Executive Summary

In recent years, several studies have argued that teacher pensions are a raw deal for most teachers and should be replaced with account-style plans. In reality, however, most teachers working today are building a secure retirement:

- Claims that most teachers do not benefit from pensions are based on studies that give equal weight to career teachers and to those who leave after a year or two rather than examining a cross section of the teaching workforce.

- Research that is based on a cross section of teachers in California found that at least three-fourths of teachers accumulate 20 years of service or more in their retirement plan and at least half accumulate 30 years or more. These teachers earn a healthy return on contributions and a level of retirement security few participants in account-style plans can count on.

- While attrition is high in the first years, teachers who end up leaving the profession are a small share of the teaching workforce and at a minimum recover their contributions to the pension plan plus interest. They may not leave with substantial accrued benefits, but they are not being deprived of something they would likely have gotten elsewhere. Young workers in general do not accrue much in retirement savings, no matter what their profession.

- Some young teachers who leave before vesting in their retirement plan move to teach in another state or another district in the same state, and they typically accumulate significant retirement benefits in their second jobs.

- Mobile teachers who switch districts midcareer and retire at the normal retirement age receive full pension benefits based on their total years of service, though some of these benefits are tied to lower earnings from their first jobs. In contrast, teachers who spend their careers in one district earn higher benefits because all their service credits are tied to their final salaries, typically averaged over three to five years. The fact that service credits are worth more to teachers who retire after spending their careers in a single district is a positive feature of pensions because it discourages turnover, and this feature is not as disadvantageous to mobile teachers as critics suggest.

- Teachers who choose to retire after the normal retirement age continue to accrue service credits and salary increases that translate into higher lifetime incomes. Critics who point out that these teachers are not fully compensated for their shorter expected retirements ignore the fact that experienced teachers earn higher salaries and are not unduly disadvantaged if they choose to work past the normal retirement age.

The myth that most teachers get a raw deal while a lucky few receive generous pensions lives on despite having been soundly debunked. The purveyors of this myth suggest that older, experienced teachers are benefiting at the expense of younger and more mobile peers. They use their flawed research to advocate for replacing teacher pensions with account-style plans, such as cash balance plans and 403(b) plans, which are similar to 401(k) plans. Account-style plans are inefficient because they do not pool investment risk, typically have lower investment returns, and create perverse incentives that encourage turnover or cause workers to time their retirements based on stock market performance.

A shift to account-style plans would not benefit most teachers and would increase teacher turnover to the detriment of students. While the existing pension system can and should be tweaked to meet changing needs, it successfully serves the goals of attracting and retaining teachers, promoting orderly retirement, and providing retirement security.

Correcting the record on a Manhattan Institute report

The myth that most teachers get a raw deal while a lucky few receive generous pensions gained currency in 2013 after the Manhattan Institute published a study claiming that the majority of teachers leave before the normal retirement age, many before vesting (teachers typically have to be employed five years to qualify for employer-provided pension benefits). According to authors Josh McGee and Marcus Winters, “only about 28 percent of American public school teachers remain in the profession for even 20 years. The overwhelming majority separate from service well before reaching the retirement thresholds in any public retirement system” (McGee and Winters 2013). The Manhattan Institute study, which suggested that most teachers are short-changed because they fail to vest or because they leave before the normal retirement age, was cited in other studies critical of teacher pensions, many of which were funded by McGee’s employer, the Laura and John Arnold Foundation.1

With traditional “defined benefit” (DB) pensions, benefits at the normal retirement age are based on years of service and final salary, typically averaged over three to five years. Teachers who take up benefits before the normal retirement age receive reduced monthly benefits to offset their longer expected retirements. Teachers who leave midcareer but still retire at the normal retirement age receive full benefits based on their years of service, but these are tied to lower (midcareer) salaries. If they continue their teaching careers in another state, they may accrue the same number of service credits but receive somewhat lower benefits than teachers who earn credits under just one system.

McGee and Winters said that teachers who spend full careers in one district benefit at the expense of short-term and mobile teachers. McGee and Winters claim that short-term and mobile teachers are the majority of teachers, but they did not examine a cross section of active teachers. Instead, they gave equal weight to anyone who ever tried teaching, however briefly. This is equivalent to saying that most gymnasts are not able to do a cartwheel based on counting every child who enrolls in a gymnastics class rather than surveying gymnasts actually practicing in gyms. The difference, of course, is attrition. While attrition is high in the first years, teachers who end up leaving the profession (leavers) are a small share of the teaching workforce.

This is not to say that young teachers who drop out after a year or two should not be counted. However, their weight in the sample should reflect the time they spend teaching in order for the sample to be representative of the teaching workforce.

The weighting problem was noted in an EPI briefing paper (Morrissey 2015) and addressed in greater detail in a report by Nari Rhee and William B. Fornia published by the University of California, Berkeley Center for Labor Research and Education (UC Berkeley Labor Center) (Rhee and Fornia 2016). Rhee and Fornia found that the vast majority of active teachers work long enough to accrue significant pension benefits. Specifically, they estimated that, properly weighted, fully three-quarters (75 percent) of active teachers in California stay 20 or more years and receive a substantial pension and almost half (49 percent) stay 30 years or more. Rhee and Fornia estimated that only six percent of California teachers leave before vesting. Rhee and Fornia’s research relied on detailed tenure data and actuarial assumptions for California teachers obtained from the California State Retirement System (CalSTRS) and its outside actuary, Milliman. They used forward-looking projections to account for changes in the expected tenure of current teachers compared with past cohorts.

In addition to exaggerating the share of leavers and mobile teachers, McGee and Winters make the experiences of leavers and mobile teachers out to be more negative than they really are. Even if these teachers do not stay long enough to become vested in their pensions, they recover their contributions to the pension plan plus interest. Young teachers who leave and never return to teaching are not worse off than most other young workers, few of whom accrue retirement savings or pension benefits.

Though leavers may or may not earn retirement benefits in their second careers, it is unlikely that they would have saved more early in their careers if they had started in another line of work. Most private-sector employers require a waiting period of up to a year before new employees become eligible to participate in a 401(k)-style “defined contribution” (DC) plan, compared with immediate participation (but not immediate vesting) in most teacher pensions (U.S. GAO 2016). Because many young people are not covered by a retirement plan, choose not to participate if they are covered, or tap their retirement savings between jobs, 58 percent of households headed by someone 35 years old or younger have no savings at all in a retirement account. Even among the 42 percent who do have retirement account savings, the median account balance is just $12,300 (Federal Reserve Board of Governors 2017).

Meanwhile, mobile teachers—teachers who move to another state or retirement system— typically accumulate significant benefits in their second jobs. It is fairly common for young teachers to move in search of better pay or working conditions, as well as for personal reasons (Goldring, Taie, and Riddles 2014; Raue and Gray 2015).

Because it is difficult to track mobile teachers who continue their careers elsewhere, almost any methodology will overstate the share of teachers who leave without earning substantial benefits. This problem is greatly compounded when all newly hired teachers are given the same weight (as McGee and Winters do) rather than weighted by the number of years worked or, equivalently, by their share of the active workforce (as Rhee and Fornia do).

University of Arkansas researchers double down on a debunked claim

Rhee and Fornia’s critique of the Manhattan Institute study should have put an end to the claim that most teachers are paying into a system that will never fully pay them back. But in a University of Arkansas working paper, McGee and co-author Robert Costrell of the University of Arkansas defended a methodology that gives equal weight to all newly hired teachers, claiming that “for a cost-neutral comparison, the gains and losses of winners and losers must offset one another, and this requires a focus on entrants, rather than incumbents” (Costrell and McGee 2016). The first part of this claim is tautological and the second is simply false. There is nothing to prevent researchers from examining a cross section of active teachers in a given year rather than a cohort of entrants and comparing the value of benefits each teacher accrues that year based on similar actuarial assumptions.

