What this report finds: Rapid growth in the cost of U.S. health care has put sustained downward pressure on wages and incomes. This rapid growth of spending has not purchased notably high-quality care, however. U.S. spending on health care is higher than in peer countries, while quality is lower. These high costs cannot be attributed to overuse of health care in America; instead, it is clear that the high price of health care is the culprit. Prices for pharmaceuticals, physician salaries, and medical procedures are almost uniformly higher in the U.S. than in peer countries—sometimes staggeringly so.

Why it matters: Rising premiums, out-of-pocket costs, and public health spending are crowding out income gains and spending on other goods and services. Meanwhile, our health care system ranks low on measures of equity and quality relative to peer countries. Recognizing the role of health care prices in driving health spending is crucial: Efforts to contain costs by controlling use are not only economically inefficient but also dangerous—leading to decreases in medically indicated and preventive care that would improve health outcomes for Americans and that is more cost efficient in the long run.

What can be done about it: Policymakers need to focus on controlling health care prices, not restricting use. While much attention has understandably focused on the ambitious vision of adopting a “single-payer” or “Medicare-for-all” plan, there are steps policymakers could adopt in the nearer term that would allow many of the virtues of single-payer to be realized more quickly and that could serve as useful stepping stones to even more ambitious reform:

- Extend already existing public plans and incorporate a “public option” into ACA exchanges.

- Adopt “all-payer rates”—mandating that the same prices apply regardless of who is paying—to allow private insurers to benefit from the bargaining power of Medicare.

- Pursue policies that would diminish the intellectual property rights monopolies of key health care sectors, like pharmaceutical companies.

- Increase antitrust scrutiny of consolidation of hospitals and physician networks.

Introduction and key findings

Health care remains one of the most salient policy issues on the minds of American households. Polling indicates that people who currently have coverage are generally “satisfied with how the healthcare system is working for [them]” (Auter 2016). This holds true for both public coverage (Medicare and Medicaid) and employer-sponsored insurance (ESI), with unionized workers particularly likely to be satisfied with their ESI plans. On the one hand, this broad-based satisfaction with ESI is good news, as this type of coverage is by far the largest single source of health insurance for American families, with roughly 181 million enrollees. However, another survey stresses that even currently covered Americans realize that there is great pressure on the future sustainability of all forms of health coverage. When asked if they are satisfied about the “total cost of health care in this country,” only 14 percent respond “yes,” with 84 percent saying that they are dissatisfied (CNN/ORC 2017).

This widespread dissatisfaction with health care costs is completely rational; the cost of American health care is exceptionally expensive while its quality is subpar when compared with health care in similarly rich nations.1 Further, the high (and rising) costs of health care have drawn too little attention from policymakers. The Affordable Care Act (ACA) was a major step forward in addressing some key problems with the American health care system. The ACA expanded coverage to millions and established clear and popular rules to eliminate bias against preexisting conditions. Its provisions provided much better protection against personal bankruptcy due to medical costs. These advances notwithstanding, the provisions of the ACA were insufficient for achieving the aim of reining in the fast-rising costs of American health care without sacrificing households’ access to needed medical care.

Worse, since the ACA was passed, the Republican-controlled Congress has done nothing to usefully reform or strengthen the ACA but has instead sought to subvert its gains. A full repeal of even the most popular ACA provisions (like the ban against discrimination on the basis of preexisting conditions) just barely failed in Congress, and the Trump administration has engaged in numerous efforts to thwart the ACA’s effectiveness.2

On the cusp of the 2018 election, this has left the American health care system in limbo. The GOP has undermined the already insufficient reforms of the ACA without offering any alternative plan to provide health security. At the same time, many Democrats have expressed considerable desire to have the United States adopt a “single-payer” health system.3

Doing nothing but undermining an already-troubled American health system should not be a serious policy option. While a single-payer system has large potential benefits, moving toward such a system will almost certainly be a long process that promises little short-run relief for families. Luckily, however, many of the key policy virtues that allow more robust public systems (like Medicare or the health systems of peer countries) to achieve greater cost containment without sacrificing quality can be realized much more quickly and with potentially less political opposition.

These cost-containment strategies would not only make a large public role for health care more plausible, they would also supply needed short-run relief to the private American health care system, particularly the system of employer-provided health care. This ESI system, which provides coverage for American families through the workplace and is paid for with contributions from both employers and employees, is by far the single largest source of health insurance coverage in the United States today.4 This means that the ESI system is where key problems troubling the American health insurance system are most visible to working American families. In the decade before the Affordable Care Act was passed, the ESI system was clearly burdened with the most pressing problem facing the overall American health insurance system: rapidly rising costs. These rising costs in turn led to the rapid erosion of ESI coverage, even during the economic expansion of the early and mid-2000s.5 As costs have slowed a bit in the past decade, ESI coverage rates have largely stabilized. The lesson here is clear: controlling health care costs is vital to the economic well-being of the majority of Americans.

This report highlights trends in health care costs in both ESI and the overall American health system. It demonstrates the various channels through which rising health care costs put downward pressure on the growth of living standards of American families, and it identifies the key sources of rising health costs. Finally, it provides a series of recommendations for policymakers looking to pass reforms to slow the rate of health care cost growth, identifying, in particular, broad approaches that do and do not have merit.

Key findings

- Premium prices in the employer-sponsored insurance system have risen rapidly over the past two decades. The total cost of a family ESI plan rose from $5,791 to $18,142 between 1999 and 2016.6 As a share of average annual earnings for the bottom 90 percent of the workforce, these premium costs rose from 25.6 to 51.7 percent over that same period.

- Fast premium growth did not purchase better protection from health care cost growth for workers. Out-of-pocket costs rose faster between 2006 and 2016 than total costs or costs paid by insurers did. Out-of-pocket costs rose 53.5 percent cumulatively over that time, while total costs rose 49.2 percent and costs paid by insurers rose 48.5 percent.

- The rapid growth in health care costs has led to a rapid increase in total health spending as a share of GDP. This measure has risen from 5.2 percent of U.S. GDP in 1963 to 8.4 percent in 1979 to 17.4 percent in 2016.

- Among industrialized nations, the U.S. has the highest health care costs and below average quality and utilization. When comparing the American health system with the health systems of advanced economy peer countries, American health care spending and prices are by far the highest, while utilization—the volume of health goods and services being consumed—and measures of quality are decidedly below average.

- Policymakers need to focus on controlling prices, not utilization. The weight of the empirical evidence in this report indicates clearly that policies to “bend the health care cost curve” should focus on efforts to control prices, not use. The common root in strategies to contain prices in the health care sector is the need to bring countervailing market power to bear against monopoly-like pricing power currently wielded by health care providers.

- Policy focusing on utilization leads to inefficiency. To date, most efforts to control use of health care services have been poorly tailored because they focus simply on “cost sharing”—or raising the cost of receiving health care across the board. Raising the marginal cost of health in this way does reduce utilization, but patients do not cut back only on low-value care. They also cut back on medically indicated care that could actually be cost-saving in the long run.

- Meaningful policy to address pricing includes public negotiation of “all-payer rates.” The most straightforward way to provide countervailing force against the pricing power of health care providers, as well as to make health care prices informative to consumers, is more robust public negotiation of prices and the extension of this public-sector pricing power to all payers. For example, policymakers should strongly consider setting caps on rates as a tool to slow growth and provide greater transparency and accountability to consumers.

These findings underscore the depth of the challenges that remain to making our health care system more equitable and efficient. They also provide a clear series of steps that policymakers can take to improve this situation. These steps can be part of the groundwork for a more fundamental transformation of the American health system but would also ensure that the current pillar of this system—ESI—will remain strong as new reforms are made.

The canary in America’s health care coal mine: Rising costs for ESI

Table 1 shows one of the most salient trends in American economic life over recent decades—the rising cost of premiums for ESI. It shows employee contributions for these premiums, as well as their total cost, for both family and individual plans. The top panel of Figure A visually depicts the dramatic rise in health care costs as a share of income.

