Policy Memo #130

In all three recent presidential debates, the moderators asked the candidates what economic policies they would forgo in the wake of the Treasury’s $700 billion financial bailout package.

The implication is that fiscal austerity is necessitated by the current efforts to shore up financial markets, and that even the best laid plans—including an economic stimulus—may need to be abandoned. This premise, however, is faulty. Not only are such assessments of next year’s deficit intentionally and wildly overstated, but the actual deficit being considered is actually appropriate and necessary given our current circumstances. In fact, the levels of national debt that would result from an economic stimulus (of even a substantial size) are clearly manageable and consistent with a growing economy.

The notion that plans must be delayed or abandoned has been fueled by many budget alarmists—some of whom are now suggesting a $1 trillion deficit is likely for next year.1 This new fiscal panic attack is in many ways an outgrowth of “entitlement reform” crusaders, who even before the financial crisis have argued that the long-term problems of Medicare, Social Security, and other liabilities demand fiscal austerity in the near term.2 The financial market “bailout” is being used, inappropriately, to escalate these calls for austerity. For example, David Walker, former U.S. comptroller general and current head of the Peter G. Peterson Foundation, was recently quoted as stating: “I think they’re going to have to reconsider all the tax and spending proposals in light of recent economic problems and government actions.”3 Entitlement-reform proponents argue that we cannot afford our current commitments, let alone expand in new areas.

While it is certainly true that the bailout will necessitate a temporary increase in the national debt (as well as a boost to the asset side of the balance sheet), we can expect the long-run budgetary costs will be significantly less than the headline-grabbing $700 billion number because the Treasury will eventually sell back the financial assets acquired in the bailout. The Congressional Budget Office concluded that the plan “would likely entail some net budget cost—which would, however, be substantially smaller than $700 billion.”4 Even if there are long-term costs to the bailout—and that is far from certain—the enacted legislation requires the Treasury to propose a way to offset these costs and suggests a financial transactions tax after five years to cover any of the program’s remaining expenses. So, counting the full $700 billion as an addition to the deficit is inaccurate.

It is also important to remember where deficits currently stand in relation to recent history. In 2007, deficits were just 1.2% of gross domestic product, lower than any year since 1974 (with the exception of the latter 1990s). This year we saw an uptick in deficits to 3.2% of GDP, but that is primarily due to the economy’s slowdown (with the attendant loss of revenues and higher spending) coupled with the one-time “stimulus” last summer. Even that 3.2% is still well below the 4.7%-of-GDP deficit inherited by the Clinton administration in 1992, which was turned into surpluses with just six years of prudent policy as the economy recovered.5 Any notion that we are at or near a fiscal breaking point ignores where we have been over the last 30 years.

With the economy struggling, the job market in recession, and vital national priorities left unaddressed, inaction is not an option. Unemployment is at 6.1% and rising. The United States has lost 760,000 jobs this year, and underemployment—which includes those who want full-time work but are working part time or have stopped looking—is at a 14-year high. The cost of idle hands is tremendous, both for those without a job as well as for the broader economy. As former Treasury Secretary Lawrence Summers put it: “in the current circumstances the case for fiscal stimulus—policy actions that increase short-term deficits—is stronger than ever before in my professional lifetime.”6 Federal Reserve Chairman Ben Bernanke has also echoed this sentiment.7

Getting the economy moving again and pursuing national priorities will be expensive. But it is a cost that we as a nation can certainly afford. Short-term economic stimulus and long-term initiatives—for example, to invest in energy independence, to improve education, or to maintain our national infrastructure—are both necessary and affordable.

What can be done?

In light of current economic developments, rising deficits are inevitable for the next couple of years. We know from history that increasing taxes on the middle class or cutting back on federal spending in the midst of a recession will only make things worse by reducing the demand for goods and services, thereby exacerbating the downturn. As a consequence, deficit reduction must take a back seat to short-term stimulus for the moment.

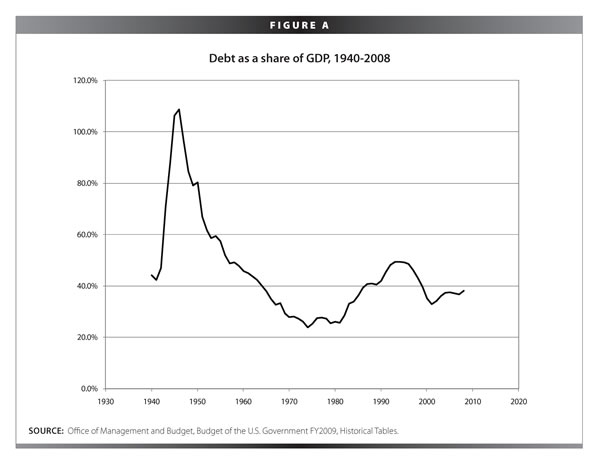

But how far can the government go to help prod the economy? The government can still continue to borrow at very low interest rates (as it has done to fund the $10 billion a month military actions in Iraq, for example, and current levels of debt do not typically create excessive instabilities. Despite the fact that the budget surpluses inherited by President Bush have since been turned to deficits, the overall national debt as a share of the economy—at about 40%—is still on the low end of historical norm (see Figure A).