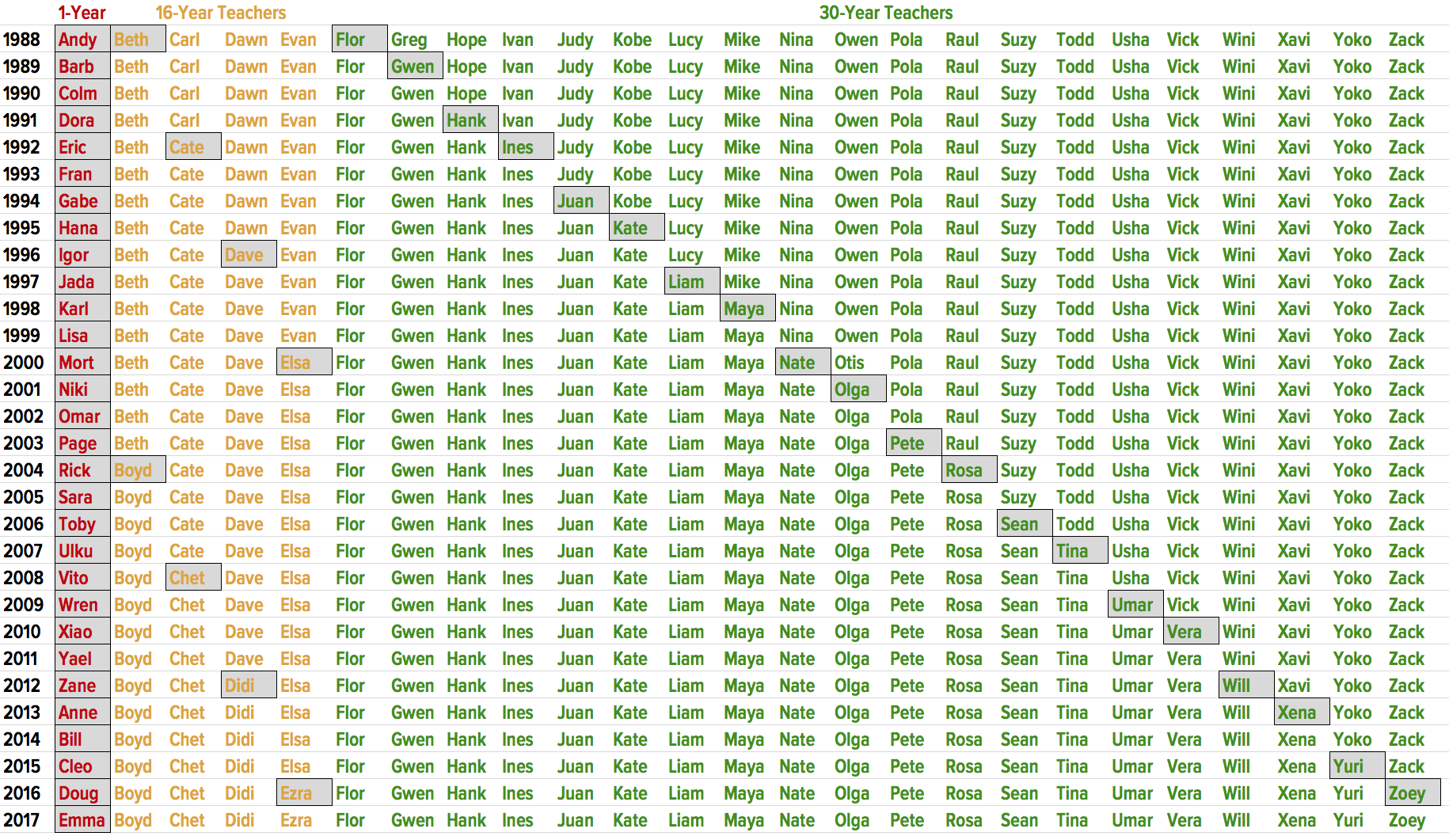

This can be demonstrated with a simple example. Imagine a school, the “ABC School,” with a stable workforce of 25 teachers (see Figure A—new teachers are indicated by boxes). The school hires roughly two teachers every year to replace teachers who leave or retire.2 Looking at a cross section of the workforce in any given year, one teacher in 25 (4 percent of the workforce) is a teacher who will leave before vesting and receive no employer-provided pension benefit. Another four teachers (16 percent of the workforce) are teachers who will vest but leave midcareer, accruing fewer than 30 years of service. The remaining 20 teachers (80 percent of the workforce) are career teachers who will work 30 or more years. This is fairly representative of the actual teaching workforce in California.

Less realistically, assume for simplicity that nonvesting teachers work exactly one year, vested “leavers” work exactly 16 years, and career teachers work exactly 30 years. Based on these assumptions, critics would say that of 58 new teachers hired over the course of 30 years, 30 teachers (52 percent) will receive no employer-provided benefit; eight teachers (14 percent) will leave midcareer and receive what critics describe as reduced benefits (though based on the same formula as benefits for career teachers); and 20 teachers (34 percent) will work 30 years and receive what everyone agrees is a substantial benefit.

While the critics’ calculations may be accurate, it is highly misleading to say that “most teachers” receive reduced or no benefits when their calculations are based on new teachers not a cross section of the actual teaching workforce. Again, CalSTRS and EPI analysis both find that the vast majority of active teachers accrue 30 or more years of service credits.

Are most pension participants “losers”? Only by the strangest of yardsticks

Weighting problems aside, Costrell and McGee make much of the large share of teachers they deem pension “losers.” It is worth noting that if all teachers enrolled in a traditional DB pension receive excellent benefits, but one teacher in a hundred receives a penny more than the others, Costrell and McGee would say that 99 percent of these teachers were getting a raw deal—a meaningless statistic. Meanwhile, a uniformly bad 401(k)-style DC plan, where the vast majority of participants fare worse than in a DB pension due to lower average investment returns and greater risk, would make all teachers “winners” in Costrell and McGee’s estimation simply because differences in retirement outcomes appear random rather than based on a benefit formula (see Appendix A: Retirement plan types).

This is not a hypothetical point. DC plans may be fairer in Costrell and McGee’s estimation yet still worse than DB pensions for the vast majority of teachers because, as stated above, DC plans are inefficient and risky. DC plans provide lower average net returns while requiring participants to save more to guard against outliving their savings or retiring during a bear market (Morrissey 2009; Fornia and Rhee 2014). This means not only that average returns are lower in inefficient DC plans, but that many retirees will have even worse outcomes due to lower-than-average investment returns or longer-than-average lifespans. In contrast, DB pensions efficiently minimize longevity risk through risk pooling and investment risk through intergenerational risk smoothing.

To alleviate concerns about adopting DC plans, some critics of DB pensions focus instead on replacing them with cash balance plans, hybrid plans that have some DB and some DC features (see Appendix A: Retirement plan types). Cash balance plan benefits are structured as an employer contribution earning a rate of return, known as an interest credit, which may be fixed or variable. Cash balance plans with fixed interest credits can be an improvement over DC plans, since participants are not subject to investment risk and net investment returns can approach those of traditional DB pensions. But most cash balance plans still require participants to save more or to purchase expensive individual annuities to guard against outliving their savings. In any case, cash balance plans are not necessarily “fair,” as will be discussed in more detail below. A cash balance plan with a fixed interest credit of 7.5 percent, as proposed by Costrell and McGee, would provide the greatest benefit to young teachers, including job leavers. These plans therefore encourage, rather than discourage, turnover.

Do short-term and mobile teachers subsidize career teachers?

Costrell and McGee claim that teacher pension benefits amount to a bait-and-switch:

Each individual is led to believe that a common percentage contribution is made on his or her behalf by the employer (in addition to the employee’s own contribution). However, those contributions are heavily redistributed, with some employees receiving no benefit from the employer contributions and others receiving benefits that cost far more than was contributed on their behalf.

This claim is highly misleading. Teaching recruits are not told that they will receive benefits based on the fixed percentage contribution employers make on their behalf (though most will exceed this low bar due to investment returns). Instead, recruits are accurately informed that if they stay long enough to vest—five years in California—they will receive benefits based on a formula linking their final average salary and years of service. The benefit formula is the same whether vested teachers leave midcareer or retire from teaching, as long as take-up occurs at the same age. However, it is generally better to be covered by a traditional pension later in your career because benefits are tied to your final average salary, which generally increases with age and experience.