Bottom 90% earnings, and insurance premiums and premium contributions for employer-sponsored health insurance, 1999 and 2016 and 1999–2016 change

| 1999 | 2016 | Change 1999–2016 | ||||

|---|---|---|---|---|---|---|

| Dollars | As share of annual earnings | Dollars | As share of annual earnings | Dollars | Share of annual earnings | |

| Bottom 90% earnings | $22,651 | $35,083 | $12,432 | |||

| Total single premium | $2,196 | 9.7% | $6,435 | 18.3% | $4,239 | 8.6 ppt |

| Worker portion of single premium | $318 | 1.4% | $1,129 | 3.2% | $811 | 1.8 ppt |

| Total family premium | $5,791 | 25.6% | $18,142 | 51.7% | $12,351 | 26.1 ppt |

| Worker portion of family premium | $1,543 | 6.8% | $5,277 | 15.0% | $3,734 | 8.2 ppt |

Sources: Data on ESI premiums comes from the Kaiser Family Foundation (2017) Employer Benefits Survey. Data on average annual earnings for the bottom 90 percent are author’s analysis of data from the Social Security Administration 2017, updated using the methods of Mishel and Kroeger 2016.

The average annual employee contribution to single ESI premiums rose from $318 to $1,129 between 1999 and 2016. This 7.7 percent average annual increase far outpaced the 2.6 percent average annual increase in (nominal) average earnings for the bottom 90 percent of wage earners. This relatively rapid growth of ESI single premium costs led to employee payments for ESI single premiums rising from 1.4 percent to 3.2 percent of average annual earnings for the bottom 90 percent, while employee payments for family plans rose from 6.8 to 15.0 percent of earnings over the same time.

While increased costs of employee contributions to ESI premiums are one of the most salient ways that rising health costs can put pressure on living standards, most economists would agree that in the long run even rising employer contributions to ESI premiums harm potential wage growth.7 The intuition is simple: employers care about the level of employee compensation, not its composition. If workers would rather have more compensation in the form of health insurance contributions and less in cash, employers should in theory be happy to oblige this. This reasoning is why we also show the share of total ESI premiums (both employee and employer contributions) in Table 1 as well. These total premiums have grown slightly slower than just the employee contributions, but still rapidly enough to increase their share of average earnings of the bottom 90 percent in every year. Total ESI premiums for singles rose from $2,196 in 1999 to $6,435 in 2017, and as a share of average annual earnings for the bottom 90 percent, they rose from 9.7 percent to 18.3 percent. For family coverage, total ESI premiums rose from $5,791 in 1999 to $18,142 in 2016, and as a share of average annual earnings for the bottom 90 percent, they rose from 25.6 percent to 51.7 percent.

A straightforward way to interpret the findings shown in Table 1 (looking just at the dollar amounts) is that average annual earnings that could be spent on non-health-care-related goods and services could have been $4,239 higher for those with individual ESI coverage in 2016 but for the rise in ESI premiums. Looking at the change in ESI premiums as a share of annual earnings gives a potentially more realistic description of what the boost in earnings could be had premium price inflation not run ahead of wage growth. Had single ESI premiums simply stayed constant as a share of average earnings, the table shows that this would imply a boost to annual pay of 8.6 percent (or $3,032).8 For those with family ESI coverage, this boost to pay that could be spent on non-health-related consumption could have been $12,350 (as a simple dollar amount), or a 26.1 percent raise ($9,161)9 even if ESI premiums had simply stayed constant as a share of average earnings. Given that nominal annual earnings rose by 54.8 percent cumulatively between 1999 and 2016, this implies that earnings growth for those with single ESI coverage could have been 15.7 percent as rapid, and earnings growth for those with family coverage could have been 47.6 percent as rapid, but for the rising cost of ESI premiums.10

If these rising ESI premiums were purchasing more insulation against health care costs for workers, then perhaps their rapid rise in recent years would have stung less. In other words, if workers were paying less out of pocket when they go to the doctor, then the higher premiums might seem like a good deal. But out-of-pocket costs for health care (that is, costs not paid for by insurance companies even after they have received employees’ premiums) rose rapidly from 1999 to 2016 as well. The bottom panel of Figure A shows the rise of total health costs for those covered by ESI, the rise in costs covered by ESI, and the rise in costs covered by insured households’ out-of-pocket payments (deductibles, copayments, and coinsurance). Between 2006 and 2016, total health costs cumulatively rose by 49.2 percent. Out-of-pocket costs actually rose slightly faster in this period, at 53.5 percent.11 Costs covered by insurance rose by 48.5 percent. This indicates clearly that the rapid growth in ESI premiums paid in this time did not translate into enhanced coverage of total health costs (i.e., reduced out-of-pocket costs for insured households).

Workers' health insurance premiums are rising much faster than wages but not lowering out-of-pocket costs

Average annual earnings of the bottom 90 percent and premiums for employer-sponsored health insurance, 1999–2016

| Year | Average bottom 90% earnings | Family premiums | Single premiums |

|---|---|---|---|

| 1999 | $22,651 | $5,791 | $2,196 |

| 2000 | 23,854 | 6,438 | 2,471 |

| 2001 | 24,636 | 7,061 | 2,689 |

| 2002 | 24,989 | 8,003 | 3,083 |

| 2003 | 25,572 | 9,068 | 3,383 |

| 2004 | 26,255 | 9,950 | 3,695 |

| 2005 | 26,994 | 10,880 | 4,024 |

| 2006 | 28,055 | 11,480 | 4,242 |

| 2007 | 29,079 | 12,106 | 4,479 |

| 2008 | 30,042 | 12,680 | 4,704 |

| 2009 | 29,909 | 13,375 | 4,824 |

| 2010 | 30,205 | 13,770 | 5,049 |

| 2011 | 30,984 | 15,073 | 5,429 |

| 2012 | 31,682 | 15,745 | 5,615 |

| 2013 | 32,283 | 16,351 | 5,884 |

| 2014 | 33,269 | 16,834 | 6,025 |

| 2015 | 34,471 | 17,545 | 6,251 |

| 2016 | 35,083 | 18,142 | 6,435 |

Cumulative growth in total health care costs for workers covered by employer-sponsored insurance, costs paid by insurers, and costs paid out of pocket by covered households, 2006–2016

| Year | Total costs | Paid by insurer | Paid by insured household |

|---|---|---|---|

| 2006 | 0.0% | 0.0 | 0.0 |

| 2007 | 3.7 | 3.5 | 5.3 |

| 2008 | 9.7 | 10.2 | 6.9 |

| 2009 | 17.8 | 18.6 | 13.5 |

| 2010 | 20.5 | 20.4 | 20.8 |

| 2011 | 24.7 | 24.6 | 25.5 |

| 2012 | 27.9 | 26.8 | 34.1 |

| 2013 | 32.6 | 31.1 | 41.5 |

| 2014 | 39.8 | 39.2 | 43.4 |

| 2015 | 46.1 | 45.5 | 49.5 |

| 2016 | 49.2 | 48.5 | 53.5 |

Notes: In the bottom panel, costs paid out of pocket by employees include deductibles, copayments, and coinsurance but do not include employee contributions toward premiums. If insurers were compensating for rising premiums by providing more comprehensive coverage, their costs paid would be rising at a faster rate, but the closeness of the lines in the graph shows that the share of medical bills paid for by insurers has not increased.

Sources: Data on ESI premiums (top panel) and cumulative growth in total health care costs (bottom panel) come from the Kaiser Family Foundation (2017) Employer Benefits Survey. Data on average annual earnings for the bottom 90 percent are author’s analysis of data from the Social Security Administration 2017, updated using the methods of Mishel and Kroeger 2016.