So by historical standards, there is room to fund stimulus and other initiatives, even without additional revenue. And though we cannot simply ignore the overall budget situation, allowing a temporary increase in the national debt next year to levels no higher than what we averaged in the 1990s (46.1%) would allow room for about $900 billion in additional debt. This level would fully cover the new debt required to finance the $700 billion Wall Street bailout as well as fund a substantial $150-200 billion stimulus for Main Street and the broader economy in 2009. Allowing the debt to increase by 2010 to no higher than the 1990s peak (49.4%), would allow $1.3 trillion to be used over the next two years to cover the bailout, a stimulus, and provide a substantial jump-start for investments in job creation, energy independence, and other priorities.

These levels of national debt have been proven to be stable and not a threat to a growing economy. The mid- to late 1990s saw substantial growth in the overall economy and in individual incomes. As the economy recovered from the early 1990s recession and grew throughout the decade, we saw the national debt begin to decline. We can achieve the same results this time, and putting the economy back on sound footing is the first step.

Scoring the bailout

Because the federal bailout of the financial industry will consist of loans, asset purchases, and direct investments in financial firms, it is an open question about how best to measure its impact on the deficit. It is clear that the $700 billion package—as well as the bailouts of Fannie Mae, Freddy Mac, and AIG—will affect the federal government’s balance sheets (both on the debt and on the asset side). Taxpayers will be required to pick up the tab if those assets are later sold at lower prices than their purchase, and if federal loans are not paid back.

Given the extraordinary nature of the current crisis, budget agencies (including the CBO, Treasury Department, and Office of Management and Budget) should coordinate to develop off-budget accounting procedures to measure its impact. In particular—and consistent with past practice—these departments should estimate the projected current value of taxpayer liabilities that might arise from equity stakes, loans, and asset purchases. Over time, these estimates should be revised as assets are sold and loans repaid, and also as market prices for these assets change.

Future baseline deficit estimates should provide estimates that both include and exclude the expenditure impact of the various bailout measures.

In fact, it was the progress made on budget deficits in the 1990s (which brought the debt down by 16 percentage points of GDP between 1993 and 2001) that allows us the financial resources to address today’s problems. One reason to keep the debt low during economic expansions is to ensure that we have enough “rainy day” reserves to stimulate the economy. Clearly that day has arrived.

Finally, when the banking sector is stabilized, the Treasury will begin to sell some of the assets acquired during this crisis—helping to mitigate the increased debt incurred in the short-run. While the government will take on some risk—and risk always entails the possibilities of costs—in the long-run, those costs should be minor (especially in comparison with the costs of doing nothing), and even they could be paid for with tax increases on the financial industry.

Conclusion

A change in economic direction is not unaffordable. We can, in the short-run, stimulate the economy and put a down payment on longer-term national priorities. Scaremongering about “trillion dollar deficits” is misleading and will misdirect policy.

Presidential candidates should be asked about their priorities—and clearly the two candidates have very different views—but it is a mistake to think that we as a nation must be paralyzed by the current fiscal situation at a time when positive, forward-thinking action is needed most.

Endnotes

1. The $1 trillion estimate assumes $438 billion from CBO’s estimate, then adds the off-budget social security surplus, a $150 stimulus package, and unspecified revenue declines from a slowing economy. For example, see Ruth Marcus, “When Life Hands You Deficits…” Washington Post, October 15, 2008 at

http://www.washingtonpost.com/wp-dyn/content/article/2008/10/14/AR2008101402562.html

2. The primary example here is of the well-funded Peter G. Peterson Foundation (http://www.pgpf.org/getinvolved/nyt-debate-questions/). The $53 trillion figure comes from a present value calculation of the 75-year gap between projected outlays and revenues in Medicare, Social Security, and other programs. This figure is very sensitive to alternative assumptions about, for example, growth rates in medical care costs. The figure also needs to be compared to the size of the economy to put it in perspective. By this measure, $53 trillion is about 6.9% of future income.

3. Russ Britt, MarketWatch, October 15, 2008 at

http://www.marketwatch.com/news/story/can-obama-mccain-really-cut/story.aspx?guid={02881347-F2DE-4A86-BEC2-426654A0C537}

4. Congressional Budget Office, Letter to Senator Dodd, October 1 2008, at http://cbo.gov/ftpdocs/98xx/doc9852/hr1424Dodd.htm

5. Final deficit for fiscal year 2008 is $455 billion, see U.S. Treasury at http://treasury.gov/press/releases/hp1213.htm

6. L. Summers, “A Bailout is Just a Start,” Washington Post, September 29,2008 at http://www.washingtonpost.com/wp-dyn/content/article/2008/09/28/AR2008092802232.html

7. See the October 20, 2008 Statement of Ben S. Bernanke, Chairman Board of Governors of the Federal Reserve System, before the Committee on the Budget, U.S. House of Representatives.