Far from misleading prospective teachers, school districts want them to understand that there is a payoff for sticking around, since reducing turnover and recruiting career-minded teachers are key reasons school districts offer traditional pensions. Reducing turnover is especially important in education, where there is a steep learning curve and considerable on-the-job training (see, for example, Henry, Fortner, and Bastian 2012). Pensions are also valued as recruitment tools, especially since research has found that job candidates who value pensions also have other attributes prized by school districts (Boivie and Weller 2012).

The reason school districts contribute an amount based on a fixed percent of pay is to prevent costs from increasing as teachers vest or approach retirement, not to give prospective teachers the impression that their benefits will be equal to employer contributions, as the above quote implies. Nor are teachers led to expect a benefit equal to employer contributions plus a specified rate of return, the actual yardstick Costrell and McGee use to judge teacher pensions.

Costrell and McGee downplay their assumed investment return, leaving casual readers with the impression that many teachers who vest nevertheless receive benefits that are less than the employer contributions. In fact, however, Costrell and McGee deem pension participants “losers” if their benefits are less than these contributions plus an annual 7.5 percent investment return until they retire, whether or not they remain in covered employment. Costrell and McGee do not explain why school districts should provide a 7.5 percent rate of return to teachers who leave, thereby conferring the largest benefit relative to earnings to young job leavers, perversely encouraging turnover (Morrissey 2015).

Costrell and McGee claim that with account-type plans, in contrast to traditional DB pensions, “the cost of the individual benefit is transparent to all, because it equals the contribution.” This is generally true only of DC plans, in which there is no guaranteed investment return. DC plans may be “fair” in the sense that the employer contribution is the same percent of salary for all participants, but, as noted above, DC plans are risky and inefficient and therefore a much worse deal than pensions for the vast majority of teachers (Rhee and Fornia 2016).

Costrell and McGee’s suggestion that benefits should be proportional to salary is generally not true of cash balance plans. Costrell, McGee, and other cash balance plan advocates contrast the supposed fairness of cash balance plans with DB pension benefits that are more valuable to older workers. In fact, cash balance benefits may be more or less valuable to younger workers to the extent that the interest credit is higher or lower than the risk-adjusted return these workers could expect to get elsewhere.

Most cash balance plans promoted by critics of traditional pensions favor younger workers. This is certainly true of a cash balance plan with a 7.5 percent interest credit, because job leavers who are not cash strapped or unusually risk-loving would be foolish to cash out accounts earning such a high rate of return. Because much of the value of such a benefit lies in the guaranteed return rather than the employer contribution, young job leavers get the biggest benefit, and teachers close to retirement get the smallest benefit, relative to earnings.

The extent of any redistribution between teachers depends on the yardstick used. Costrell and McGee are critical of what they describe as “cross subsidies” from shorter-term to career teachers, though employer contributions are not designated for particular teachers but simply take into account the average cost of employer-provided benefits. With any type of retirement plan, retirement outcomes vary depending on such factors as how long an employee works, how much he or she earns, and at what age he or she retires. Thus, there is no single agreed-upon measure of what constitutes a reduced or enhanced benefit, since this depends on normative assumptions about what participants “should” be getting.

If you assume benefits should be based on years of service and final salary, then a teacher who leaves midcareer is not disadvantaged relative to a career teacher in a traditional pension, since both teachers’ benefits are based on the same formula. If, on the other hand, you assume benefits should reflect a fixed contribution rate and investment return, as Costrell and McGee do, then a traditional pension benefit will appear generous for career teachers and less so for mobile teachers. Finally, if benefits are compared with career earnings or contributions (as Costrell and McGee preach but do not practice), then traditional pensions may appear to benefit either career teachers or mobile teachers depending on the pattern of pay increases during teachers’ tenures. The ambiguity stems from the fact that pension benefits increase, relative to earnings, with steeper pay increases or longer tenure. The former effect favors younger teachers and the latter effect favors career teachers.

Cost differences between shorter-term and career teachers appear larger in measures that take into account investment returns because contributions made on behalf of teachers who leave early in their careers have more time to accrue interest before these teachers retire, driving down the cost of their benefits. Based on CalSTRS salary growth and inflation assumptions, and assuming all teachers start working at age 25 and take up benefits at age 62, the total cost (including employee contributions) of pension benefits is around seven percent of pay for 16-year teachers and 12 percent of pay for 30-year teachers.

This assumes a 7.5 percent rate of return on contributions. However, the difference between 16-year and 30-year teachers essentially disappears if you simply compare the ratio of total contributions to total benefits. In other words, 16-year teachers appear to be subsidizing 30-year teachers only if you assume that pension benefits should reflect an annual 7.5 percent return on contributions. Even by this measure, properly measured cross subsidies are much smaller than suggested by pension critics because short-term teachers are a small share of the teaching workforce.

By any measure, of course, teachers who leave before vesting do not receive employer-provided benefits. Teachers begin contributing before vesting. If they leave before vesting, they are refunded their contributions, usually with interest. Employer contributions, meanwhile, are expressed as a share of total payroll, including the salaries of unvested teachers. The employer contribution rate takes into account the likelihood that some teachers will not vest in their pensions and is therefore lower than it would be if all teachers vested. If teacher turnover declined, pension costs would rise, but other costs associated with turnover would decline, and school districts would be better off. There is no evidence that school districts tolerate or encourage turnover to reduce costs and help pay for the benefits of career teachers, as critics suggest. To the contrary, teacher turnover is a source of concern for school districts.

Bellwether Education Partners misrepresent pension funds’ experiences and assumptions

Costrell and McGee are not the only authors who persist in repeating the debunked claim that teacher pensions benefit the few at the expense of the many. Chad Aldeman and Kelly Robson of Bellwether Education Partners added a twist to the teacher turnover argument in a recent Education Next article, claiming that pension funds’ own assumptions about tenure demonstrate that “most teachers are paying into a system that, most likely, will never fully pay them back” (Aldeman and Robson 2017).

As noted earlier, even teachers who leave before vesting recoup their contributions with interest. However, Aldeman and Robson’s assertion is not true even if it is loosely interpreted to include employer contributions as well as teacher contributions. In fact, pension funds’ own experience and assumptions confirm that the vast majority of teachers earn at least 20 years of service credits—typically 30 years or more—providing a healthy return on contributions and a level of retirement security few participants in account-style plans can count on.

Once again, the claim that most teachers do not benefit from pensions is based on giving equal weight to all new hires rather than examining a cross section of the actual teaching workforce. As Rhee and Fornia noted, three-fourths of active teachers in California will retire with at least 20 years of service credits and nearly half will retire with 30 or more years.

Using publicly available data from CalSTRS, EPI confirmed Rhee and Fornia’s finding that most teachers in California are in it for the long haul. EPI found that California teachers will receive lifetime pension benefits worth over seven times the contributions made to the fund (by themselves and by their employers on their behalf), thanks to investment returns and efficiencies associated with pooling investments and risks in group plans (see Appendix B: Methodology).

Another measure of the value of benefits is the implicit, or “internal” rate of return on contributions. Based only on retiree benefits, EPI calculated that the internal rate of return on employee contributions is 7.1 percent for 20-year teachers and 8.7 percent for 30-year teachers, not taking into account the value of survivor and disability benefits. Even if you assume teachers indirectly pay for employer contributions in the form of lower salaries, the internal rate of return on total contributions is 5.0 percent for 20-year teachers and 6.4 percent for 30-year teachers, not counting survivor and disability benefits (see Appendix B: Methodology).

These findings do not suggest a large-scale redistribution from mobile to career teachers, since the assumed investment return is 7.0 percent. If pension benefits of career teachers were in large part paid for by cross subsidies from short-term teachers rather than investment returns, this would be reflected in a higher internal rate of return. Because teachers who leave before vesting or before earning substantial benefits represent a small share of the teaching workforce, and because some of these teachers and their dependents receive disability and survivor benefits, their forfeited or reduced benefits do not amount to much of a cross subsidy flowing to career teachers.

EPI’s findings do not depend on rosy projections about teacher tenure, but rather CalSTRS’ publicly available experience studies. Compared with Rhee and Fornia’s forward-looking estimates based on nonpublic records, EPI finds that an even higher share of California teachers—84 percent—stay 20 or more years.