In short, rising ESI premiums seem to be paying for essentially the same level of protection against health cost shocks as they ever did, with the overall cost of health shocks increasing over time. This implies that the real driver behind ESI premium growth is underlying health costs—an implication that is confirmed in the next section of this report.

Finally, besides their potential role in stifling wage growth, the rapidly rising costs of ESI premiums surely played a role in the rapid erosion of ESI coverage over much of this period. Gould (2013a) documents the erosion in the share of Americans covered by ESI in most of the period between 2000 and 2012. Before 2008, much of this fall was surely driven by historically fast “excess cost growth” (ECG) of health care. (As described in the next section, we define ECG as the difference between the per capita growth rate of potential GDP and the per capita growth rate of health costs.) After 2008, the pace of this excess cost growth relented (at least temporarily), and coverage declines were driven largely by the labor market crisis of the Great Recession. In recent years, ESI coverage has largely stabilized in a post-recession environment, with relatively moderate excess health care cost growth.

The rising cost of health care is a systemwide problem

Given that rising ESI premiums seem to not be paying for more comprehensive coverage, and seem instead to simply be paying for constant protection against steadily rising health costs, it seems likely that trends in premium growth are being driven by overall health costs. The simplest test of the hypothesis that rising health costs are not unique to ESI coverage can be found in Figure B. This figure shows annual growth rates of per capita potential gross domestic product (GDP) and per capita growth rates of health costs, and it also charts the growth in national health spending as a share of potential GDP over time.

GDP is essentially a measure of total domestic income, and potential GDP is a measure of what GDP could be in a given year assuming the economy did not suffer from excess unemployment during that year.12 For health costs, we show average annual growth in national health costs divided by the total population of the United States. The difference between the per capita growth rate of potential GDP and the per capita growth rate of health costs is one version of what is often labeled “excess costs” in health care. Because we are interested in growth rates of health care costs, and because these growth rates are influenced by price changes, neither of these series are adjusted for inflation; instead, we simply track nominal growth in both measures.

National health spending grows faster than the economy, leading to rising health costs as a share of GDP: Annual growth in potential gross domestic product (GDP) and national health spending per capita, and national health spending as a share of GDP, 1963–2016

| Health spending per capita, annual growth rate | Potential GDP per capita, annual growth rate | Health spending as a share of potential GDP | |

|---|---|---|---|

| 1963 | 6.6630% | 3.6753% | 5.2100% |

| 1964 | 8.1860% | 4.1030% | 5.4148% |

| 1965 | 8.1550% | 4.4119% | 5.6083% |

| 1966 | 8.7561% | 5.3061% | 5.7904% |

| 1967 | 9.0819% | 5.9913% | 5.9596% |

| 1968 | 10.6157% | 7.1631% | 6.1522% |

| 1969 | 11.5567% | 7.8402% | 6.3638% |

| 1970 | 11.9869% | 8.2077% | 6.5862% |

| 1971 | 11.0592% | 7.6787% | 6.7924% |

| 1972 | 10.8231% | 6.9372% | 7.0395% |

| 1973 | 10.0730% | 6.8901% | 7.2487% |

| 1974 | 11.2432% | 8.8411% | 7.4081% |

| 1975 | 12.0202% | 10.8218% | 7.4887% |

| 1976 | 13.2363% | 10.8772% | 7.6519% |

| 1977 | 13.2562% | 9.6124% | 7.9098% |

| 1978 | 12.5668% | 8.7754% | 8.1821% |

| 1979 | 12.1997% | 9.7512% | 8.3633% |

| 1980 | 12.6633% | 10.4858% | 8.5286% |

| 1981 | 13.7348% | 10.7466% | 8.7601% |

| 1982 | 13.5286% | 9.9516% | 9.0449% |

| 1983 | 11.8397% | 8.5082% | 9.3209% |

| 1984 | 10.0617% | 7.0991% | 9.5783% |

| 1985 | 8.7952% | 6.1881% | 9.8131% |

| 1986 | 7.8322% | 5.6611% | 10.0133% |

| 1987 | 7.4082% | 5.2874% | 10.2151% |

| 1988 | 8.4922% | 5.3897% | 10.5176% |

| 1989 | 9.7172% | 5.7079% | 10.9173% |

| 1990 | 10.5963% | 5.8368% | 11.4079% |

| 1991 | 9.5018% | 5.4317% | 11.8465% |

| 1992 | 8.5510% | 4.6792% | 12.2820% |

| 1993 | 7.0628% | 4.0980% | 12.6307% |

| 1994 | 5.8493% | 3.7034% | 12.8890% |

| 1995 | 5.0867% | 3.8628% | 13.0398% |

| 1996 | 4.3902% | 3.8349% | 13.1094% |

| 1997 | 4.4475% | 4.0035% | 13.1652% |

| 1998 | 4.4001% | 3.9734% | 13.2193% |

| 1999 | 4.9253% | 4.3937% | 13.2867% |

| 2000 | 5.4291% | 4.8084% | 13.3654% |

| 2001 | 6.3346% | 5.0957% | 13.5235% |

| 2002 | 7.4139% | 4.6979% | 13.8788% |

| 2003 | 7.8801% | 4.0745% | 14.3885% |

| 2004 | 7.4597% | 3.8726% | 14.8797% |

| 2005 | 6.5299% | 4.2965% | 15.1954% |

| 2006 | 5.8841% | 4.5144% | 15.3942% |

| 2007 | 5.6311% | 4.2787% | 15.5946% |

| 2008 | 4.7853% | 3.5169% | 15.7850% |

| 2009 | 4.0717% | 2.6437% | 16.0044% |

| 2010 | 3.3192% | 1.8707% | 16.2332% |

| 2011 | 3.0945% | 1.7810% | 16.4419% |

| 2012 | 3.1002% | 2.0850% | 16.6051% |

| 2013 | 2.7039% | 2.3707% | 16.6588% |

| 2014 | 3.2489% | 2.4439% | 16.7893% |

| 2015 | 3.8346% | 2.3154% | 17.0397% |

| 2016 | 4.3914% | 2.3941% | 17.3713% |

Notes: Potential GDP is a measure of what GDP could be as long as the economy did not suffer from excess unemployment. The difference between the growth rate of potential GDP per capita and health spending per capita is often described as “excess cost growth” in health care. Potential GDP is used to measure excess health care cost growth so that it is not infected by economic recessions and booms.

Sources: Data on potential GDP are from the Congressional Budget Office 2018a. Data on national health spending are from the National Health Expenditure (NHE) Accounts from the Centers for Medicare and Medicaid Studies (CMS) 2018.

As the chart shows, the per person annual rate of health care cost growth is substantially faster than annual growth in potential GDP per person over the entire period, by an average of 2.4 percentage points between 1963 and 2016 and an average of 2.1 percentage points between 1979 and 2016. This more rapid growth of health care costs implies that these costs have been rising over time as a share of total U.S. GDP. The figure also charts this evolution, indicating that health care spending has risen from 5.2 percent of U.S. GDP in 1963 to 8.4 percent in 1979 to 17.4 percent in 2016.

Figure C also shows the average annual excess cost growth of health care for the period from 1979 to 2007, just before the Great Recession, and for the period since 2007 (the period during and after the Great Recession). In addition to per capita rates for the entire U.S. population, Figure C also shows ECG rates per insurance enrollee (that is, for just the population that is covered by insurance). Figure C highlights that excess cost growth was quite steady for both of these populations until roughly a decade ago, when it fell substantially.

Excess health care cost growth was quite steady until roughly a decade ago, when it fell substantially: Average annual rates of excess cost growth per capita and per insurance enrollee, 1979–2007 compared with 2007–2016

| Per capita | Per insurance enrollee | |

|---|---|---|

| 1979–2007 | 2.3648% | 2.5510 |

| 2007–2016 | 1.3149 | .5848 |

Notes: Excess growth in health care costs is the difference between the growth rate of potential GDP per capita and the growth rate of health spending per capita (health costs divided by the entire population) and health spending per insurance enrollee (health care costs divided by the number of persons with health insurance). Potential GDP is a measure of what GDP could be as long as the economy did not suffer from excess unemployment.

