Briefing Paper #319

See also: PowerPoint presentation: Paid sick days in the United States

American workers are more productive than ever before, but they are less secure in their ability to provide for their families. Workers without paid sick days—nearly 40% of the private-sector workforce—are among the least economically secure, and an illness forces them to take time away from work without pay and puts them at risk of losing their job. Lack of paid sick time means that an illness can potentially cost a family thousands of dollars in income and jeopardize their ability to afford food, rent, health insurance, and many of the other basic goods that are essential to well-being. Just three and a half days of missed work because of illness is equivalent to an entire month’s groceries for the average family.

This paper looks at economic security for working families, and shows how a national paid sick days policy—providing a few federally protected paid days off each year that workers can use to recover from illness, care for sick family members, or seek medical care—would promote workers’ financial stability and the economic security of their families. The paper explores in detail the following major findings:

- Nearly 40 million private-sector workers do not have paid sick time.

- Employees without paid sick time are likely to go to work sick, where they will have reduced productivity, at a significant cost both to their employer and to their possibility for professional advancement.

- Without paid sick leave, parents are forced to send sick children to school, which could potentially impact their long-term health and educational performance.

- A two-child family with two workers earning the average wage for workers without paid sick time would lose the family’s entire health care budget after just three days of missed work.

- A two-child family with a single working parent earning the average wage for workers without paid sick time ($10/hour) cannot miss more than three days of work in a month without falling below the federal poverty line.

- Taking unpaid sick time leaves workers vulnerable to losing their jobs in an economy with a stubbornly high long-term unemployment rate.

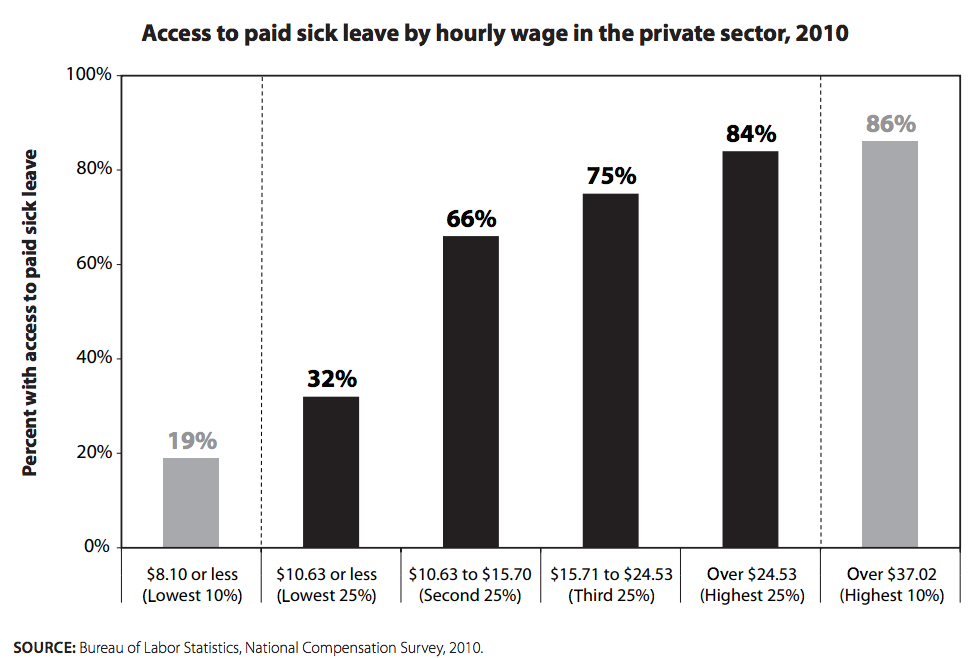

Despite the obvious need for paid sick time for workers and their families, there is currently no federal law that ensures all workers are able to earn such paid leave. As a result, only about 62% of private-sector workers have paid sick time, leaving almost 40 million workers without this basic protection (U.S. DOL 2010b). Furthermore, access to paid sick time is not evenly distributed throughout the workplace—workers in some occupations and industries are much more likely to have it than others (Levine 2010). As Figure A shows, the disparity by wages is very large: 86% of workers in the highest wage decile (top 10%) have access to paid sick time, compared to just 19% of those in the lowest wage decile and 32% in the lowest quartile (bottom 25%). The general trend is that workers who have the fewest economic resources are also the least likely to have access to paid sick time.

In this paper, we primarily make two major points. First, we define economic security and show how, for most working families, it has declined over the past 30 years, a time when changing family and workplace demographics require updated workplace standards that take these changes into account. Second, we show why access to paid sick time is critically important for family financial security and well-being by outlining the consequences that the lack of access to paid sick time has on basic family budgets and the ability of working families to make ends meet.