Specifically, an EPI analysis of CalSTRS’ experience shows that:

- 4.2 percent of active California teachers hired at age 25 will leave with fewer than 5 years of service and will be refunded their own contributions plus interest

- 9.2 percent will accrue at least 5 years but fewer than 20 years of service, earning benefits equal to 10 percent to 39 percent of their final average salary at the normal retirement age

- 5.0 percent will accrue at least 20 years but fewer than 30 years of service, earning benefits equal to 40 percent to 59 percent of their final average salary at the normal retirement age

- 78.9 percent will accrue at least 30 years of service, earning benefits equal to 60 percent or more of their final average salary at the normal retirement age

- 1.8 percent will retire on disability by age 55

- 0.8 percent will die by age 55

Rhee and Fornia’s somewhat more conservative estimates reflect projected increases, not decreases, in turnover, compared with past experience, in addition to more realistic assumptions about the age when teachers are hired (EPI and most pension critics assume teachers are hired at age 25, though the median age of hire is 29).

In contrast with the EPI and UC Berkeley studies, a methodology looking at just new entrants and weighting them all equally regardless of how many years they teach would find that less than half (48.7 percent) of teachers in California stay at least 20 years (see Appendix B: Methodology). While past experience is not a perfect predictor of future attrition, this demonstrates that different weights, not different assumptions about attrition, drive different findings about whether most teachers receive substantial pension benefits.

Do pensions reduce turnover?

Critics say pensions fail to reduce turnover despite favoring career teachers. Aldeman and Robson (2017) portray vesting rules as a failed retention strategy reflected in the high attrition among rookie teachers. However, vesting requirements are primarily cost-saving, not retention, devices, and are common in DC and cash balance plans as well as public- and private-sector DB pensions. Five-year vesting is defensible as a way for states to recoup sunk costs associated with hiring, on-the-job training, and administering benefits to rookie teachers who leave. Young teachers with a few years of teaching under their belts may be recruited by other states or districts that can provide better pay or working conditions. Recouping some of the costs associated with turnover can help districts offset this “free-rider” problem (when one school district pays for training and another reaps the benefits), at least when teachers move to another retirement system (pension service credits are usually, but not always, transferrable within states).

Likewise, the nine states that increased vesting periods to 10 years in the wake of the 2008 financial crisis did so to save money, not promote employee retention—a move opposed by teachers’ unions (Brainard and Brown 2016; NEA 2016). While few would defend 10-year vesting except as a last-resort cost saver, teacher pensions are only adequate, not generous, so reducing vesting periods to no more than 5 years should be paid for by increasing contributions rather than cutting benefits of career teachers. In any case, a 10-year vesting period in some teacher pension plans is no reason to support replacing all traditional DB pensions with DC or cash balance plans, since all types of plans can have 10-year vesting in the public sector.

“Backloaded” benefits are not excessive and promote employee retention

Critics of traditional teacher pensions do not just focus on teachers who leave before vesting, but also mobile teachers who switch districts midcareer. Though these teachers receive full benefits based on their total years of service if they retire at the normal retirement age, some of these benefits are tied to lower earnings from their first jobs. In contrast, teachers who spend their careers in one district earn higher benefits because all their service credits are tied to their final salaries, typically averaged over three to five years. “Backloading”—providing higher benefits relative to salary to career teachers who do not move between pension systems—is intentional and helps promote employee retention.

Backloading occurs two ways. First, with traditional DB pension benefits, the final average salary is multiplied by past service credits and a multiplier, so service credits are more valuable with longer tenure due to the salary increases that come with longer tenure. This effect, however, is partly offset by the fact that salaries rise faster earlier in teachers’ careers. Second, teachers who leave before retiring, though they will receive benefits based on the same formula as those who teach until they retire, will see the real value of their benefits eroded by inflation.

Backloading is often exaggerated by critics. EPI analysis shows that a teacher who spends 15 years in one state and 15 years in another state will receive benefits that are roughly 26 percent lower than a teacher who spends 30 years in the same state, all else equal. However, backloading is less pronounced if mobile teachers spend most of their careers in one state, as most do, rather than dividing their time equally between states. In a more realistic situation, a teacher who spends 5 years in one state and 25 years in another state will see benefits that are roughly 13 percent lower than those of a teacher who spends 30 years in the same state (see Appendix B: Methodology).

Do pensions “push” veteran teachers out the door?

The backloading of benefits generally does not extend beyond the designated normal retirement age (California, which increases the benefit multiplier between age 62 and 65, is a partial exception). Though teachers who work beyond the normal retirement age continue to accrue service credits and receive larger annual pension benefits, their lifetime benefits are reduced because they are not usually compensated for their shorter expected retirements. For most teachers who are looking forward to retirement, this encourages them to retire at or before the normal retirement age, promoting an orderly transition to retirement.

Aldeman and Robson (2017) question whether incentives to retire at the normal retirement age are in the public’s interest, “because veteran teachers tend to perform better than a replacement teacher just entering the profession” (a rare admission from pension critics). Given the higher salaries earned by veteran teachers, however, it is more accurate to characterize the pension incentive to retire at the normal retirement age as moderating a strong salary incentive to continue working, as opposed to “a push out the door” as Aldeman and Robson characterize it.

Aldeman and Robson highlight the apparent inconsistency of using pensions to encourage teachers to stay early in their careers, then nudging them to retire at the normal retirement age. However, this reflects productivity, which initially increases with experience but may gradually level off or even decline as health deteriorates with age and skills become obsolete. This does not mean that older teachers who remain in the workforce after the normal retirement age are less productive than midcareer teachers. The opposite may be true if teachers in poor health or suffering from burnout retire early while those who continue their educations or are promoted retire later. However, if we made it difficult for teachers to retire by replacing pensions with inadequate and risky account-style plans, we would observe average productivity declining in old age while pay remained high, since it is difficult to reduce salary without running afoul of age discrimination laws. (For a negative accounting of costs associated with delayed retirement, see Prudential 2017.)

It is important to keep in mind that teachers who choose to work past the normal retirement age remain well compensated compared with less experienced teachers. Their lifetime incomes—salary plus pension benefits—will be higher if they keep working, and their annual pensions will be higher as well. Though pension critics often misleadingly suggest that teachers who work past the normal retirement age are left worse off financially, this ignores salaries, which are higher for veteran teachers.

Is teacher turnover high?

Pension critics say teacher turnover is high, but not necessarily a problem—except insofar as mobile teachers are shortchanged by teacher pensions. It appears that their main concern is not retaining good teachers but dismissing bad ones. Bellwether Partners’ Chad Aldeman, for example, in an earlier paper criticizing teacher pensions, approvingly cited school reforms that would make it easier to dismiss teachers, saying, “If those efforts succeed, more teachers will be forced out of the profession. We may even start to see a different workforce, one that values efficacy, flexibility, and opportunity more than stability and predictability” (Aldeman and Rotherham 2014).

In fact, teacher turnover is relatively low, but nonetheless a problem. The education sector as a whole has a low quit rate: 13.6 percent annually versus 22.0 percent in all nonfarm sectors (author’s analysis of Bureau of Labor Statistics, Job Openings and Labor Turnover Survey data, 2012–2016).

This is partly because sectors with more-educated workers tend to have lower turnover. However, public school teachers are also less likely to change occupations or exit the workforce than other college-educated prime-age workers. When we look at workers age 25 to 49 with a bachelor’s degree or more education, 6.6 percent of public school teachers change occupations or exit the workforce every year, versus 12.3 percent of all workers in that category (author’s analysis of Current Population Survey data (IPUMS-CPS, 2012–2016)). This comparison is sensitive to how occupational categories are defined, and includes teachers who change occupations within teaching, such as switching from general to special education. Leaving out public school teachers who change occupations within teaching, and just including those who change sectors, still around 7.3 percent of prime-age public school teachers leave the profession or sector each year (author’s analysis of Current Population Survey data, (IPUMS-CPS, 2012–2016)).

