Low wage earners face the most challenges saving for retirement, yet the tax subsidies for retirement saving are skewed overwhelmingly in favor of top earners. Since tax breaks for 401(k)s and similar retirement plans are tied to a participant’s income tax rate, low-income taxpayers receive modest or no tax subsidies for each dollar put into these plans. The highest-paid workers, who have more resources to save for retirement without government assistance, receive the largest tax breaks. The problem is compounded by the fact that higher-paid workers are more likely to be offered a plan by their employer, and to receive a generous employer match, so they’re more likely to participate.

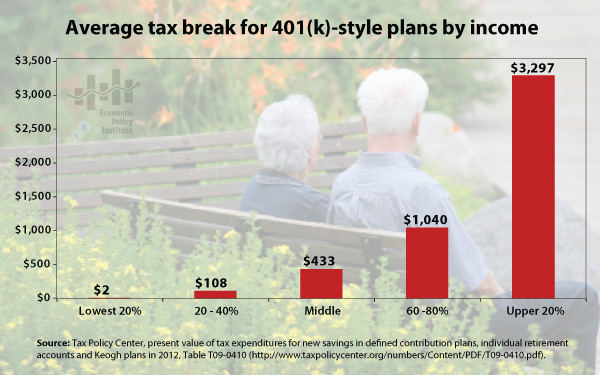

As a result, taxpayers in the top 20% of the income distribution will receive an average tax break worth $3,297 for contributions made in 2012, compared with almost nothing – an average of just $2 — for those in the bottom 20%, according to an estimate from the Urban-Brookings Tax Policy Center. The Tax Policy Center bases its estimate on the conservative assumption that taxpayers will be in the same tax bracket at retirement as when they are working. That assumption understates the potential value of these tax breaks for the highest earners, who often shift into a lower tax bracket after they stop working. Urban-Brookings estimates that only 14% of tax subsidies for these retirement plans will go to taxpayers in the bottom 60% of the income distribution.

EPI is part of Retirement USA, which is hosting a conference October 21 on Re-envisioning Retirement Security. Read the conference report, Toward a universal, secure, and adequate retirement system.