Sources: Data on potential GDP come from the Congressional Budget Office 2018a. Data on national health expenditures come from the National Health Expenditure Accounts from the Centers for Medicare and Medicaid Studies (CMS 2018). Data on the share of the population with access to health coverage before 1987 come from Cohen et al. 2009; data for this share for the years 1987–2016 are from CMS 2018.

Figure C also shows that between 1979 and 2007, excess costs were slightly higher when calculated with health care costs divided by the share of the insured population rather than the entire population. Unlike nearly every other advanced economy, the United States has allowed a large share of its population to go without access to health insurance each year for decades. Because lack of insurance can make seeking medical care prohibitive on the grounds of cost, this failure to provide universal access to insurance may well have slightly held costs down at the national level. Figure C also highlights that the relative success in containing costs post-2007 is even more dramatic once one accounts for the large increase in the share of population covered in that time; excess cost growth calculated using a measure of cost per insured is far slower post-2007.13 While the recent slowdown in excess health care costs is welcome, policymakers should not be complacent about its durability, for reasons that are discussed in depth in Appendix A.14

Finally, it is worth emphasizing that—as has been documented extensively—the fast pace of health spending growth has not bought high health care quality for the United States relative to other advanced economies. In international comparisons, American health outcomes are decidedly below average when compared with these rich country peers. Figure D shows a comparison of 11 countries’ health systems across a range of measures, based on the findings of Schneider et al. (2017).15 In Schneider et al.’s study, the U.S. is ranked fifth out of 11 in “care process,” 10th out of 11 in “administrative efficiency,” and dead last in “equity,” “affordability,” and “health care outcomes.” The combination of “affordability” and “timeliness” represents a country’s score on “access,” and Schneider has the U.S. ranked last on this measure as well. Finally, the U.S. is also ranked last overall.

The scores in Figure D are normalized so that the weakest performance measured for each criterion is equal to 1. The figure shows the United States’s normalized performance measure alongside the average, minimum, and maximum of the remaining 10 non-U.S. countries. Not shown in Figure D, but worth noting, is the fact that within the “heath care outcomes” ranking, in Schneider et al.’s underlying data, the United States ranks last in the following specific outcomes: infant mortality, the share of nonelderly adults with at least two chronic health conditions, life expectancy at the age of 60, mortality amenable to health care, and the 10-year decline in mortality amenable to health care.16 In short, international comparisons provide no evidence that high U.S. spending buys it a particularly good national health system.

High U.S. health care spending buys poor health system outcomes: U.S. score on health system attributes relative to scores of 10 other advanced country peers

| 10-peer-country score (non-U.S. average) | Highest-scoring non-U.S. country | Lowest-scoring non-U.S. country | U.S. score | |

|---|---|---|---|---|

| 1 | ||||

| Care process* | 0.88 | 1.16 | 0.49 | |

| Affordability | 3.06 | 3.84 | 2.28 | |

| Timeliness | 1.15 | 1.71 | 0.51 | |

| Administrative efficiency | 2.11 | 2.63 | 0.83 | |

| Equity | 2.04 | 2.87 | 1.41 | |

| Health care outcomes | 1.85 | 2.38 | 1.13 | |

| 1 |

* “Care process” covers prevention, safe care, coordination, and patient engagement.

Notes: Because the different performance evaluations drew on different data sources and thus were not based on a common indexing scale, each measure was first transformed to make the worst-performing measure equal to 1. Then this normalized index was re-sorted to make the U.S. score equal to 1 on each measure. This process allows us to show how far the U.S. system falls from the average performance of all 10 peer countries and the performance of the highest- and lowest-scoring peer countries. The 10 comparison countries are Australia, Canada, France, Germany, the Netherlands, New Zealand, Norway, Sweden, Switzerland, and the United Kingdom.

Source: Author’s analysis of data from Schneider et al. 2017

How rising health spending puts pressure on growth of living standards

Rising health care costs crowd out household resources that could be spent on other things. In the first section of this report, we highlight one potential channel through which rising health costs could pressure living standards: crowding out potential growth in cash wages as employers put more money into compensation in the form of health insurance premiums for ESI coverage.17 Besides this crowd-out of cash wages, rising health care costs can also pressure living standards by forcing families to spend more of their own money on insurance premiums or on out-of-pocket health care costs like copays or insurance deductibles increase.

Finally, even though the U.S. federal government has a smaller role in providing health care financing relative to most international peers, this does not mean that this role is small relative to other important economic benchmarks. In 2017, for example, the federal government spent more than $1.2 trillion, or about 6.7 percent of total GDP, on Medicare, Medicaid, and the Children’s Health Insurance Program (CHIP) (CBO 2018c). Figure E tracks the role of various financers of health care spending in the United States over time. The most striking finding is that public sources of payment have grown the fastest by far; by 2016, public sources accounted for more than half of all spending.

Public sources are financing a growing share of all health care spending: Health care spending as a share of GDP, by source of payments, 1960–2016