Though teachers are less mobile than pension critics suggest, even low turnover is costly to schools due to a significant learning curve in teaching. Churning has a negative effect on institutional cohesion, and there is evidence that teachers who leave high-turnover schools tend to have stronger credentials. There are also significant costs associated with recruiting and hiring.

High turnover among charter school teachers sheds light on value of teacher pensions

Comparing the experiences of charter school teachers, who are less likely to have DB pensions, and traditional public school teachers, who are more likely to be unionized and have DB pensions, provides indirect evidence that traditional pensions do, in fact, reduce turnover. This comparison is complicated by other differences between teachers at traditional public schools and at charter schools.

Teacher turnover may be higher in charter schools because charter school teachers are unhappy or because they can be dismissed more easily—both factors likely play a role. However, the fact that turnover is lower among unionized public school teachers suggests that pensions also play a role in reducing turnover at traditional public schools because unions prioritize pension benefits in negotiations.

David Stuit and Thomas M. Smith at the National Center for School Choice at Vanderbilt University compared charter schools with traditional public schools and found that turnover was twice as high at charter schools (Stuit and Smith 2010 and 2012). Much of the difference could be attributed to teacher characteristics, especially charter school teachers’ relative youth and inexperience, their lower likelihood of having a teaching certificate, and their greater likelihood of working part time. These factors reflect on charter schools’ staffing policies as well as the fact that charter schools tend to be newer.

Involuntary exits (dismissals and layoffs) account for 15 percent of charter school exits, compared with 6 percent of exits from traditional public schools. However, for charter school teachers, involuntary exits are far outweighed by voluntary exits for professional (56 percent) and personal (29 percent) reasons. It is not easy to differentiate between involuntary exits due to underperformance and those due to layoffs or school closings, which are more common at charter schools (Stuit and Smith 2012).

Stuit and Smith found union membership to be a significant factor in the lower turnover of teachers in traditional public schools. It is difficult to tell to what extent this is related to unions’ ability to protect teachers from dismissal versus other factors. The union effect likely reflects many differences in working conditions and compensation, including the structure and generosity of retirement benefits. Since pension benefits are not included in the model, any retention effect of pensions would likely be captured by the union variable, because teachers’ unions prioritize pensions in contract negotiations. If the union effect primarily reflected protections from dismissal, and not the retention effect of pensions and other compensation, we would also expect principals’ influence on hiring and firing and teachers’ perceived job security to be important factors in lower turnover. However, principals’ influence and perceived job security, which are included in the model, have small or statistically insignificant effects (Stuit and Smith 2012).

Charter school teachers who leave the profession are significantly more likely to cite dissatisfaction with the school or teaching assignments and compensation as reasons for leaving than their counterparts at traditional public schools. Similarly, charter school teachers who move to other schools are significantly more likely to cite dissatisfaction with administrator support, dissatisfaction with workplace conditions, less job security, dissatisfaction with changes in job description, dissatisfaction with opportunities for professional development, and lack of autonomy as reasons (Stuit and Smith 2012). In short, Stuit and Smith (2014) find that “most of the turnover in charter schools is voluntary by teachers and dysfunctional (i.e., detrimental to the school) rather than functional (i.e., beneficial to the school).” If so, we should be more concerned with stemming attrition in charter schools than restructuring retirement benefits to favor mobile teachers.

Are younger generations more mobile?

Are pensions losing their ability to promote retention, or are other factors driving attrition? Many studies critical of teacher pensions assume that young workers today experience more mobility than earlier generations, though there is little evidence to support this claim. Tenure among all workers barely budged between 1996 and 2006, with middle-aged men having slightly shorter tenure with their current employers and older workers of both sexes having slightly more (BLS 2006 and 2016).

Teacher turnover did increase somewhat in the 1990s and early 2000s (Table 1). However, statistics about job leavers and movers are affected by hiring trends and demographics, especially the share of the workforce made up of rookie teachers, which also increased over this period (Table 2). It is not surprising that turnover increased when school districts were hiring more teachers, since attrition is higher among rookie teachers. Hiring and turnover both declined after 2008 in the wake of the Great Recession (Tables 1 and 2).

Distribution of public school teacher stayers, movers, and leavers, by academic year, 1988–2013

| Academic year | Stayers | Movers | Leavers |

|---|---|---|---|

| 1988–1989 | 86.5% | 7.9% | 5.6% |

| 1991–1992 | 87.6% | 7.3% | 5.1% |

| 1994–1995 | 86.3% | 7.2% | 6.6% |

| 2000–2001 | 84.9% | 7.7% | 7.4% |

| 2004–2005 | 83.5% | 8.1% | 8.4% |

| 2008–2009 | 84.5% | 7.6% | 8.0% |

| 2012–2013 | 84.3% | 8.1% | 7.7% |

Notes: Statistics are from the Teacher Follow-up Survey (TFS), conducted by the U.S. Census Bureau, of a nationally representative sample of teachers who participated in the previous year’s Schools and Staffing Survey (SASS). “Stayers” are teachers still teaching in the same school as the previous year; “movers” are teachers teaching in a different school; and “leavers” are former teachers who left the profession.

Source: Goldring, Taie, and Riddles 2014

Share of public school teachers with less than three years of teaching experience, by academic year, 1987--2012

| Academic year | Share |

|---|---|

| 1987–1988 | 8.1% |

| 1990–1991 | 8.7% |

| 1993–1994 | 9.7% |

| 1999–2000 | 12.9% |

| 2003–2004 | 12.2% |

| 2007–2008 | 13.4% |

| 2011–2012 | 9.0% |

Source: NCES 2016

As noted earlier, teacher turnover if much higher in charter schools. There is also some evidence that teacher turnover is concentrated in urban schools that have top-down leadership and less teacher autonomy (Ingersoll and May 2011). Teachers who leave the profession also tend to be paid less and report lower job satisfaction (Raue and Gray 2015). If tight budgets and declining job satisfaction are driving attrition (MetLife 2013), changing the structure of pension benefits could exacerbate rather than alleviate the problem.

Conclusion

It is possible to have a reasoned debate about the goals that can be met with retirement plans and different plans’ effectiveness at meeting these goals. However, many studies that criticize DB pensions as unfair mislead the public about teacher turnover, among other things. These critics recycle the same arguments, forming an echo chamber that gives the impression of scholarly consensus, often failing to even acknowledge counterarguments. Aldeman and Robson, for example, do not mention the UC Berkeley report, let alone attempt to refute it.

Pension critics deliberately ignore the ways pensions are designed to provide secure and easy-to-understand retirement benefits to participants while also serving recruitment, retention, and workforce planning needs. DB pensions promote retention when teachers are likely to be most productive, while minimizing sunk costs associated with hiring, training, and providing benefits. Specifically, DB pensions reduce turnover among experienced midcareer teachers while encouraging an orderly transition into retirement around a normal retirement age, goals that are difficult to achieve with salary and other forms of compensation.

DC plans are not effective at meeting these human resource goals or ensuring the retirement security of America’s teachers. With DC plans, retirement income and the age when people retire are a random function of financial markets. Meanwhile, most cash balance plans being promoted as alternatives to traditional pensions favor younger teachers and encourage turnover.

Rather than acknowledge these perverse incentives for teacher turnover, research funded by the Laura and John Arnold Foundation and likeminded donors seeks to normalize these incentives, criticizing benefits that are not based on contributions plus an often unspecified rate of return. They never explain why taxpayers owe job leavers the benefit of a guaranteed return that is not available to the general public.

School districts and the vast majority of teachers benefit from a system that provides secure and adequate retirement income after a career in teaching. Teachers earn these benefits by sacrificing higher salaries earned by other highly educated workers and by contributing directly toward their pensions.

None of this is to deny that pensions too tilted in favor of career workers should be reformed. Military pensions with 20-year vesting are an extreme example, and 10-year vesting is not allowed in the private sector for good reason. However, the campaign being waged against public pensions is about more than whether career teachers should continue to get a bump in benefits compared with mobile teachers due to backloading. If that were the goal of the campaign the debate would focus on ways to tweak the existing system to address any legitimate concerns. But the use of faulty analysis to argue for jettisoning the entire system suggests another agenda. It also appears to be an attack on teacher unions, a key Democratic Party constituency, though critics take pains to appear bipartisan (McGuinn 2014).