The decline of family economic security

The Great Recession showed how quickly millions of workers can lose their jobs and their incomes, with unemployment often lasting for months or even years. The recession and its aftermath have been fraught with economic insecurity and job loss, in many cases leading to downward mobility, declining living standards, and a growing inability to pay for basic needs. Although there is no technical definition for “economic security,” most people know intuitively that it means the ability to provide for your family, and the confidence that you will continue to be able to provide for them in the near future and beyond. Economic security can also help the overall economy—families who are more confident in their finances are more likely to make investments, like buying or fixing a home (Hacker 2007). They may also be more likely to help pay for their children’s

education, leading to better incomes for the next generation.

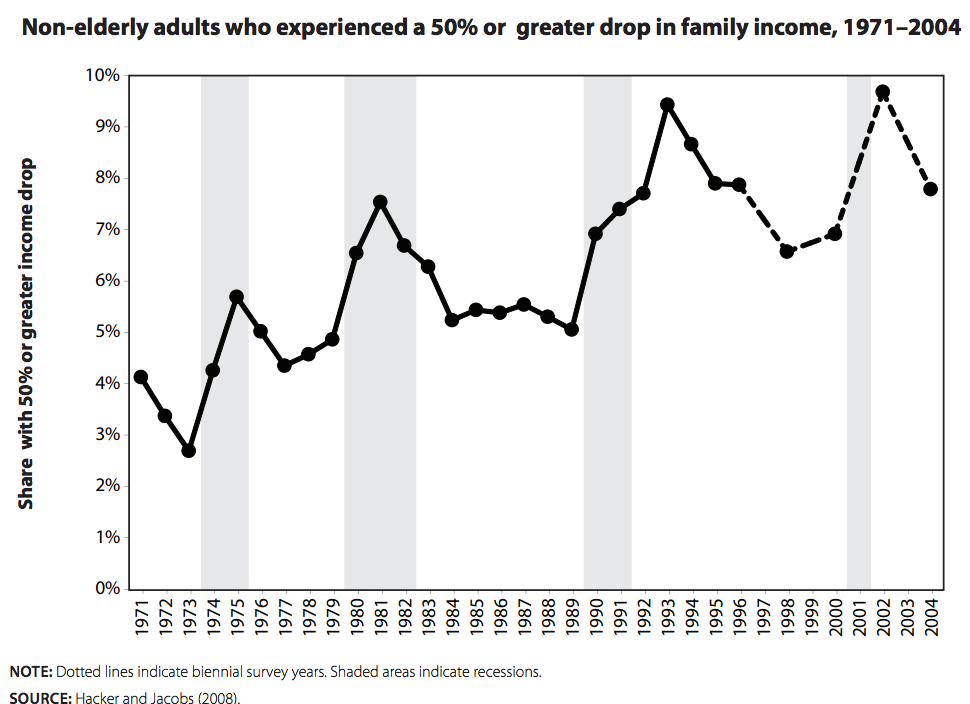

Many recent studies examine the issue of economic security. Hacker and Jacobs (2008) document the decline of economic security in America in recent decades. As shown in Figure B, they find that around 4% of non-elderly adults experienced family income drops of 50% or more during the early 1970s, compared with about twice that in the early 2000s. The authors attribute this decline to several factors, including the decreases in employer-sponsored health insurance and pension plans, and increases in consumer debt and involuntary job displacement. This greater family income volatility can also heighten family conflict and cause families to move in search of better economic opportunities (Batchelder 2010). Hacker et al. (2010) show how economic security typically falls during a recession. These trends have been worsening for over 30 years, and the Great Recession has only exacerbated these problems, especially for those with low incomes. These workers typically don’t have savings to draw from during a downturn, leaving them more vulnerable to income volatility. As we show later in the paper, simply missing a few days of work for a low-income worker can mean falling under the poverty threshold.

Paid sick time is one of many important ways to increase economic security for working families. It gives workers a valuable safety net when they or their loved ones fall ill. Paid sick time provides workers with job and income stability and the knowledge that if a common illness arises, they will still be able to provide for their families. Workers with paid sick time have a more predictable level of income that makes it easier for them to manage their monthly finances. Even for workers who don’t use paid sick time, simply knowing they have this safety net makes them feel more secure. Furthermore, workers with paid sick time don’t need to worry about losing their jobs as a result of illness.

The growing need for paid sick time

Families and workplaces look different now than 20, 40, or 60 years ago, and yet workplace policies have not kept pace. Our lack of federal legislation ensuring paid sick leave is the vestige of a time when only one parent worked while another provided primary care to children and older adults. Now, however, women make up half of the labor force, and families are increasingly dependent on two parents’ incomes to make ends meet. This mismatch between families’ needs and our workplace policies has serious economic consequences for families.

