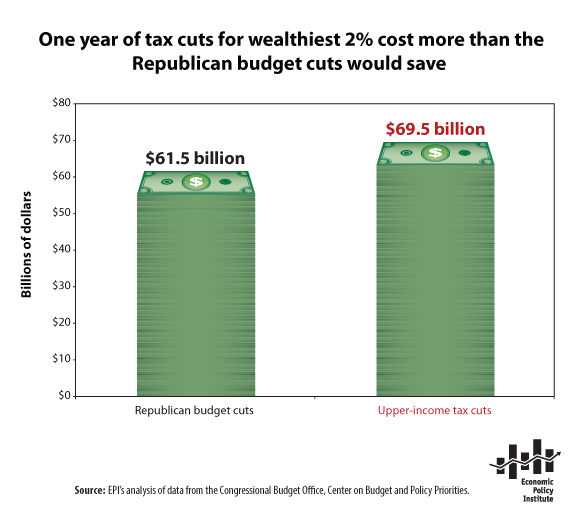

Republican leaders in Congress are seeking immediate spending cuts that would hurt the economic recovery and cost at least hundreds of thousands of jobs. The cuts, which would affect everything from child nutrition and early childhood education to college tuition assistance and food safety inspections, aim to reduce the deficit. But Congress intentionally increased the deficit last December by extending Bush-era tax cuts for families making more than $250,000 and passing an estate tax cut that benefits only the top quarter of one percent of earners. The figure compares the amount of money that would be saved by the proposed budget cuts with the one-year cost of the tax cuts for the wealthy that were approved late last year. As shown, tax cuts for the wealthy have added more to the deficit than would be shaved from the deficit by the proposed spending cuts to important social programs.

The budget passed by the House of Representatives February 19 would cut an additional $61.5 billion from nondefense discretionary funding relative to the annual funding level in the short-term budget passed last December, which roughly froze spending at 2010 levels, unadjusted for inflation. (The House-passed budget would cut $51.5 billion from the current budget that expires April 8, which is prorating the House-passed budget by cutting $2 billion a week). The Center on Budget and Policy Priorities estimates that the two-year upper-income tax cuts in December’s tax deal cost $139 billion, or roughly $69.5 billion per year. In other words, the spending cuts in the House-passed budget would not even recoup the cost of the tax cuts passed last year for the wealthiest 2% of Americans. Trading tax cuts for the wealthy for these nondefense domestic spending cuts will cost jobs and increase the deficit.