate aid to this sector is actually correct. But because this sector was so impaired by the burst housing bubble and resulting financial crisis, and because QE works best when focused on impaired markets, I think this was an economically appropriate thing to do.

If one takes as given that pushing down long-term interest rates even below where the extraordinarily weak economy had pushed them was a useful response to the Great Recession and resulting slow recovery (and I do take this as given), then the Fed was going to have to buy some sort of assets. Buying long-term Treasuries was likely undertaken (at least in part) because these purchases seemed to stray the least distance from conventional Fed open market operations. But concentrating QE only on Treasuries would have severely hamstrung its overall effectiveness.

This is because one key benefit of QE is to reduce long-term rates for assets besides Treasuries, by reducing the risk premium associated with them – sometimes known as the “market functioning channel.” The intuition is that assets that are not Treasuries can sometimes be risFky simply because the market trading in them is not as liquid as that for Treasuries, and asset holders looking to sell them may find they cannot do so without impacting the price because of a lack of willing buyers. By boosting their purchase of mortgage-backed securities, the Fed substantially reduced the risk premium associated with them, and the empirical estimates of the interest rate effects on MBS are significantly larger than for Treasuries.

It is well-established that QE is more effective when undertaken in markets that are impaired and afflicted by deficient liquidity – and the MBS market in the aftermath of the Great Recession was almost certainly so impaired. Further, a key benefit of expansionary monetary policy has traditionally been the ability of homeowners to refinance their mortgages at lower interest rates, thereby freeing up more resources for spending elsewhere. QE in the MBS market significantly helped this channel of monetary policy.2

The key insight behind recognizing that QE needed to go beyond simple Treasury purchases to be most effective is simply that there is not just one “interest rate” in the economy. Instead, there are multiple interest rates, and even multiple long-term interest rates. And expansionary monetary policy should aim to reduce those long-term interest rates most relevant to households’ consumption and firms’ investment decisions – and these are not the Treasury rates. Putting downward pressure on Treasury rates should result in these other rates coming down as well, but there are times when the risk premium to assets that aren’t Treasuries rises substantially (say in the aftermath of the Great Recession and the related financial crisis), and simply pulling down only Treasury rates would not be the most effective way to conduct monetary policy.

So has the QE activity of purchasing MBS “favored one sector of the economy”? Well, yes. But it was a deeply impaired sector, and its impairment was blocking what has been a traditionally powerful transmission mechanism that translated expansionary monetary policy into increased economic activity and employment. Targeting asset purchases on those markets that are most impaired and would benefit the most from such purchases seems like prudent policy. This is not a perspective that is incompatible with rules-based policy either – as Posen (2012) has noted:

What matters for the central banks’ mandates is not that you do something that has no distributive effects because that’s nonsense to hope for. Everything the central bank does has some amount of distributive effects. What matters is that the committee is pursuing a policy that is not clearly motivated or traced to a distributive effect as a goal – monetary policy can still be motivated by aggregate welfare in design. That should be done upfront when proposing a targeted QE policy. And so central bank committees can identify that, for example, in the U.K. the small business market for lending is the most impaired and therefore, the new FLS should be acting on that. You can identify that in the Euro area, in my view, the key issue was the semi-panic in sovereign debt markets for Italy and Spain, and that is where the ECB has now committed to conditionally intervening. You can identify in the U.S. that the mortgage market remains in many ways impaired, though has been some progress, and that is where the FOMC has since chosen to intervene further…such targeted QE policies should lead to bigger bang for the central banks’ created buck.”

Have regulations promulgated since the Great Recession provided a bias to holding some assets over others?

The final concern raised in the introductory memorandum concerns regulations passed in recent years in response to the financial crisis caused by the burst housing bubble. The memo raises concerns that such regulations “provide strong incentives for banks to crowd into certain asset classes, particularly sovereign debt.”

I agree, in regards to this concern, that the premise is largely right, but the conclusion is not. Some regulations passed in the wake of the Great Recession and associated financial crisis do indeed provide incentives for banks to have a different capital structure than they would have absent these regulations. But far from being a source of concern, such incentives are a reasonable response to the financial excesses that built up and help cause the financial crisis.

In frictionless textbook models, a firm’s (including a bank’s) choice of capital structure is irrelevant and no one structure is riskier than another. In such models, a government that then provides incentives for one capital structure over another is bound to simply introduce inefficiencies into the capital allocation process with no corresponding benefit.

However, the last financial crisis should have convinced us that this just is not true. Left to their own devices, financial institutions are prone to, over time, taking on higher leverage and less liquid capital structures than is healthy in the longer term in a search for higher short-run returns.

Regulations in recent years have aimed to reduce banks’ leverage and to boost requirements for banks’ liquidity coverage ratios. It is this last category – boosting liquidity – that probably has the largest impact on the incentive of financial institutions to invest in sovereign debt.

These regulations essentially allow financial institutions to hold some forms of sovereign debt instead of cash and still have it count towards required liquidity coverage ratios. For U.S. debt, this seems completely appropriate. While there is economic risk associated with financial institutions holding U.S. debt, there is also economic risk associated with holding currency or demand deposits. What is relevant in this context is not the complete absence of risk, but the expectation that such debt is liquid. And the liquidity of U.S. debt has never been cast into doubt during this crisis.

The Volcker rule allows banks to continue proprietary trading of some sovereign debt using their own funds, while many other trades are limited. The rationale for this is related to the insight above about the Basel III regulations: A highly liquid market in government securities demands that financial institutions play a market-making role.

If one was determined to believe that financial markets were always and everywhere efficient and self-regulating, then many of the regulations promulgated in recent years would not make much sense. But these markets are not efficient and self-regulating, and the routine abandonment of liquidity in favor of higher returns was a key root of the financial crisis. Regulatory changes that provide an incentive for financial institutions to hold a higher share of more-liquid assets on their books are a sensible (though very partial) response to these crises.

—Josh Bivens joined the Economic Policy Institute in 2002 and is currently the director of research and policy. His primary areas of research include macroeconomics, social insurance, and globalization. He has authored or co-authored three books (including The State of Working America, 12th Edition) while working at EPI, edited another, and has written numerous research papers, including for academic journals. He appears often in media outlets to offer economic commentary and has testified several times before the U.S. Congress. He earned his Ph.D. from The New School for Social Research.

References

Bernanke, Ben. 2012. “Long-Term Interest Rates.” Speech At the Annual Monetary/Macroeconomics Conference: The Past and Future of Monetary Policy, sponsored by Federal Reserve Bank of San Francisco, San Francisco, Calif.

Gagnon, Joseph, Matthew Raskin, Julie Remache, and Brian Sack. 2011. “The Financial Market Effects of the Federal Reserve’s Large-Scale Asset Purchases.” International Journal of Central Banking. Volume 7(1).

Posen, Adam. 2012. Comments on “Methods of Policy Accommodation at the Interest-Rate Lower Bound,” by Michael Woodford. FRBKC Economic Policy Symposium on the Changing Policy Landscape. Jackson Hole, Wyo., August 31, 2012.

Endnotes

1. It’s important to note that these countervailing effects do not mean that QE is hence ineffective. In essence, QE is at root an effort to return the economy to a state where higher interest rates can be sustained, and the upward interest rate pressure described above is actually evidence that this is (partially, at least) working.

2. Many observers have noted that this mortgage refinance channel has unfortunately been blocked by the fact that many homeowners are underwater (owing more on their mortgage than the house is currently worth), and the failure of housing regulators to modify refinancing rules to allow such underwater homeowners a chance to refinance.