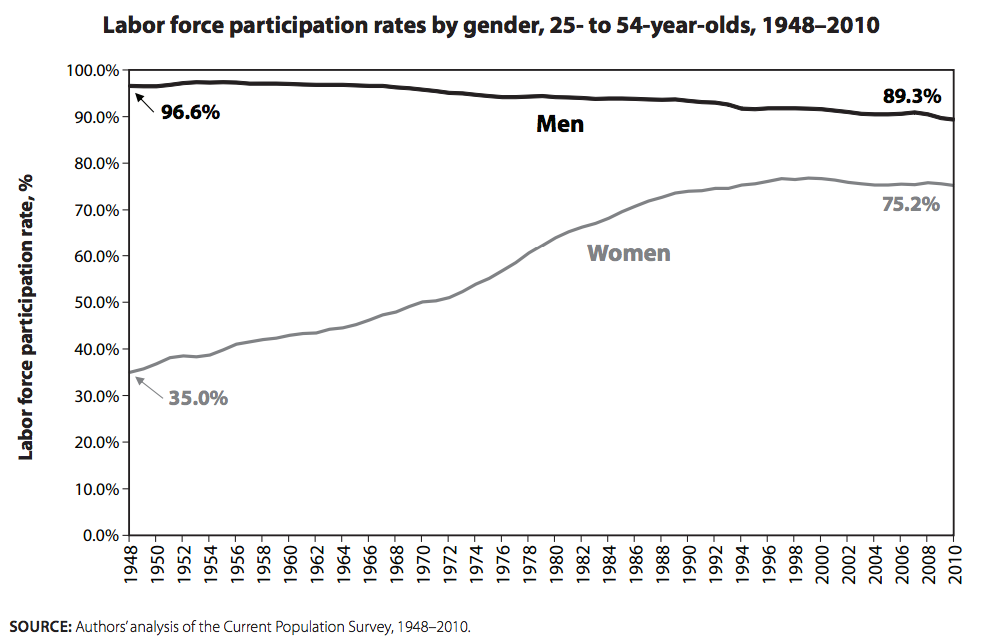

As shown in Figure C, women are now more than twice as likely to be in the workforce than they were 60 years ago. In 1948, only about 35.0% of working-age women were in the labor force, compared with 75.2% in 2010 (U.S. DOL 2010a). During this period, men’s labor force participation fell slightly, but this small decline was dwarfed by the increase for women. Furthermore, families are more than twice as reliant on the income provided by women: More than 63% of mothers earned a significant share1 of their family’s income in 2008; the percentage was a little under 28% in 1967 (Boushey 2009). The movement of women into the workplace is being driven by families’ needs for a second income just to get by. Over the last 30 years, hourly wages have barely budged for most workers after adjusting for inflation. Women have entered the labor force in part to compensate for this lack of real wage growth. According to Mishel, Bernstein, and Shierholz (2009), married couples without a working wife earned about the same amount in 2007 as they did in 1973; in other words, these families saw zero income growth over more than 30 years.

These changes have resulted in a larger number of children with all parents working full time (either both parents or one in the case of single-parent families).2 In 1968, only 24.6% of kids had all their parents working full time, compared with 48.3% in 2008 (CEA 2010). Parents in many families today are unable to take care of a sick child without missing work, unlike in the past. With more kids dependent on working parents, families have a greater need for access to paid sick time that can be used when a child is sick, but we know that millions of parents lack this protection.

In addition to child-care concerns, many U.S. workers also care for their aging parents. As health care advances lead to greater life expectancy, this kind of care-giving will only become more widespread. In 2009, there were 27 people age 65 and older for every 100 workers, the highest this ratio has ever been (U.S. DOL 2010a). This recent increase is partially due to the recession, which destroyed several million jobs, but it is also a result of the aging baby boomer generation. And as baby boomers retire, this ratio is expected to increase. According to the Council of Economic Advisors (2010), almost one out of five workers already provide care for someone over the age of 50. However, despite the growing need for workplace flexibility, including the ability to take a paid sick time when an older parent or relative needs medical care or has a routine illness, our laws have not adapted to the new norm. This argues not only for paid sick time for the occasional illness, but also an even more substantial safety net, such as paid family and medical leave for longer care requirements.

The costs of going to work or school while sick

For the tens of millions of workers without access to paid sick time, falling ill creates a dilemma with no good options. For many, there really is no choice—missing work and losing a day’s pay might mean being unable to pay rent for the month or buy food or medicine. Many workers feel forced to simply go to work sick (known as “presenteeism”), where they are likely to be less productive and more prone to mistakes.3 As job quality suffers, the worker may be at risk of termination. Finally, the lack of rest and/or medical attention may cause workers to be sick for a longer period of time. This is not only a cost to workers and their families, but also to businesses. Research shows that workers without paid sick time are more likely to go to work sick (Smith and Kim 2010), and employers bear the cost of the lost productivity that results—a cost that may well exceed that of providing paid sick time.