Teachers have more retirement security than most private-sector workers in the 401(k) era (Brown et al. 2016; Morrissey 2016). However, teachers’ salaries are lower than those of comparable private-sector workers and their pension benefits are less generous than those of most public-sector workers. All but teachers with unusually long careers will likely see a drop in living standards in retirement even factoring in reduced expenses.

We should all be concerned that most Americans are not on a path to a secure retirement. However, mobile teachers are not an especially disadvantaged group, since those who remain in the profession will earn substantial benefits. The plight of those who leave the profession, who are no more disadvantaged than other workers in our broken system, is not a reason to cut the benefits of career teachers.

Reforms that make most teachers worse off in the name of fairness while increasing teacher turnover harm not just the career teachers who bear most of the teaching load, but schools and students. These misguided reforms are often justified on the debunked but still widely repeated claim that most teachers do not benefit from teacher pensions. An honest debate starts with acknowledging that most teachers teaching today will receive substantial pension benefits.

The image of teachers toiling for years without achieving retirement security has no bearing on reality. Nor is it true that experienced teachers are “pushed” out the door at the normal retirement age, a claim that ignores the higher salaries of experienced teachers.

Contrary to the claims of pension critics, account-style plans in which participants bear investment and other risks do not promote equality of outcomes or give participants free choice in when they retire, since retirement income and timing both depend on market fluctuations. Cash balance plans with fixed interest credits, meanwhile, are not necessarily fair to workers at different life stages, but typically favor younger workers and promote turnover. Advocates of account-style plans should stop relying on misleading claims that seem geared at capturing the attention of casual observers rather than persuading experts familiar with the pros and cons of different plan types.

Appendix A: Retirement plan types

Traditional “defined benefit” (DB) pensions are the most common retirement plans for teachers and other public-sector workers. DB pensions used to be common in the private sector as well, but many have been replaced by 401(k) and other “defined contribution” (DC) plans.

DB pensions provide retired teachers and their spouses with secure benefits that are usually adjusted in retirement to keep up with the cost of living. They also include life and disability insurance, of particular importance to the roughly 40 percent of teachers not covered by Social Security (NASRA 2016). Most teachers and other public-sector workers, unlike private-sector workers with DB pensions, contribute toward their pensions—typically around 7 percent of pay (NEA 2016).

DB pension formulas provide a specified monthly benefit at retirement based on years of service and salary—typically the highest or final salary averaged over three to five years. For example, participants in the California Teachers Retirement System (CalSTRS) who retire at the normal retirement age of 62 will receive a benefit equal to 2 percent times their years of service times their final salary averaged over the highest-paid three years of their career. Thus, California teachers, who are not covered by Social Security, will replace 60 percent of their final average salary after 30 years of service and 80 percent after 40 years if they retire at the normal retirement age.

Teachers who change districts within a state can usually, but not always, transfer pension credits. That is, their years of service with their first employer will be included in benefit calculations tied to their final salary with their second employer, rather than receiving two separate pensions that add up to less because one is tied to a midcareer salary. Those who move to other states can typically purchase a limited number of service credits on actuarially fair or slightly favorable terms. For example, the cost of purchasing annuitized benefits through CalSTRS is slightly less than the cost of “purchasing” higher Social Security benefits by delaying take-up by one year, though cost-of-living adjustments and other provisions are not strictly comparable (see Appendix B: Methodology).

Defined contribution plans are so named because the employer contribution, rather than the employee benefit, is specified in advance. This does not necessarily mean that employer contributions are fixed over a worker’s career, however, since they are often contingent on voluntary employee contributions and the employer match can be suspended at any time. DC plans entail no long-term commitment by employers and consequently offer less retirement security to participants than DB pensions.

DC plans for teachers are called 403(b) plans. They are similar to 401(k) plans, but can only be offered by nonprofit employers. The 403(b) plans sponsored by government entities are exempt from the requirements of the Employee Retirement Income Security Act (ERISA), which governs private-sector retirement plans. The 403(b) plans for teachers, which are available to most teachers, usually as an optional supplement to a DB pension, have a reputation for charging even higher fees than private-sector 401(k) plans (Siegel Bernard 2016).

DC plan participants and their spouses face considerable investment and longevity risks. Retirement outcomes for the luckiest 25 percent of participants are over two and a half times outcomes for the unluckiest 25 percent due to market fluctuations (see Appendix B: Methodology). In contrast, DB pensions eliminate much of the investment risk by pooling the savings of workers who retire during bull and bear markets. DC plan participants also need to save more, or purchase expensive individual annuities, to guard against longer-than-average lifespans.

In contrast, participants in DB pensions incur no investment or longevity risks and are automatically enrolled in their pension. Some of these risks are eliminated without cost through risk pooling, and some are retained by employers. DB plan participants do incur salary risk, since benefits depend on their final average salaries.

All told, contributions to inefficient DC plans need to be nearly twice as high to provide retirement security approaching that of a DB pension (Morrissey 2009; Fornia and Rhee 2014).

Many private-sector employers are not in a position to take on long-term pension liabilities. The same is generally not true of government entities, which rarely go bankrupt or go out of business. This is one of the reasons DB pensions are more common in the public sector. However, there can be a temptation to shift costs and risks onto future taxpayers. This problem is not limited to traditional DB pensions, but also shared by cash balance plans. In theory, pension underfunding should be made up by increasing employer contributions. In practice, underfunding often leads to benefit cuts for future employees. Though accrued benefits are supposed to be guaranteed, courts have allowed cuts to cost-of-living adjustments that affect current workers and retirees.

Two-tier plans that combine a DB and DC benefit are sometimes referred to as hybrid plans, as are cash balance plans that have some DB and some DC features. Cash balance plans resemble traditional pensions in that they have pooled and professionally managed investments rather than participant-directed accounts. However, benefits are expressed as account balances, similar to DC plans, rather than as streams of income.

Cash balance plan sponsors guarantee a minimum interest rate that may be fixed or variable (interest credits are sometimes tied to benchmarks like Treasury bond rates or a stock market index). Some cash balance plan participants receive additional interest contingent on investment performance. While interest credits are typically modest, some employers guarantee rates of return as high as 7 percent, approaching the expected return on pension plan assets.

Cash balance benefits are typically paid out as lump sums, though some plans give participants the option of converting account balances to income streams at retirement. All cash balance plans are legally considered “defined benefit” plans like traditional pensions because employers must provide a guaranteed minimum benefit. However, this is somewhat of a misnomer in the case of cash balance plans with variable interest credits, where the benefit may be “defined” in a legal sense but much of the investment risk is borne by participants as in defined contribution plans.

Cash balance plan benefits are based on a hypothetical (or “notional”) contribution rate and a hypothetical rate of return, known as an interest credit, rather than on a worker’s years of service and final salary. However, as in traditional DB pensions, actual cash balance plan contributions reflect actuarial estimates of future benefits and vary from year to year depending on realized investment returns, salary growth, and other factors.

As noted, investments in DB and cash balance plans are pooled and professionally managed, whereas those in DC plans are participant directed, in theory allowing participants to tailor investments based on their risk preferences and investment savvy. In practice, DC plans tend to have lower risk-adjusted returns net of expenses than DB pensions. Cash balance plans may have net returns approaching those of traditional DB pensions (whether or not these are passed on to participants). However, if cash balance plans encourage turnover or make cash-outs difficult to predict, returns may suffer due to a shorter investment horizon.

DB, DC, and cash balance plans are all tax-advantaged retirement plans. The tax subsidy takes the form of deferred taxes on investment income, which is advantageous compared with earnings being taxed annually. There may be an additional tax advantage if marginal tax rates decline after retirement.

Appendix B: Methodology

Except where otherwise noted, estimates in this report are based on information in CalSTRS’ most recent actuarial valuation (Collier, Olleman, and Smith 2017) and experience analysis (Olleman, Collier, and Smith 2017). EPI estimates assume new teachers are hired at age 25. Linear interpolation is used where CalSTRS’ published tables have five-year intervals. Methodology is provided for EPI calculations in this report, shown in italics.