| Year | Other | Out-of-pocket | Private insurance | Public |

|---|---|---|---|---|

| 1960 | 0.7% | 2.4% | 1.1% | 0.3% |

| 1961 | 0.8% | 2.4% | 1.1% | 0.3% |

| 1962 | 0.8% | 2.4% | 1.2% | 0.3% |

| 1963 | 0.8% | 2.4% | 1.2% | 0.3% |

| 1964 | 0.8% | 2.5% | 1.3% | 0.3% |

| 1965 | 0.9% | 2.4% | 1.4% | 0.3% |

| 1966 | 0.8% | 2.3% | 1.3% | 0.8% |

| 1967 | 0.7% | 2.2% | 1.2% | 1.6% |

| 1968 | 0.7% | 2.2% | 1.3% | 1.7% |

| 1969 | 0.8% | 2.2% | 1.3% | 1.8% |

| 1970 | 0.8% | 2.3% | 1.4% | 2.0% |

| 1971 | 0.8% | 2.3% | 1.5% | 2.2% |

| 1972 | 0.8% | 2.2% | 1.6% | 2.4% |

| 1973 | 0.8% | 2.2% | 1.6% | 2.4% |

| 1974 | 0.8% | 2.2% | 1.7% | 2.6% |

| 1975 | 0.9% | 2.2% | 1.8% | 2.9% |

| 1976 | 0.9% | 2.2% | 2.0% | 3.0% |

| 1977 | 0.9% | 2.2% | 2.2% | 3.1% |

| 1978 | 0.9% | 2.0% | 2.2% | 3.1% |

| 1979 | 0.9% | 2.0% | 2.3% | 3.2% |

| 1980 | 1.0% | 2.0% | 2.4% | 3.5% |

| 1981 | 1.0% | 2.0% | 2.5% | 3.6% |

| 1982 | 1.1% | 2.2% | 2.8% | 3.8% |

| 1983 | 1.1% | 2.2% | 2.9% | 3.9% |

| 1984 | 1.0% | 2.1% | 2.9% | 3.9% |

| 1985 | 1.1% | 2.2% | 3.0% | 3.9% |

| 1986 | 1.2% | 2.3% | 3.0% | 4.0% |

| 1987 | 1.2% | 2.3% | 3.1% | 4.1% |

| 1988 | 1.3% | 2.3% | 3.3% | 4.1% |

| 1989 | 1.2% | 2.2% | 3.6% | 4.3% |

| 1990 | 1.3% | 2.3% | 3.9% | 4.7% |

| 1991 | 1.3% | 2.3% | 4.1% | 5.4% |

| 1992 | 1.3% | 2.2% | 4.2% | 5.8% |

| 1993 | 1.4% | 2.1% | 4.3% | 6.1% |

| 1994 | 1.3% | 1.9% | 4.2% | 6.3% |

| 1995 | 1.3% | 1.9% | 4.2% | 6.5% |

| 1996 | 1.3% | 1.9% | 4.2% | 6.6% |

| 1997 | 1.3% | 1.9% | 4.2% | 6.5% |

| 1998 | 1.3% | 1.9% | 4.2% | 6.3% |

| 1999 | 1.3% | 1.9% | 4.3% | 6.4% |

| 2000 | 1.2% | 1.9% | 4.5% | 6.5% |

| 2001 | 1.2% | 1.9% | 4.7% | 7.0% |

| 2002 | 1.3% | 2.0% | 5.1% | 7.4% |

| 2003 | 1.3% | 2.0% | 5.3% | 7.7% |

| 2004 | 1.3% | 2.0% | 5.4% | 7.8% |

| 2005 | 1.3% | 2.0% | 5.4% | 7.9% |

| 2006 | 1.3% | 2.0% | 5.3% | 7.9% |

| 2007 | 1.3% | 2.0% | 5.4% | 8.1% |

| 2008 | 1.3% | 2.0% | 5.5% | 8.5% |

| 2009 | 1.3% | 2.0% | 5.8% | 9.4% |

| 2010 | 1.4% | 2.0% | 5.8% | 9.5% |

| 2011 | 1.3% | 2.0% | 5.8% | 9.5% |

| 2012 | 1.4% | 2.0% | 5.7% | 9.5% |

| 2013 | 1.4% | 1.9% | 5.7% | 9.6% |

| 2014 | 1.4% | 1.9% | 5.7% | 10.0% |

| 2015 | 1.3% | 1.9% | 5.9% | 10.3% |

| 2016 | 1.4% | 1.9% | 6.0% | 10.4% |

Notes: Public spending includes what the federal and state governments spend in Medicare, Medicaid, CHIP, and Departments of Defense and Veterans’ Affairs payments; private insurance spending is what insurers of both employer-sponsored and individually purchased plans spend; and out-of-pocket spending is what households spend on health care and includes households with and without insurance. Total spending minus these sources produces the “Other” spending category.

Source: Data from CMS 2018

Publicly provided health insurance is funded through a mix of taxes (both general revenue and dedicated revenue sources), user premiums, and increased debt. Dedicated funding sources for these programs include the Medicare portion of the Federal Insurance Contributions Act (FICA) taxes (2.9 percent of wage incomes); a surcharge on high incomes included as part of the ACA (0.9 percent on cash incomes over $200,000); the application of the Medicare portion of the FICA tax to investment incomes over $200,000 per year; and premiums that finance Medicare Parts B and D. In 2015, these dedicated revenue sources raised just under 2 percent of GDP (TPC 2018), leaving almost 5 percent of GDP spent on public insurance programs to be financed by a contribution of general federal government revenue, state revenues (for their contributions to Medicaid), and debt.

In the remainder of this section, we document how each of these direct channels that finance health care spending can lead to pressure on growth in non-health-related spending, and we provide an empirical assessment of how large this pressure might be.

Income pressure stemming from out-of-pocket costs

Figure F shows a sharp long-run decline in the share of total health costs paid out of pocket by households since 1961. However, this decline has done essentially nothing to relieve the pressure that out-of-pocket (OOP) costs puts on household incomes: Figure F also shows the share of household income for the bottom 90 percent of households that went to paying medical OOP costs for each year from 1961 to 2014. Since 1961, OOP costs have fallen from nearly 46 percent to roughly 11 percent of total health spending, yet the share of household income for the bottom 90 percent that must go to OOP costs has not really budged since 1979—averaging roughly 4 percent of income in the years since then.

Out-of-pocket (OOP) costs have declined as a share of overall health spending but their burden on households has remained steady: Out-of-pocket spending as a share of total health spending and as a share of bottom 90 percent household income, 1960–2014

| OOP costs as share of bottom 90% household incomes | OOP costs as share of total health costs | |

|---|---|---|

| 1961 | 5.247% | 45.840% |

| 1962 | 5.338% | 44.768% |

| 1963 | 5.446% | 44.258% |

| 1964 | 5.725% | 44.090% |

| 1965 | 5.726% | 43.508% |

| 1966 | 5.364% | 40.351% |

| 1967 | 4.936% | 35.949% |

| 1968 | 4.965% | 35.102% |

| 1969 | 4.922% | 34.284% |

| 1970 | 4.934% | 33.466% |

| 1971 | 4.799% | 31.805% |

| 1972 | 4.821% | 30.916% |

| 1973 | 4.723% | 30.761% |

| 1974 | 4.365% | 29.493% |

| 1975 | 4.345% | 27.957% |

| 1976 | 4.386% | 26.612% |

| 1977 | 4.353% | 25.800% |

| 1978 | 4.154% | 24.582% |

| 1979 | 3.953% | 23.614% |

| 1980 | 3.895% | 22.773% |

| 1981 | 3.948% | 22.068% |

| 1982 | 4.034% | 21.689% |

| 1983 | 4.190% | 21.375% |

| 1984 | 4.211% | 21.358% |

| 1985 | 4.391% | 21.594% |

| 1986 | 4.439% | 21.827% |

| 1987 | 4.543% | 21.229% |

| 1988 | 4.651% | 20.753% |

| 1989 | 4.514% | 19.643% |

| 1990 | 4.641% | 19.113% |

| 1991 | 4.562% | 17.869% |

| 1992 | 4.376% | 16.764% |

| 1993 | 4.212% | 15.721% |

| 1994 | 4.026% | 14.685% |

| 1995 | 3.821% | 14.175% |

| 1996 | 3.778% | 13.994% |

| 1997 | 3.861% | 14.215% |

| 1998 | 3.963% | 14.717% |

| 1999 | 3.948% | 14.681% |

| 2000 | 4.007% | 14.527% |

| 2001 | 3.937% | 13.875% |

| 2002 | 4.139% | 13.464% |

| 2003 | 4.221% | 13.331% |

| 2004 | 4.195% | 13.108% |

| 2005 | 4.236% | 13.036% |

| 2006 | 4.131% | 12.673% |

| 2007 | 4.102% | 12.634% |

| 2008 | 4.061% | 12.304% |

| 2009 | 4.050% | 11.771% |

| 2010 | 4.074% | 11.534% |

| 2011 | 4.079% | 11.526% |

| 2012 | 4.070% | 11.380% |

| 2013 | 4.038% | 11.295% |

| 2014 | 3.923% | 10.907% |

Notes: Exact data are unavailable for years prior to 1979, so we assumed that household incomes rose at the same rate as per capita personal income from BEA 2018, NIPA Table 2.1. For OOP costs as a share of income for the bottom 90 percent of households, we allocate 90 percent of total out-of-pocket costs to the bottom 90 percent of households in each year.

Sources: Data on out-of-pocket costs and overall costs come from CMS 2018. Data on total income for the bottom 90 percent of households come from CBO 2018a.

Income pressure stemming from increases in costs for employer-provided health insurance

As discussed above, Table 1 shows the rise in average ESI premiums as a share of the bottom 90 percent’s annual earnings. Figure A provides an illustrative estimate that ESI premium growth since 1999 could have crowded out $4,239 in spending on non-health-care-related goods and services for an employee with single coverage: $811 through higher employee contributions to premiums, and the rest through potentially lower cash wages due to employers’ need to contribute more to premiums instead of cash wages.

Figure G shows employer contributions to ESI premiums as a share of total labor compensation and as a share of compensation for the bottom 90 percent since 1979, using data from the National Income and Product Accounts (NIPA) of the Bureau of Economic Analysis as well as data on comprehensive household incomes from the Congressional Budget Office.18 Between 1960 and 2016, employer contributions to ESI premiums rose from 1.1 to 8.2 percent of total employee compensation. Data for examining the bottom 90 percent are only readily available since 1979. Between 1979 and 2016, employer contributions as a share of compensation rose by 3.9 percentage points overall, but rose by 4.4 percentage points for the bottom 90 percent of earners.