Families also bear costs when working parents are forced to send a sick child to school or delay necessary preventive care. According to one survey, parents without paid sick days are twice as likely to send a sick child to school, and are five times as likely to take a child or family member to an emergency room because of the inability to take time off during the work day (Smith and Kim 2010). If a parent is forced to work instead of attending to a child’s care, then the family may experience financial burdens associated with delayed health services, including higher costs arising from untreated illnesses, the higher incidence of health problems, and future financial risks associated with long-term illnesses. In some cases, where routine care or early treatment can mitigate the need for hospitalization, the family (or the health care system) incur the unnecessary cost of hospitalization. In 2006, nearly 4.4 million hospital admissions in the U.S., totaling $30.8 billion in hospital costs, could have been prevented with timely and effective ambulatory care or adequate patient self-management of the condition (Russo, Jiang, and Barrett 2007).

Delayed medical care undermines a child’s health and future development (IOM 2002). Children may, as a result, face longer illnesses and poorer health in general. Parents whose children lack routine care may fail to detect conditions such as ear infections, iron deficiency anemia, and lead poisoning. Such conditions, left untreated, have serious ramifications on a child’s language development, performance in school, and overall intellectual ability (Dallman, Yip, and Johnson 1984; Lozoff et al. 1998; Canfield et al. 2003). Unfortunately, many parents of children with chronic conditions do not have access to paid sick days. Forty percent of working mothers with asthmatic children and 36% of working mothers whose children have chronic conditions have no paid leave (Heymann, Earle, and Egleston 1996). Asthma is one of the most common chronic conditions among children, and if left untreated may result in hospitalization (Lovell and Miller 2009).

Improvements in health lead to better outcomes at school, including paying attention in class and keeping up in school activities (Brown 2004). In the long run, better health improves future prospects and increases earnings, which benefits both the future adults and their communities in the form of a better economy and higher government revenues (Hadley 2002). For example, Savage et al. (2004) find some evidence that children who receive early preventive dental care incur fewer dental health costs in the future. In contrast, untreated vision, hearing, and oral health problems can all cause distractions from learning (Rothstein 2004).

The costs of missing work without paid sick leave

The second option for ill workers without paid sick time is simply to miss work. However, losing even a day of pay may not be a viable option for workers who are living paycheck to paycheck—missing work might mean being unable to pay rent or buy food for that week. According to a recent survey, some 44% of people are living paycheck to paycheck all of the time or most of the time (Lake Research Partners 2010). Missing work also leads to job loss, the threat of job loss, or other workplace discipline. Sixteen percent of American workers report that they or a family member have lost a job or been otherwised punished, or that they would be fired, for taking time off work to care for a sick family member or their own illness (Smith and Kim 2010).

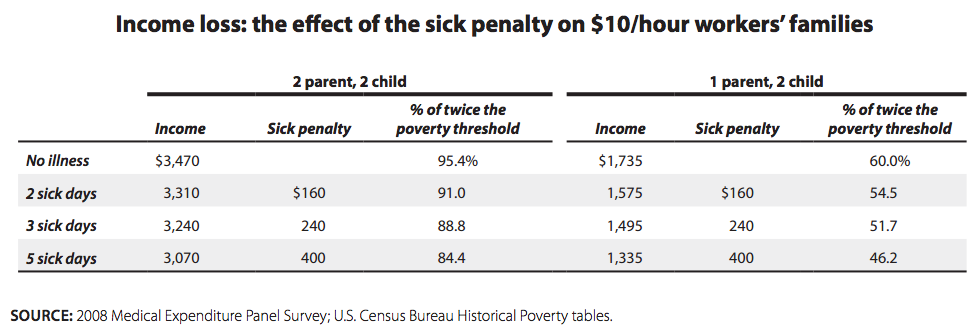

The income loss associated with sick days is not trivial. For millions of working families, missing a day, two days, or five days of pay can have serious consequences. As noted earlier, the workers without access to paid sick time generally earn much less than those who have it. Lack of paid sick days compounds the critical shortfalls that already exist in family budgets. The median wage for workers without paid sick time is $10 an hour, compared with $19 for workers who do have it.4 This means that a full-time worker without paid sick time can expect to earn about $20,800 a year, or $1,735 a month. In many places, this is not nearly enough to make ends meet. There are several estimates of what a family of a given size needs to earn in order to get by, but one of the most frequently used is twice the federal poverty threshold (Blank 2008; Lin and Bernstein 2008), though many estimates suggest that even 200% of the poverty line is insufficient (Fremstad 2010). If both parents are working at $10 an hour full time, then their total family income would be $41,600, about 95% of twice the federal poverty line and thus just below the standard for a family budget. Three days of illness more than double that shortfall, while five days of illness triple it.