EPI found that California teachers will receive lifetime pension benefits worth over seven times the contributions made to the fund (by themselves and by their employers on their behalf), thanks to investment returns and efficiencies associated with pooling investments and risks in group plans.

Based only on retiree benefits, EPI calculated that the internal rate of return on employee contributions is 7.1 percent for 20-year teachers and 8.7 percent for 30-year teachers, not taking into account the value of survivor and disability benefits. Even if you assume teachers indirectly pay for employer contributions in the form of lower salaries, the internal rate of return on total contributions is 5.0 percent for 20-year teachers and 6.4 percent for 30-year teachers, not counting survivor and disability benefits.

These estimates use a salary growth rate assumption based on merit increases in Table B.7 of the actuarial valuation compounded by a general wage increase assumption of 3.5 percent. Total contributions are based on a normal cost rate of 16.723 percent of salary for “2 percent at 62” members in the actuarial valuation (as the name suggests, these are teachers hired on or after 2013 who will receive pensions worth 2 percent of their final average salary multiplied by years of service if they retire at age 62). Teachers contribute nearly half of this amount themselves—8 percent of salary. The life expectancy at age 62 is 27 years, based on mortality rates in Table A.2 of the experience analysis. The male (29 percent) and female (71 percent) shares of the active workforce age 55–60 are from Table C.2 of the actuarial valuation.

Benefits at the normal retirement age are based on a 2 percent multiplier applied to the 3-year final average salary (FAS) after 20 and 30 years of experience (e.g., 2 percent x FAS x 20). These benefits increase by 2 percent each year after the first year to roughly keep pace with inflation.

Based on these assumptions, the ratio of total benefits to total contributions is 6.7 for 20-year teachers and 7.6 for 30-year teachers. According to Rhee and Fornia (2016), 26 percent of the workforce will teach 20–29 years and 49 percent will teach 30 years or more, so the benefit-to-contribution ratio for all teachers with 20 or more years of service is at least 7.3 for teachers hired at age 25. The ratio would be somewhat higher for teachers hired before age 25 and somewhat lower for those hired after age 25 because younger teachers tend to receive steeper pay increases.

The internal rate of return is the rate of return that equalizes the present value of contributions and benefits. Thus, if a $100 contribution goes toward funding a $163 benefit 10 years later, the internal rate of return of return is 5 percent because 100 x (1.05)10 = $163.

EPI finds that an even higher share of California teachers—84 percent—stay 20 or more years.

Sex- and age-specific mortality, disability, and withdrawal rates are from Tables A.2, A.4, and A.5 of the CalSTRS experience analysis. The shares of male (24 percent) and female (76 percent) 25- to 30-year-olds are from Table C.2 of the actuarial valuation. With this information, it is possible to estimate how many 25-year-old newly hired teachers leave, retire on disability, or die each year until age 55. Weighting these by the number of years worked provides an estimate of pension benefits earned by a cross section of active teachers, though actual benefits received will depend on age of take-up, refund rates, and mortality and disability rates between age 55 and 62, among other factors.

In contrast with the EPI and UC Berkeley studies, a methodology looking at just new entrants and weighting them all equally regardless of how many years they teach would find that less than half (48.7 percent) of teachers in California stay at least 20 years.

This is based on the methodology described in the previous section, but without weighting teachers by number of years worked.

EPI analysis shows that a teacher who spends 15 years in one state and 15 years in another state will receive benefits that are roughly 26 percent lower than a teacher who spends 30 years in the same state, all else equal… In a more realistic situation, a teacher who spends 5 years in one state and 25 years in another state will see benefits that are roughly 13 percent lower than those of a teacher who spends 30 years in the same state.”

This assumes that the other state offers the same salary and pension benefits as California. Assumptions are the same as those used in previous sections.

For example, the cost of purchasing annuitized benefits through CalSTRS is slightly less than the cost of “purchasing” higher Social Security benefits by delaying take-up by one year, though cost-of-living adjustments and other provisions are not strictly comparable.

For workers born in 1960 and later, Social Security benefits for workers who take up benefits at age 62 are 70 percent of the primary insurance amount (PIA), the benefit received at the normal retirement age (67 for these workers); for workers who take up benefits at age 63, the share of PIA increases to 75 percent (SSA 2010). Delaying take-up by one year increases annual benefits by 5 percent of the PIA and costs one year of forgone benefits equal to 70 percent of the PIA. The cost-benefit ratio is therefore (70 percent x PIA)/(5 percent x PIA x 26) if life expectancy at age 63 is 26 years. This comes to approximately 0.54, ignoring interest, mortality risk at age 62, and cost-of-living adjustments.

Purchasing a CalPERS service credit at age 62 costs 26.5 percent of the participant’s final average salary (FAS) (CalSTRS 2016). The additional service credit increases benefits by 2 percent x FAS x 27, assuming life expectancy at 62 is 27 years. The cost-benefit ratio is therefore approximately equal to (26.5 percent x FAS)/(2 percent x FAS x 27), or 0.49, ignoring interest and cost-of-living adjustments.

Adjustments for delaying Social Security benefits are more or less “actuarially fair,” meaning that the system’s finances are unaffected by when people decide to take up benefits, taking into account mortality risk and interest income. In comparison, then, CalSTRS benefits can be purchased on slightly favorable terms by participants. However, CalSTRS and Social Security benefits are not strictly comparable. Among other things, CalSTRS benefits increase by a fixed 2 percent per year while Social Security benefits are pegged to a consumer price index.

Retirement outcomes for the luckiest 25 percent of participants are over two and a half times outcomes for the unluckiest 25 percent due to market fluctuations.

This estimate is based on a stochastic (Monte Carlo) analysis of 30-year DC plan participants, assuming 3 percent annual salary growth and based on the risk and expected return on a 60-percent-bond, 40-percent-stock portfolio from McCauley (2016).

About the author

Monique Morrissey joined the Economic Policy Institute in 2006. Her areas of interest include Social Security, pensions, savings, tax expenditures, older workers, public employees, and unions. She is the author of The State of American Retirement, among other EPI publications. She is active in coalition efforts to reform our private retirement system to ensure an adequate, secure, and affordable retirement for all workers. She is a member of the National Academy of Social Insurance. Prior to joining EPI, Morrissey worked at the AFL-CIO Office of Investment and the Financial Markets Center. She has a Ph.D. in economics from American University and a B.A. in political science and history from Swarthmore College.

Endnotes

1. Studies claiming that today’s teachers are mobile and poorly served by teachers’ pensions are part of a larger body of research critiquing the structure of DB pension benefits and promoting account-style plans in their stead. Many of these studies are funded by the Laura and John Arnold Foundation, which has spent $64 million funding research and advocacy in the area of public finance (LJAF 2017). The foundation was established by former Enron trader John Arnold. The Enron scandal cost teacher and other public pension funds an estimated $1.5 billion (Greenhouse 2002).

The Arnold Foundation supports a variety of causes, including reproducibility in scientific research, criminal justice reform, and Head Start (Apple 2017; Marek 2015). After John Arnold read a book by a conservative journalist entitled Plunder: How Public Employee Unions are Raiding Treasuries, Controlling Our Lives and Bankrupting the Nation (Farmer 2017; Greenhut 2009), the foundation began spending millions on research arguing that public pensions are unfair to young and mobile workers, especially mobile teachers (see, for example, McGee 2015; Pyke 2014; Lueken 2017).

A possible explanation for the Arnold Foundation’s negative focus on teacher pensions is that the foundation supports charter schools, which tend to rely heavily on noncareer nonunion teachers (Hall 2016). The foundation also supports Teach for America (TFA), which recruits top college graduates to teach for two years in traditional public schools and public charter schools in low-income communities. Because TFA does not require recruits to have teaching degrees before entering the classroom, it provides teaching opportunities for idealistic young people who had not planned on a teaching career. It is not clear that school districts are better off hiring Ivy League graduates with little training over teachers who plan to make a career of teaching (Clark et al. 2017). In any case, TFA, which places only a few thousand teachers per year, is not easily scalable and should not be the model on which teacher retirement plans are based, especially since most TFA recruits do not stay longer than their two-year commitment (Hansen 2016).