Employer contributions to health insurance premiums are consuming a rising share of employee compensation, especially for the bottom 90 percent: Employer contributions to employer-sponsored insurance premiums as a share of total employee compensation, all employees and bottom 90 percent, 1960–2016

| All employees | Bottom 90% | |

|---|---|---|

| 1960 | 1.1258% | |

| 1961 | 1.2211% | |

| 1962 | 1.2613% | |

| 1963 | 1.3098% | |

| 1964 | 1.3797% | |

| 1965 | 1.4521% | |

| 1966 | 1.6656% | |

| 1967 | 1.7809% | |

| 1968 | 1.9921% | |

| 1969 | 2.1160% | |

| 1970 | 2.3516% | |

| 1971 | 2.4438% | |

| 1972 | 2.6172% | |

| 1973 | 2.9322% | |

| 1974 | 3.0102% | |

| 1975 | 3.3046% | |

| 1976 | 3.6716% | |

| 1977 | 3.9350% | |

| 1978 | 4.1657% | |

| 1979 | 4.2874% | 4.4956% |

| 1980 | 4.4949% | 4.7128% |

| 1981 | 4.9070% | 5.1757% |

| 1982 | 5.2837% | 5.6367% |

| 1983 | 5.5062% | 5.8389% |

| 1984 | 5.4879% | 5.8704% |

| 1985 | 5.5918% | 5.9723% |

| 1986 | 5.6765% | 6.0767% |

| 1987 | 5.6829% | 6.0115% |

| 1988 | 5.8558% | 6.1358% |

| 1989 | 6.0912% | 6.4337% |

| 1990 | 6.3348% | 6.6571% |

| 1991 | 6.6952% | 7.0387% |

| 1992 | 6.9704% | 7.2655% |

| 1993 | 7.2228% | 7.5817% |

| 1994 | 7.2768% | 7.6092% |

| 1995 | 6.9270% | 7.3356% |

| 1996 | 6.7033% | 7.1421% |

| 1997 | 6.4355% | 6.8426% |

| 1998 | 6.4595% | 6.8850% |

| 1999 | 6.6156% | 7.0158% |

| 2000 | 6.7865% | 7.2485% |

| 2001 | 7.0931% | 7.5718% |

| 2002 | 7.4426% | 7.9656% |

| 2003 | 7.8821% | 8.4330% |

| 2004 | 7.9970% | 8.5740% |

| 2005 | 8.1813% | 8.7971% |

| 2006 | 7.9388% | 8.5540% |

| 2007 | 7.8621% | 8.4417% |

| 2008 | 7.9802% | 8.5957% |

| 2009 | 8.3982% | 9.0379% |

| 2010 | 8.3506% | 8.9437% |

| 2011 | 8.3677% | 9.0088% |

| 2012 | 8.2276% | 8.9760% |

| 2013 | 8.3044% | 9.0010% |

| 2014 | 8.1925% | 8.9205% |

| 2015 | 8.1646% | 8.8901% |

| 2016 | 8.1654% | 8.8909% |

Sources: Data on total compensation and total employer contributions to employer-sponsored insurance (ESI) premiums come from BEA 2018, NIPA Table 7.8. Data for bottom 90 percent are constructed using shares of total compensation and employer ESI contributions from Congressional Budget Office 2018b.

If employer contributions to ESI premiums had remained constant as a share of cash wages since 1979, cash compensation could have been $387 billion higher by 2016 for the total labor force, or $327 billion higher for the bottom 90 percent.19 For the bottom 90 percent of full-time-equivalent employees, this would imply cash wages that were higher by roughly $2,740 on average. Appendix B gives some texture to this aggregate analysis by examining the potential crowd-out of cash wages by rising ESI premiums across wage fifths.

Income pressure stemming from rising public costs of health coverage

The rise in spending on public health coverage stems from rising per-enrollee costs of this coverage combined with an increase in the population covered by public insurance. A simple way to hold the latter influence constant is to look at what public spending on health coverage would have been in recent decades had the “excess cost” of these insurance programs been zero. We provide a broad measure of this “excess cost” in Figure B—the growth rate of health costs per capita minus the growth rate of potential GDP per capita. For Figure H, we use the excess growth rates calculated by the Congressional Budget Office (CBO) specifically for the public programs. CBO measures take into account demographic changes within the public programs that may have influenced costs. Figure H charts actual federal spending on health costs versus what federal spending would have been in 2016 had there been no excess costs in health programs since 1987. The figure shows that public spending as a share of GDP in 2016 would have been 1.3 percentage points—or more than $250 billion—lower had there been no excess cost growth in public insurance programs over that time period.

Excess cost growth pushes up spending on public health insurance programs: Public spending on Medicare, Medicaid, and Children’s Health Insurance Program as a share of GDP, actual and if there had been no excess cost growth, 1987–2016

| Year | Actual | No excess cost growth |

|---|---|---|

| 1987 | 2.7% | 2.7% |

| 1988 | 2.7% | 2.7% |

| 1989 | 2.9% | 2.8% |

| 1990 | 3.1% | 2.9% |

| 1991 | 3.5% | 3.1% |

| 1992 | 3.7% | 3.2% |

| 1993 | 4.0% | 3.3% |

| 1994 | 4.1% | 3.3% |

| 1995 | 4.3% | 3.4% |

| 1996 | 4.3% | 3.3% |

| 1997 | 4.3% | 3.2% |

| 1998 | 4.2% | 3.2% |

| 1999 | 4.1% | 3.3% |

| 2000 | 4.2% | 3.4% |

| 2001 | 4.5% | 3.6% |

| 2002 | 4.7% | 3.9% |

| 2003 | 4.8% | 4.0% |

| 2004 | 5.0% | 4.0% |

| 2005 | 5.0% | 4.0% |

| 2006 | 5.2% | 4.0% |

| 2007 | 5.3% | 4.0% |

| 2008 | 5.6% | 4.2% |

| 2009 | 6.1% | 4.5% |

| 2010 | 6.2% | 4.6% |

| 2011 | 6.2% | 4.7% |

| 2012 | 6.2% | 4.8% |

| 2013 | 6.3% | 4.9% |

| 2014 | 6.5% | 5.1% |

| 2015 | 6.7% | 5.2% |

| 2016 | 6.7% | 5.4% |

Notes: We use potential GDP in our calculations. Potential GDP is a measure of what GDP could be as long as the economy did not suffer from excess unemployment. The difference between the growth rate of potential GDP per capita and health spending per capita is often described as “excess cost growth” in health care. Potential GDP is used to measure excess health care cost growth so that it is not infected by economic recessions and booms.

Source: Author’s analysis of data from CMS 2018

Pressure on incomes stemming from rising health costs is projected to rise significantly

As discussed above, by 2016, excess health care cost growth had already caused the employer-provided premium share of total compensation to rise by 3.9 percentage points overall (and by 4.4 percentage points for the bottom 90 percent) since 1979; it had also caused public health spending as a share of GDP to rise by 1.3 percentage points since 1987. But this past performance may understate potential future pressures from health care cost growth. The 30 to 40 years ending in 2016 that saw pervasive excess health care growth saw these costs start from a much more modest base.

Going forward from today, rates of excess health care cost growth in line with the historical averages over the past 40 years would put rapid and large pressure on Americans’ incomes available for nonhealth consumption. Figure I highlights the outcome of such a forecast, showing employer contributions to ESI premiums and spending on public insurance programs as a share of total GDP in two scenarios. In the first scenario, excess cost growth follows the path forecast by the CBO long-term budget outlook for public programs. For employer-paid ESI premiums, we use the forecast of the Social Security Administration (SSA) about the pace of decline in the ratio of earnings to total compensation, a decline that SSA attributes entirely to the rising cost of health care (SSA 2018). In the second scenario, there is no excess cost growth in either public or private health costs.