For the workers least likely to have paid sick days, it is clear that missing work because of illness has a serious impact on family economic security (Table 1). Using the same standard of twice the poverty threshold, a family needs to earn $3,639 a month in order to get by. As mentioned above, even without getting sick, the average two-child family with two parents working full-time jobs without paid sick leave earns $3,470, not enough to meet this standard. Missing five days of work will cost this family $400, reducing its income to $3,070 for the month. Five unpaid days means an income drop to 84% of the amount needed to get by, putting families in the position of potentially foregoing critical expenditures, such as gasoline, utilities, food, or health care, a benefit that is even more critical under the circumstances.

For single parents, the situation is even worse. A worker without paid sick time making $10/hour can expect to earn the same $1,735 per month, but without a second source of income, this is far below the three-person family budget of $2,891 a month. In fact, if this worker misses more than three days of work in a month, her income will be less than half of the family budget and below the federal poverty threshold.

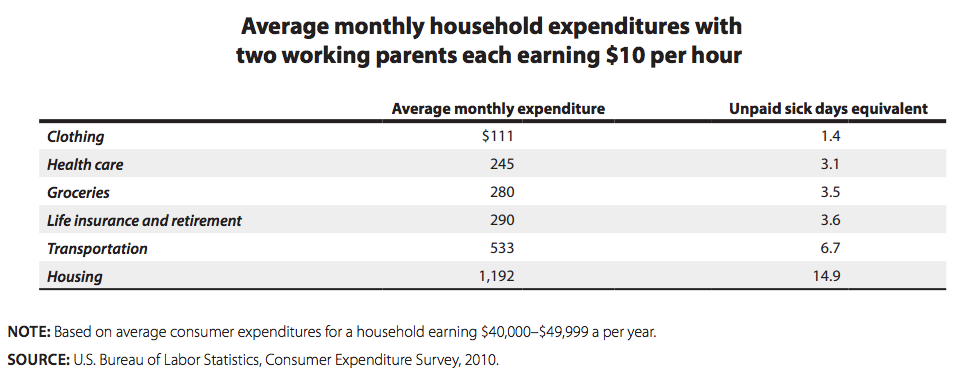

Column 1 of Table 2 displays the average monthly household expenditures on a selected set of goods for a household earning between $40,000-$49,999 per year (U.S. DOL 2008), the range in which a family of four with two parents working full time at $10 per hour ($41,600 annually) would fall. The second column illustrates the number of unpaid sick days each monthly expenditure in a family budget costs. For example, if one parent needs to take off 3.5 days in a given month due to a family illness, the lost income is equivalent to the household’s entire grocery budget ($280). Seven days is more than the household’s entire transportation budget ($533). If one parent has a long-term illness or injury that requires missing work for 15 days, that translates into a hole in the family budget equivalent to their total expenditure on housing ($1,192). That family loses a secure source of payment for their housing, even though the other parent works full time all month.

For those lucky enough to have health insurance—less common for families without paid sick days—the average premium contribution plus total monthly health care expense is $245. It takes just over three unpaid sick days to lose the funds needed to cover health expenditures in a family’s budget. Cutting back on health care at a time when it is most needed puts the family at further risk in the future in terms of both health and economic security.

These problems of reduced income and potentially losing a job don’t arise for workers with paid sick time. In Table 1, they remain in the “No illness” row, as long as they don’t use more paid sick time than they have. So instead of having an income of $3,470 one month, and $3,070 the next, those with paid sick leave can rely on a steady monthly income. This income security allows them to rest and fully recover from an illness before returning to work. More importantly, it allows workers to continue paying their monthly bills, even in the event of illness. This economic security is incredibly important for low-income families, the vast majority of whom do not currently have access to paid sick time.

Job loss

Perhaps the gravest consequence of missing work due to an illness is the possibility of losing one’s job. According to a recent survey, 16% of workers say that they had or could lose a job or be punished due to illness (Smith and Kim 2010). Indisputably, job loss is a worker’s greatest fear, but it is especially traumatic in the current economic climate. Data from the Bureau of Labor Statistics shows that the American economy shed 8.7 million jobs since the start of the Great Recession in December 2007. This is the largest drop in terms of both the total number and percent of jobs lost since 1947. It also marks the steepest rise in the unemployment rate on record, from 4.7% in December 2007 to its height of 10.1% in October 2009. While the unemployment rate has fallen slightly to 9.1% in May 2011, the U.S. economy is still 6.9 million jobs below where it was at the start of the recession.

