See Snapshots archive.

Snapshot for April 9, 2008.

Corporate tax declines and U.S. inequality

by John Irons

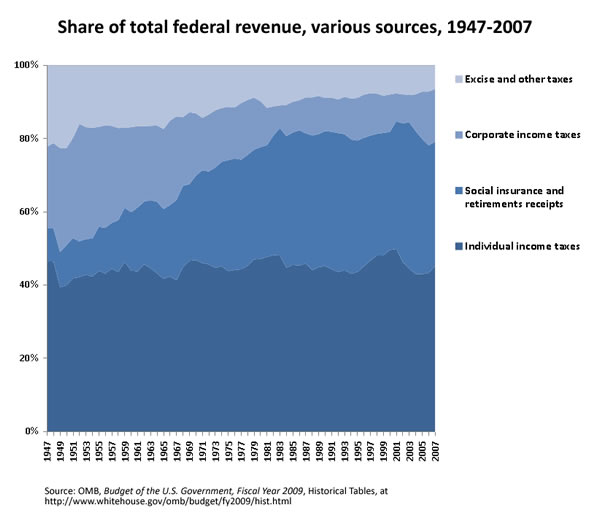

Over the last 60 years, the U.S. tax code has dramatically shifted away from corporate taxes and toward taxes on individuals, especially through the payroll tax, the financing backbone of Social Security and Medicare. In the 1950s, the corporate income tax brought in, on average, one of every four dollars in federal tax revenues. By the 2000s, however, it raised just one of every 10 tax dollars.

The shrinking share of corporate taxes was made up by an increase in payroll taxes to fund social insurance and retirement programs. Excise and other taxes—such as fuel taxes, phone taxes, etc.—shrank as well over the last 60 years, while the individual federal income tax rose slightly, from an average of 43% of total federal revenue in the 1950s to 46% in the 2000s (see chart).

This shift is important because of who pays these different taxes. The corporate income tax is significantly more progressive than other taxes. Those with incomes in the top 20% of the income distribution (those making more than about $86,000 a year in 2007) pay four times the average tax rate on corporate income than the middle 20% (those making between $27,000 and $48,000); while, for the payroll tax, those in the top 20% actually pay less than those in the middle as a share of their income.1

This shift has been one of the factors leading to the drop in average federal tax rates for the very highest earners. Between 1960 and 2004, the average tax rate has fallen by about 14 percentage points (from 44.4% to 30.4%) for the top 1% of earners (those making more than $435,000 in 2007), while it has increased slightly (from 15.9% to 16.1%) for those in the middle 20%. 2

Without offsets, further erosion of corporate tax revenues—either through lower statutory tax rates or through special preferences—would expand the already wide and growing income inequality in the United States.

Notes

1. See Tax Policy Center, Table T06-0308, “Current-Law Distribution of Federal Taxes By Cash Income Percentiles, 2007,” November 30, 2006.

2. See Thomas Piketty and Emmanuel Saez, “How progressive is the U.S. federal tax system? A historical and international perspective.” Journal of Economic Perspectives, Winter 2007; data at http://elsa.berkeley.edu/~saez/jep-results-standalone.xls .