Under the current projections path, spending on public programs and by employers on ESI premiums reaches 18.1 percent of GDP by 2048, but without excess cost growth, it reaches only 15.6 percent of GDP. The 2.5 percentage-point difference implied by these divergent paths would imply almost $500 billion in additional resources in today’s dollars. Crucially, between 2017 and 2035, a significant portion of the projected rise in public spending is attributable to the baby boom generation aging fully into Medicare eligibility.20 After the baby boomers are absorbed into Medicare, the upward pressure on health spending stemming from pure demographics is expected to slow dramatically, and excess cost growth becomes almost the sole explainer of trends thereafter.

At projected rates, excess health care cost growth will crowd out income gains in coming decades: Spending on public health insurance programs and employer contributions to employer-sponsored insurance (ESI) premiums as a share of GDP, current projections and with no excess cost growth, 2018–2048

| Projected | No excess cost growth | |

|---|---|---|

| 2018 | 13.3654% | 13.3654% |

| 2019 | 13.3653% | 13.3654% |

| 2020 | 13.4911% | 13.4654% |

| 2021 | 13.7170% | 13.6654% |

| 2022 | 14.0429% | 13.9654% |

| 2023 | 14.1687% | 14.0654% |

| 2024 | 14.0945% | 13.9654% |

| 2025 | 14.4203% | 14.2654% |

| 2026 | 14.6461% | 14.4654% |

| 2027 | 14.7719% | 14.5654% |

| 2028 | 15.0977% | 14.8654% |

| 2029 | 15.1234% | 14.7654% |

| 2030 | 15.2492% | 14.7654% |

| 2031 | 15.5749% | 14.9654% |

| 2032 | 15.7006% | 15.0654% |

| 2033 | 15.8263% | 15.0654% |

| 2034 | 16.0519% | 15.1654% |

| 2035 | 16.1776% | 15.1654% |

| 2036 | 16.4032% | 15.2654% |

| 2037 | 16.5288% | 15.2654% |

| 2038 | 16.6545% | 15.3654% |

| 2039 | 16.8801% | 15.3654% |

| 2040 | 17.0056% | 15.3654% |

| 2041 | 17.2312% | 15.3654% |

| 2042 | 17.2567% | 15.3654% |

| 2043 | 17.4823% | 15.3654% |

| 2044 | 17.6078% | 15.4654% |

| 2045 | 17.7333% | 15.5654% |

| 2046 | 17.8588% | 15.5654% |

| 2047 | 17.9842% | 15.5654% |

| 2048 | 18.1097% | 15.5654% |

Notes: We use potential GDP in our calculations. Potential GDP is a measure of what GDP could be as long as the economy did not suffer from excess unemployment. The difference between the growth rate of potential GDP per capita and health spending per capita is often described as “excess cost growth” in health care. Potential GDP is used to measure excess health care cost growth so that it is not infected by economic recessions and booms.

Sources: Data on projected public spending on public health insurance programs include Medicare, Medicaid, Children’s Health Insurance Program and subsidies for Affordable Care Act marketplace exchanges from Congressional Budget Office 2018c. For projections of employer contributions to ESI premiums, we use the data from Figure G and then project that the ratio of earnings to total compensation will be reduced by rising health care costs at the rate forecast by the Social Security Administration (SSA 2018).

Does America overutilize health care? Or is it just too expensive?

The rise in health spending as a share of GDP (shown in Figure B) could in theory stem from either of two influences: a rising volume of health goods and services being consumed (increased utilization) or an increase in the relative price of health care goods and services. Figure J provides evidence suggesting which of these is the prime driver. The figure shows price-adjusted health care spending as a share of price-adjusted GDP (“health spending, real”) and also shows the relative evolution of overall economywide prices and the prices of medical goods and services (“GDP price index” vs. “health care price index”). It shows clearly that health care has risen much more slowly as a share of GDP when adjusted for prices, rising 2.1 percentage points between 1979 and 2016, as opposed to the 9.2 percentage points when measured without price adjustments (“health spending, nominal”). The figure also shows that since 1979, prices for health-care-related goods and services rose more than twice as much as economywide prices.

Rise in health spending as a share of GDP is largely driven by prices, not use of health care: Inflation-adjusted health spending as a share of inflation-adjusted GDP, nominal health spending as a share of nominal GDP, and price indexes for GDP and health care, 1960–2016

| Year | Health spending, real | Health spending, nominal | Health care price index | GDP price index |

