Snapshot for March 25, 2009

by Tony Avirgan

The International Monetary Fund (IMF) forecasts that the global economy will contract in 2009 for the first time since World War II. Given this backdrop, the United States and other countries didn’t need the extra bit of bad news they got last week: the meeting of G-20 finance ministers ended with no concrete call for coordinated fiscal stimulus. Put simply, too many countries are free-riding on other nations’ stimulus packages.

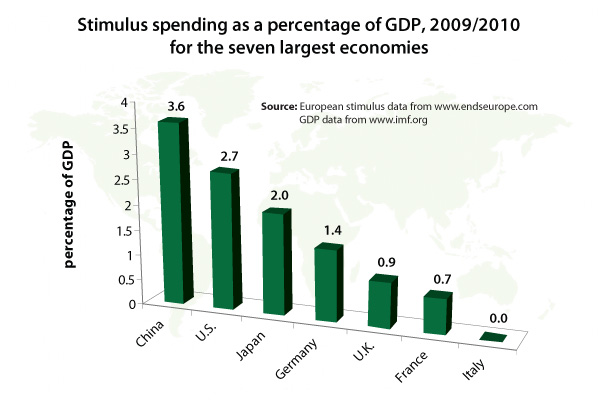

Last month the United States passed a stimulus package worth 2.7% of its total gross domestic product (GDP) in 2009 and 2010. China’s stimulus package looks to exceed that of the United States, with the government planning to dedicate over 3.5% of GDP to economic stimulus in each of the coming years, according to news reports.

Meanwhile the European Union’s 13 largest economies have stimulus packages averaging just 0.78% of GDP. Italy has no stimulus plans at all. Several European countries, led by Germany, are advocating tighter regulation instead of spending as a means to address the current economic crisis.

It is far past time for Europe to stop letting deficit hawks dictate policy. And it is time for bodies like the G-20 to adopt remedies that match the scale of the global recession. President Obama should deliver that message when the G-20 summit convenes in London during the first week in April.