2. The school has to replace a one-year teacher every year, one of four 16-year teachers every four years, and one of twenty 30-year teachers two out of every three years (1+1/4+2/3≈1,9).

References

Aldeman, Chad, and Kelly Robson. 2017. “Why Most Teachers Get a Bad Deal on Pensions; State Plans Create More Losers than Winners, and Many Get Nothing at All.” Education Next, May 16.

Aldeman, Chad, and Andrew J. Rotherham. 2014. Friends without Benefits: How States Systematically Shortchange Teachers’ Retirement and Threaten their Retirement Security. Bellwether Education Partners.

Apple, Sam. “John Arnold Made a Fortune at Enron. Now He’s Declared War on Bad Science.” Wired, January 22.

Boivie, Ilana, and Christian E. Weller. 2012. “The Fiscal Crisis, Public Pensions, and Implications for Labor and Employment Relations.” In Mitchell, Daniel J.B., ed., Impact of the Great Recession on Public Sector Employment. Ithaca, New York: Cornell University Press.

Brainard, Keith, and Alex Brown. 2016. Spotlight on Significant Reforms to State Retirement Systems. National Association of State Retirement Administrators.

Brown, Jennifer Erin, Nari Rhee, Joelle Saad-Lessler, and Diane Oakley. 2016. Shortchanged in Retirement: Continuing Challenges to Women’s Financial Future. National Institute on Retirement Security, March.

Bureau of Labor Statistics (BLS). 2006. “Employee Tenure in 2006.” BLS News, September 8.

Bureau of Labor Statistics (BLS). 2016. “Employee Tenure in 2016.” BLS News, September 22.

Bureau of Labor Statistics (BLS). 2012–2016. Job Openings and Labor Turnover Survey data.

California State Teachers Retirement System (CalSTRS). 2016. Purchase Additional Service Credit. Booklet accessed online July 6, 2017.

Clark, Melissa A., Eric Isenberg, Albert Y. Liu, Libby Makowsky, and Marykate Zukiewicz. 2017. Impacts of the Teach For America Investing in Innovation Scale-Up. Princeton, NJ: Mathematica Policy Research.

Collier, Nick J., Mark C. Olleman, and Julie D. Smith. 2017. Teachers’ Retirement Board California State Teachers’ Retirement System Defined Benefit Program Actuarial Valuation as of June 30, 2016. Milliman.

Costrell, Robert M., and Josh B. McGee. 2016. “Cross-Subsidization of Teacher Pension Normal Cost: The Case of CalSTRS.” University of Arkansas EDRE Working Paper 2016-17.

Farmer, Liz. 2017. “John Arnold: The Most Hated Man in Pensionland.” Governing, April.

Federal Reserve Board of Governors. 2017. 2016 SCF Chartbook.

Fornia, William B., and Nari Rhee. 2014. Still a Better Bang for the Buck: An Update on the Economic Efficiencies of Defined Benefit Pensions. Research Report. National Institute on Retirement Security. December.

Goldring, Rebecca, Soheyla Taie, and Minsun Riddles. 2014. Teacher Attrition and Mobility: Results from the 2012–13 Teacher Follow-up Survey. U.S. Department of Education. Washington, DC: National Center for Education Statistics.

Gray, L., and Soheyla Taie. 2015. Public School Teacher Attrition and Mobility in the First Five Years: Results from the First through Fifth Waves of the 2007–08 Beginning Teacher Longitudinal Study. U.S. Department of Education. Washington, DC: National Center for Education Statistics.

Greenhouse, Steven. 2002. “Enron’s Many Strands: Retirement Money; Public Funds Say Losses Top $1.5 Billion.” New York Times, January 29.

Greenhut, Steven. 2009. Plunder! How Public Employee Unions Are Raiding Treasuries, Controlling Our Lives, and Bankrupting the Nation, Santa Ana, Calif.: Forum Press.

Hall, L.S. 2016. “The Big Reset: Have Funder-Driven Reforms Improved New Orleans Schools?” Inside Philanthropy, May 6.

Hansen, Michael. 2016. “Two-Year Teachers: How Would Schools Benefit if Teach for America Prioritized the Retention of Teachers Following Their Two-year Commitment?” U.S. News and World Report, February 25.

Henry, Garry, C. Kevin Fortner, and Kevin Bastian. 2012. “The Effects of Experience and Attrition for Novice High School Science and Mathematics Teachers.” Science, 335:1118–1121.

Ingersoll, Richard, and Henry May. 2011. Recruitment, Retention and the Minority Teacher Shortage. The Consortium for Policy Research in Education, University of Pennsylvania, CPRE Research Report #RR-69, September.

IPUMS-CPS, University of Minnesota, www.ipums.org.

Laura and John Arnold Foundation (LJAF), website, accessed July 5, 2017.

Lueken, Martin F. 2017. (No) Money in the Bank: Which Retirement Systems Penalize New Teachers? Thomas B. Fordham Institute, January.

Marek, Kiersten. 2015. “Arnold’s Latest Big Play: Corralling Unusual Bedfellows to Reform Criminal Justice.” Inside Philanthropy, February 20.

McCauley, Philip Martin. 2016. “Expected Geometric Returns.” Society of Actuaries Pension Section News, Issue 89, May.

McGee, Josh B. 2015. Creating a New Public Pension System. LJAF Solution Paper, Laura and John Arnold Foundation.

McGee, Josh B., and Marcus A. Winters. 2013. “Better Pay, Fairer Pensions: Reforming Teacher Compensation.” Civic Report No. 79 (September), Center for State and Local Leadership at the Manhattan Institute.

McGuinn, Patrick. 2014. Pension Politics: Public Employee Retirement System Reform in Four States, Brown Center on Education Policy at Brookings, February.

MetLife. 2013. The MetLife Survey of the American Teacher; Challenges for School Leadership.

Morrissey, Monique. 2009. Toward a Universal, Secure, and Adequate Retirement System. Retirement USA Conference Report.

Morrissey, Monique. 2015. Will Switching Government Workers to Account-type Plans Save Taxpayers Money? Economic Policy Institute.

Morrissey, Monique. 2016. The State of American Retirement: How 401(k)s have Failed Most American Workers. Economic Policy Institute Report.

National Association of State Retirement Administrators (NASRA). 2016. Public Fund Survey: Summary of Findings for FY 2015.

National Center for Education Statistics (NCES), U.S. Department of Education. 2016. Digest of Education Statistics: 2015.

National Education Association (NEA). 2016. Characteristics of Large Public Education Pension Plans.

Olleman, Mark C., Nick J. Collier, and Julie D. Smith. 2017. California State Teachers’ Retirement System Experience Analysis July 1, 2010 – June 30, 2015. Milliman.

Prudential. 2017. Why Employers Should Care About the Cost of Delayed Retirements.

Pyke, Alan. 2014. “Meet the Hedge Fund Wiz Kid Who’s Shrinking America’s Pensions.” ThinkProgress (Center for American Progress), October 28.

Raue, Kimberly, and Lucinda Gray. 2015. “Career Paths of Beginning Public School Teachers Results From the First Through Fifth Waves of the 2007—08 Beginning Teacher Longitudinal Study,” U.S. Department of Education National Center for Education Statistics. Stats in Brief (NCES 2015-196) September.

Rhee, Nari, and William B. Fornia. 2016. Are California Teachers Better off with a Pension or a 401(k)? University of California, Berkeley Center for Labor Research and Education.

Siegel Bernard, Tara. 2016. “Think Your Retirement Plan Is Bad? Talk to a Teacher.” New York Times, October 21.

Social Security Administration (SSA). 2010. “Effect of Early or Delayed Retirement on Retirement Benefits.” Web page accessed July 7, 2017.

Stuit, David A., and Thomas M. Smith. 2010. Teacher Turnover in Charter Schools. National Center on School Choice Research Brief, June.

Stuit, David A., and Thomas M. Smith. 2012. “Explaining the Gap in Charter and Traditional Public School Teacher Turnover Rates.” Economics of Education Review, vol. 31, issue 2, 268–279 (April).

U.S. Government Accountability Office (GAO). 2016. 401(k) Plans: Effects of Eligibility and Vesting Policies on Workers’ Retirement Savings.