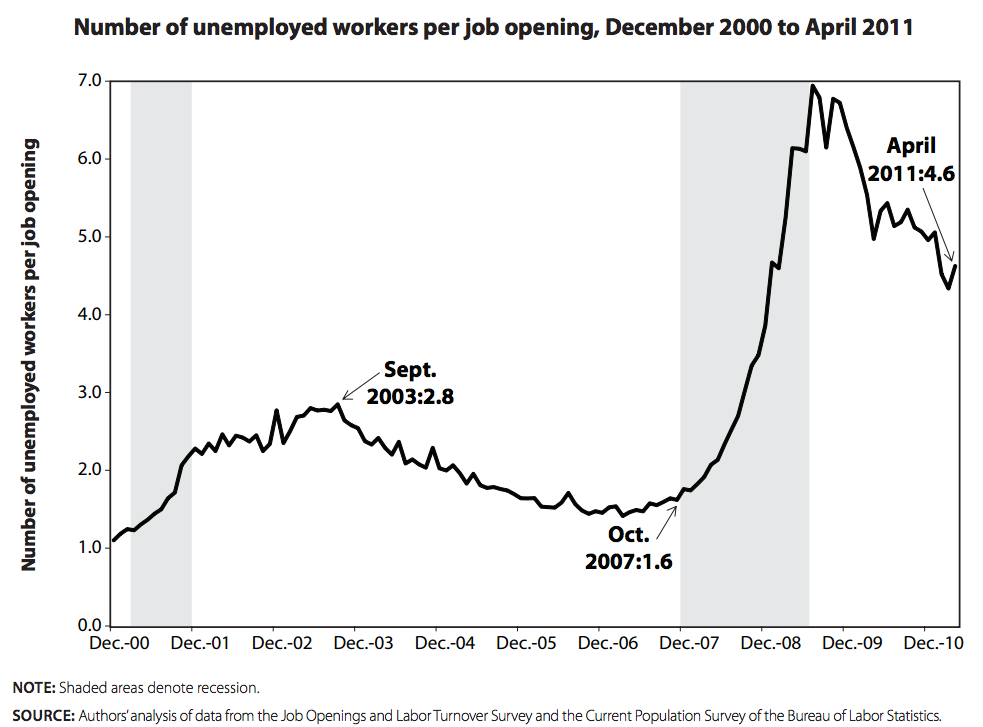

The millions of lost jobs and an unemployment rate at levels not seen in a generation highlight the weakness of the current job market, but in many ways the reality for most unemployed workers is far grimmer. Not since the crippling recession of 1981 have American workers experienced such an elevated rate of unemployment, and the record-high number of available workers for every job opening makes matters worse. As shown in Figure D, there are currently 4.6 unemployed workers for every job opening in the entire economy. This does not mean that there are 4.6 applicants for every job; there are many times more than that for any particular job opening. This means that if every job opening in the economy were filled tomorrow, 78% of those currently unemployed would still be out of a job. To put this job seeker-to-job opening ratio in historical perspective, the worst month of the last downturn saw a high of 2.8 job seekers per job opening.

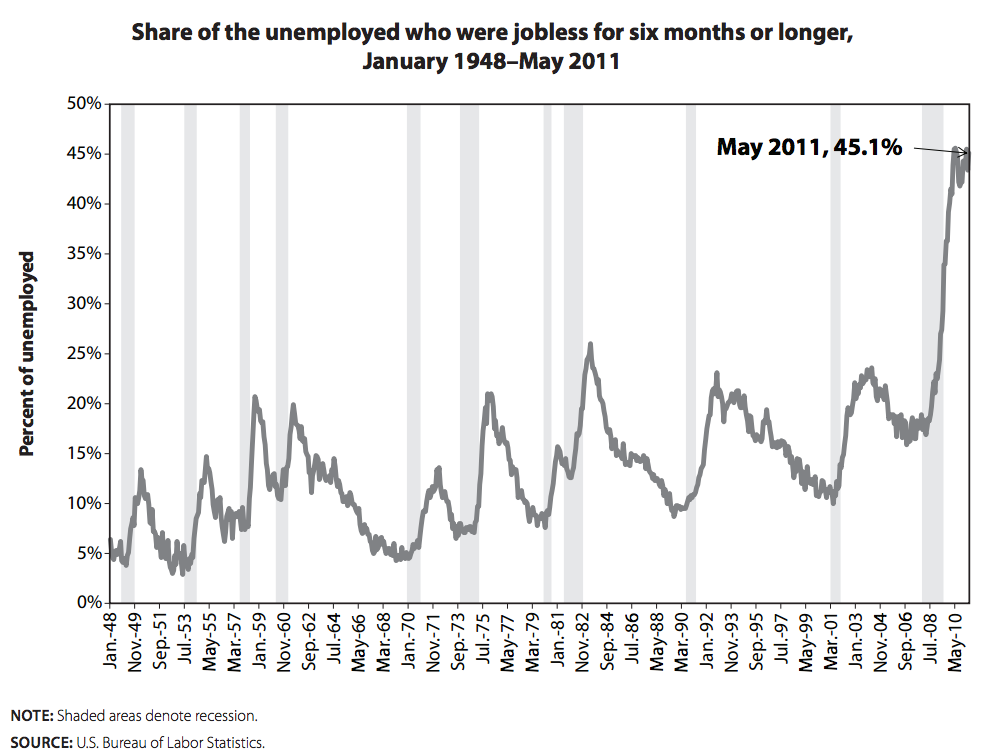

The difficulty of finding a job is further underscored by the duration of unemployment. The average duration of unemployment in May of 2011 was 39.7 weeks, or about nine months. Using the same workers and family types as discussed earlier as an example, losing a job could therefore mean a reduction in income from $20,800 a year down to $4,920—simply not enough to meet basic needs unless it is supplemented by unemployment insurance. Furthermore, the share of the long-term unemployed is at an all-time high. As shown in Figure E, in May 2011, 45.1% of the unemployed (a total of 6.2 million people) had been unemployed and actively looking for a job for six months or more. It may seem like a small sacrifice to take an unpaid sick day, but should that day lead to a worker losing his or her job, one day of illness could very easily become six months or more of foregone wages.

Finally, the pain of losing one’s job and the associated unemployment duration does not just mean lost wages, but substantial hardship for years after. Research shows that job loss negatively impacts a displaced worker’s income for years after the initial spell of unemployment, affects the educational outcomes of an unemployed worker’s children, and can exact a toll on mental health.5 Current economic conditions serve as a reminder that now is a terrible time to lose a job because of illness. Paid sick days policies that offer job protection have never been more important for working families.

Conclusion

The United States has a proud tradition of passing laws to protect workers’ health, safety, and economic security in the face of the changing needs of families and the workforce, including well-established child labor prohibitions, maximum-hour laws, and minimum-wage laws. In recent decades, however, workplace standards have failed to reflect demographic and economic realities. Family economic security has declined over the past 30 years, and the need to have two incomes to support a family means that many kids and the elderly have no one at home to care for them when they need it. Millions of working families are living in poverty and breadwinners risk income and job loss when illness strikes. A national law that ensured the ability to earn paid sick time would allow workers to meet their responsibilities at work and at home without compromising their families’ economic security.

—The authors would like to thank Nicholas Finio of EPI for his research assistance on this paper and the National Partnership for Women and Families, the Rockefeller Foundation, and the Ford Foundation for their generous support.

Endnotes

- Twenty-five percent or more of the family income.

- The additional pay brought in by a second working parent should actually increase economic security—in a one-working-parent family, if this person loses his or her job, the family income will decrease by 100%, to zero. However, in a two-working-parent family, a job loss will only decrease family income by 50% (if both parents are earning the same amount).

- Research shows that presenteeism has real and measurable costs (see Goetzel et al. 2004 and Hemp 2004). In addition to lost productivity from coming to work sick, the worker may spread illness to colleagues, further decreasing productivity in the workplace. This is especially problematic in food preparation occupations, where access to paid sick time is low, but the risk of spreading food borne illnesses (such as salmonella and norovirus) is high (JEC 2010).

- Authors’ analysis of 2008 Medical Expenditure Panel Survey.

- For a further discussion of the adverse consequences of unemployment and recessions, see Irons (2009).

References

Batchelder, Lily L. 2010. “Household Income Volatility and Tax Policy: Helping More and Hurting Less, Testimony Before the U.S. Joint Economic Committee.” New York University Law and Economics Working Papers, posted at NELLCO Legal Scholarship Repository. http://lsr.nellco.org/nyu lewp/223.

Blank, Rebecca. 2008. “Presidential Address: How to Improve Poverty Measurement in the United States.” Journal of Policy Analysis and Management. Vol. 27, No. 2, pp. 233-254

Boushey, Heather. 2009. “The New Breadwinners.” From The Shriver Report: A Woman’s Nation Changes Everything, Heather Boushey and Ann O’Leary eds. Washington, D.C.: The Center for American Progress.

Brown, Lorraine. 2004. The Healthy Families Program: Health Status Assessment (PedsQL) Final Report. Managed Risk Medical Insurance Board. September.

Canfield, Richard L., Charles R. Henderson Jr., Deborah A. Cory-Slechta, Christopher Cox, Todd A. Jusko, and Bruce P. Lanphear. 2003. Intellectual impairment in children with blood lead concentrations below 10 µg deciliter. New England Journal of Medicine. Vol. 348, No. 16, pp. 1517-26.

Council of Economic Advisers (CEA). 2010. “Work-life balance and the economics of workplace flexibility.” Washington, D.C.: CEA.

Dallman, Peter R., Ray Yip, and Clifford L. Johnson. 1984. “Prevalence and causes of anemia in the United States.” American Journal of Clinical Nutrition. Vol. 39, No. 3, pp. 437-445.

Fremstad, Shawn. 2010. “A Modern Framework for Measuring Poverty and Basic Economic Security.” Washington, D.C.: Center for Economic and Policy Research. http://www.cepr.net/documents/publications/poverty-2010-04.pdf.

Goetzel, Ron Z., Stacey R. Long, Ronald J. Ozminkowski, Kevin Hawkins, Wang Shaohung, and Wendy Lynch. 2004. “Health, Absence, Disability and Presenteeism Cost Estimates of Certain Physical and Mental Health conditions Affecting U.S. Employers.” Journal of Occupational and Environmental Medicine. Vol. 46, No. 4, pp. 398-412.

Hacker, Jacob. 2007. “The New Economic Insecurity—And What Can be Done About It.” The Harvard Law & Policy Review. Vol. 1, no. 1, pp. 111-126.

Hacker, Jacob and Elisabeth Jacobs. 2008. “The rising instability of American family incomes, 1969-2004.” Economic Policy Institute, Briefing Paper #213. Washington, D.C.: EPI.

Hacker, Jacob, Gregory Huber, Philipp Rehm, Mark Schlesinger, and Rob Valleta. 2010. “Economic security at risk.” New Haven, Conn.: Economic Security Index.

Hadley, Jack. 2002. Sicker and Poorer: The Consequences of Being Uninsured. Urban Institute. Washington, D.C.: Urban Institute.

Hemp, Paul. 2004. “Presenteeism: At Work—But Out of It.” Harvard Business Review: October 2004, reprint R0410B.

Heymann, S. Jody, Alison Earle, and Brian Egleston. 1996. “Parental Availability for the Care of Sick Children.” Pediatrics. Vol. 98, No. 2, pp. 226-230.

Institute of Medicine (IOM). 2002. Care Without Coverage: Too Little, Too Late. Washington, D.C.: IOM.

Irons, John. 2009. “Economic scarring: The long-term impacts of the recession.” The Economic Policy Institute, Briefing Paper #243. Washington, D.C.: EPI. http://www.epi.org/publications/entry/bp243/.

Joint Economic Committee (JEC). 2010. Expanding access to paid sick leave: The impact of the Healthy Families Act on America’s workers. Washington, D.C.: JEC. http://jec.senate.gov/public/index.cfm?a=Files.Serve&File_id=abf8aca7-6b94-4152-b720-2d8d04b81ed6

Lake Research Partners. 2010. Survey; “Cross-generational perspectives on Economic Security.” Conducted for Wider Opportunities for Women, Washington, D.C. http://www.wowonline.org/documents/WOWBuildingBridgesOpinionResearch.pdf

Levine, Linda. 2010. Leave Benefits in the United States. RL34088. Washington, D.C.: Congressional Research Service.

Lin, James and Jared Bernstein. 2008. “What we need to get by.” Economic Policy Institute, Briefing Paper #224. Washington, D.C.: EPI.

Lovell, V. and Miller, K. 2009. “Paid Sick Days in Massachusetts: Containing Health Care Costs through Prevention and Timely Treatment.” Washington, D.C.: Institute for Women’s Policy Research.

Lozoff, Betsy, Nancy K. Klein, Edward C. Nelson, Donna K. McClish, Martin Manuel, and Elena Maria Chacon. 1998. “Behavior of infants with iron-deficiency anemia.” Child Development. Vol. 69, No. 1, pp. 24-36.

Mishel, Lawrence, Jared Berstein, and Heidi Shierholz. 2009. The State of Working America 2008/2009. Ithaca, N.Y.: Cornell University Press.

Rothstein, Richard. 2004. Class and Schools: Using Social, Economic, and Educational Reform to close the Black-White Achievement Gap. Washington, D.C.: Economic Policy Institute.

Russo, Allison, Joanna Jiang, and Marguerite Barrett. 2007. “Trends in Potentially Preventable Hospitalizations among Adults and Children, 1997-2004.” HCUP Statistical Brief #36. Agency for Healthcare Research and Quality. Retrieved March 8, 2011, from http://www.hcup-us.ahrq.gov/reports/statbriefs/sb36.pdf

Savage, Matthew F., Jessica Y. Lee, Jonathan B. Kotch and

William F. Vann, Jr. 2004. “Early Preventive Dental Visits:

Effects on Subsequent Utilization and Costs.” Pediatrics, Vol. 114, No. 4, pp. 418-423.

Smith, Tom and Jibum Kim. 2010. Paid Sick Days: Attitudes and Experiences. Washington, D.C.: National Opinion Research Center.

U.S. Department of Labor, Bureau of Labor Statistics. 2008. Consumer Expenditure Survey. Table 2, Income Before Taxes: Average Annual Expenditures and Characteristics. http://www.bls.gov/cex/2008/Standard/income.xls.

U.S. Department of Labor, Bureau of Labor Statistics. 2010a. Author’s calculations based on data from Current Population Survey.

U.S. Department of Labor, Bureau of Labor Statistics. 2010b. “Employee benefits in the United States – March 2010.” http://www.bls.gov/news.release/pdf/ebs2.pdf