|---|---|---|---|---|

| 1960 | 9.39% | 4.94% | 1.000 | 1.000 |

| 1961 | 9.63% | 5.03% | 1.019 | 1.011 |

| 1962 | 9.91% | 5.22% | 1.036 | 1.023 |

| 1963 | 10.14% | 5.38% | 1.062 | 1.035 |

| 1964 | 10.60% | 5.64% | 1.086 | 1.051 |

| 1965 | 10.41% | 5.80% | 1.111 | 1.070 |

| 1966 | 10.28% | 5.93% | 1.155 | 1.100 |

| 1967 | 10.50% | 6.15% | 1.215 | 1.132 |

| 1968 | 10.81% | 6.37% | 1.283 | 1.180 |

| 1969 | 11.27% | 6.56% | 1.365 | 1.238 |

| 1970 | 11.93% | 6.82% | 1.462 | 1.304 |

| 1971 | 12.35% | 6.99% | 1.526 | 1.370 |

| 1972 | 12.56% | 7.31% | 1.584 | 1.429 |

| 1973 | 12.75% | 7.45% | 1.652 | 1.507 |

| 1974 | 13.28% | 7.47% | 1.797 | 1.642 |

| 1975 | 13.93% | 7.55% | 1.990 | 1.794 |

| 1976 | 13.78% | 7.94% | 2.173 | 1.893 |

| 1977 | 13.75% | 8.24% | 2.350 | 2.010 |

| 1978 | 13.66% | 8.36% | 2.545 | 2.152 |

| 1979 | 13.75% | 8.48% | 2.785 | 2.329 |

| 1980 | 14.20% | 8.74% | 3.114 | 2.539 |

| 1981 | 14.47% | 9.06% | 3.491 | 2.776 |

| 1982 | 14.78% | 9.34% | 3.882 | 2.949 |

| 1983 | 14.58% | 9.57% | 4.235 | 3.065 |

| 1984 | 13.86% | 9.83% | 4.552 | 3.174 |

| 1985 | 13.70% | 10.04% | 4.832 | 3.275 |

| 1986 | 13.67% | 10.17% | 5.122 | 3.341 |

| 1987 | 13.77% | 10.44% | 5.448 | 3.427 |

| 1988 | 13.75% | 10.95% | 5.862 | 3.546 |

| 1989 | 13.48% | 11.37% | 6.363 | 3.684 |

| 1990 | 13.70% | 11.91% | 6.899 | 3.821 |

| 1991 | 13.98% | 12.26% | 7.433 | 3.948 |

| 1992 | 13.88% | 12.67% | 7.946 | 4.038 |

| 1993 | 13.62% | 12.96% | 8.349 | 4.134 |

| 1994 | 13.25% | 13.04% | 8.671 | 4.222 |

| 1995 | 13.23% | 13.13% | 8.955 | 4.310 |

| 1996 | 13.09% | 13.16% | 9.159 | 4.389 |

| 1997 | 13.01% | 13.20% | 9.330 | 4.464 |

| 1998 | 13.02% | 13.29% | 9.500 | 4.512 |

| 1999 | 12.82% | 13.37% | 9.720 | 4.581 |

| 2000 | 12.85% | 13.44% | 9.999 | 4.685 |

| 2001 | 13.44% | 13.76% | 10.351 | 4.792 |

| 2002 | 13.98% | 14.43% | 10.646 | 4.866 |

| 2003 | 14.07% | 14.97% | 11.029 | 4.963 |

| 2004 | 14.06% | 15.24% | 11.420 | 5.099 |

| 2005 | 14.03% | 15.38% | 11.781 | 5.263 |

| 2006 | 14.09% | 15.57% | 12.149 | 5.425 |

| 2007 | 14.24% | 15.84% | 12.549 | 5.570 |

| 2008 | 14.60% | 15.95% | 12.881 | 5.679 |

| 2009 | 15.28% | 16.22% | 13.242 | 5.722 |

| 2010 | 15.08% | 16.52% | 13.600 | 5.792 |

| 2011 | 15.21% | 16.58% | 13.889 | 5.911 |

| 2012 | 15.18% | 16.71% | 14.175 | 6.020 |

| 2013 | 15.11% | 16.69% | 14.350 | 6.117 |

| 2014 | 15.28% | 16.97% | 14.554 | 6.227 |

| 2015 | 15.61% | 17.47% | 14.726 | 6.295 |

| 2016 | 15.88% | 17.68% | 14.977 | 6.375 |

Sources: Data on health spending from CMS 2018. Data on GDP and price indices for overall GDP and health spending from the Bureau of Economic Analysis 2018 National Income and Product Accounts.

The evidence in this figure argues strongly that prices are a prime driver of health care’s rising share of overall GDP. This finding is important for policymakers to absorb as they attempt to find ways to rein in the rise of health costs in coming years. International comparisons (highlighted in the next section) provide even more reason to think that the primary problem with American health care costs is prices instead of utilization.

International evidence confirms that it is prices, not utilization, that make American health care so expensive

Some researchers have made the claim that quality improvements in American health care in recent decades have led to an overstatement of the pure price increase of this health care in official statistics like those in Figure J.21 On its face, this is a reasonable enough sounding objection—most of us would rather have the portfolio of health care goods and services available today in 2018 than what was available to Americans in 1979, even if official price indexes tell us that the main difference between the two is the price.

But even if official price indexes understate the increase in health care quality made available to U.S. households in recent decades, this should not cause policymakers to be complacent about the pace of health care price growth. A look at the U.S. health system from an international perspective reinforces this view. The first finding that leaps out from this international comparison is that the United States spends more on health care than other countries—a lot more. Table 2 shows the share of health care spending in 2017 normalized by overall GDP for a group of 21 advanced country peers. The 17.2 percent figure for the United States is almost 30 percent higher than the next-highest figure (12.3 percent, for Switzerland). It is almost 80 percent higher than the group average of 9.7 percent. Table 2 also shows the average annual percentage-point change in the health care share of GDP, as well as the average annual percent change in this ratio over time.22

A particularly striking finding from this table is that not only did the United States spend more on health care as a share of the overall economy than any of its peers in the first year for which data is available, it has also generally pulled away from these peers in subsequent years. When growth in health spending is measured as the average annual percentage-point change in health spending as a share of GDP (using earliest data through 2017), the United States has seen unambiguously faster growth than any other country in recent decades. When growth in health spending is measured as the average annual percent change in this ratio, the United States has seen faster growth than all other countries except Spain and Korea (two countries that are starting from a base period ratio of half or less of the United States).

U.S. health spending is an outlier among advanced countries—and is rising faster than spending in those countries: Health spending as a share of GDP, by country, 2017, and annual growth in health spending, by country, earliest data year through 2007 and 2017

| Annual percentage-point change | Annual percent change | ||||

|---|---|---|---|---|---|

| Health spending as % of GDP, 2017 | Earliest year–2007 | Earliest year–2017 | Earliest year–2007 | Earliest year–2017 | |

| United States | 17.2% | 0.23 | 0.23 | 2.4% | 2.2% |

| Switzerland | 12.3% | 0.14 | 0.16 | 2.0% | 2.0% |

| Japan | 10.7% | 0.10 | 0.14 | 1.6% | 1.9% |

| Norway | 10.4% | 0.11 | 0.14 | 1.9% | 2.1% |

| France | 11.5% | 0.14 | 0.13 | 1.9% | 1.7% |

| Belgium | 10.0% | 0.14 | 0.13 | 2.3% | 2.1% |

| United Kingdom | 9.7% | 0.09 | 0.12 | 1.7% | 1.9% |

| Spain | 8.8% | 0.13 | 0.12 | 2.5% | 2.2% |

| Germany | 11.3% | 0.12 | 0.12 | 1.5% | 1.5% |

| Austria | 10.3% | 0.13 | 0.12 | 1.8% | 1.6% |

| Sweden | 10.9% | 0.07 | 0.12 | 1.0% | 1.5% |

| Korea | 7.6% | 0.08 | 0.11 | 2.0% | 2.3% |

| Netherlands | 10.1% | 0.10 | 0.10 | 1.4% | 1.3% |

| Australia | 9.1% | 0.10 | 0.10 | 1.6% | 1.5% |

| Finland | 9.2% | 0.08 | 0.09 | 1.2% | 1.3% |

| Canada | 10.4% | 0.08 | 0.09 | 1.0% | 1.1% |

| New Zealand | 9.0% | 0.09 | 0.08 | 1.3% | 1.2% |

| Iceland | 8.5% | 0.11 | 0.08 | 1.7% | 1.3% |

| Italy | 8.9% | 0.08 | 0.08 | 1.1% | 1.0% |

| Israel | 7.3% | 0.08 | 0.07 | 1.4% | 1.2% |

| Denmark | 10.2% | 0.05 | 0.06 | 0.5% | 0.6% |

| Ireland | 7.1% | 0.08 | 0.05 | 1.3% | 0.8% |

| Non-U.S. average | 9.7% | 0.10 | 0.10 | 1.6% | 1.5% |

| Non-U.S. maximum | 7.1% | 0.05 | 0.05 | 0.5% | 0.6% |

| Non-U.S. minimum | 12.3% | 0.14 | 0.16 | 2.5% | 2.3% |

Notes: Data are available beginning in different years for different countries. First year of data availability ranges from 1970 (for Austria, Belgium, Canada, Finland, France, Germany, Iceland, Ireland, Japan, Korea, New Zealand, Norway, Spain, Sweden, Switzerland, the United Kingdom, and the United States) to 1971 (Australia, Denmark), 1972 (Netherlands), 1975 (Israel), and 1988 (Italy).

Source: Author’s analysis of data from OECD 2018a

Examining data on utilization and prices separately shows clearly that it is high prices that drive the U.S. position as an outlier in health care spending. Figure K shows the utilization of physicians and hospitals in the United States compared with the median, maximum, and minimum utilization of physicians and hospitals among its OECD (Organisation for Economic Co-operation and Development) peers. The United States is well below typical utilization of physicians and hospitals among OECD countries.

Broad measures show Americans use less health care than residents of typical peer countries: Utilization of physicians and hospitals in the U.S. compared with utilization levels across 13 OECD (Organisation for Economic Co-operation and Development) countries

| U.S. | OECD minimum | OECD maximum | 13-OECD-country median | |

|---|---|---|---|---|

| 1 | ||||

| Physicians | 0.73 | 3.23 | 1.63 | |

| Hospitals | 0.66 | 2 | 1.3 | |

| 1 |

Notes: For physician services, the utilization measure is physician visits normalized by population. For hospital services, the utilization measure is hospital stays (determined by discharges) normalized by population. U.S. levels are set at 1, and measures of utilization for other countries are indexed relative to the U.S. As described in Squires 2015, the data represent either 2013 or the nearest year available in the data. For the U.S., the data are from 2010. The 13 OECD countries included in Squires’s analysis are Australia, Canada, Denmark, France, Germany, Japan, Netherlands, New Zealand, Norway, Sweden, Switzerland, the United Kingdom, and the United States. The U.S. is included in the median calculation.

Source: Data from Squires 2015

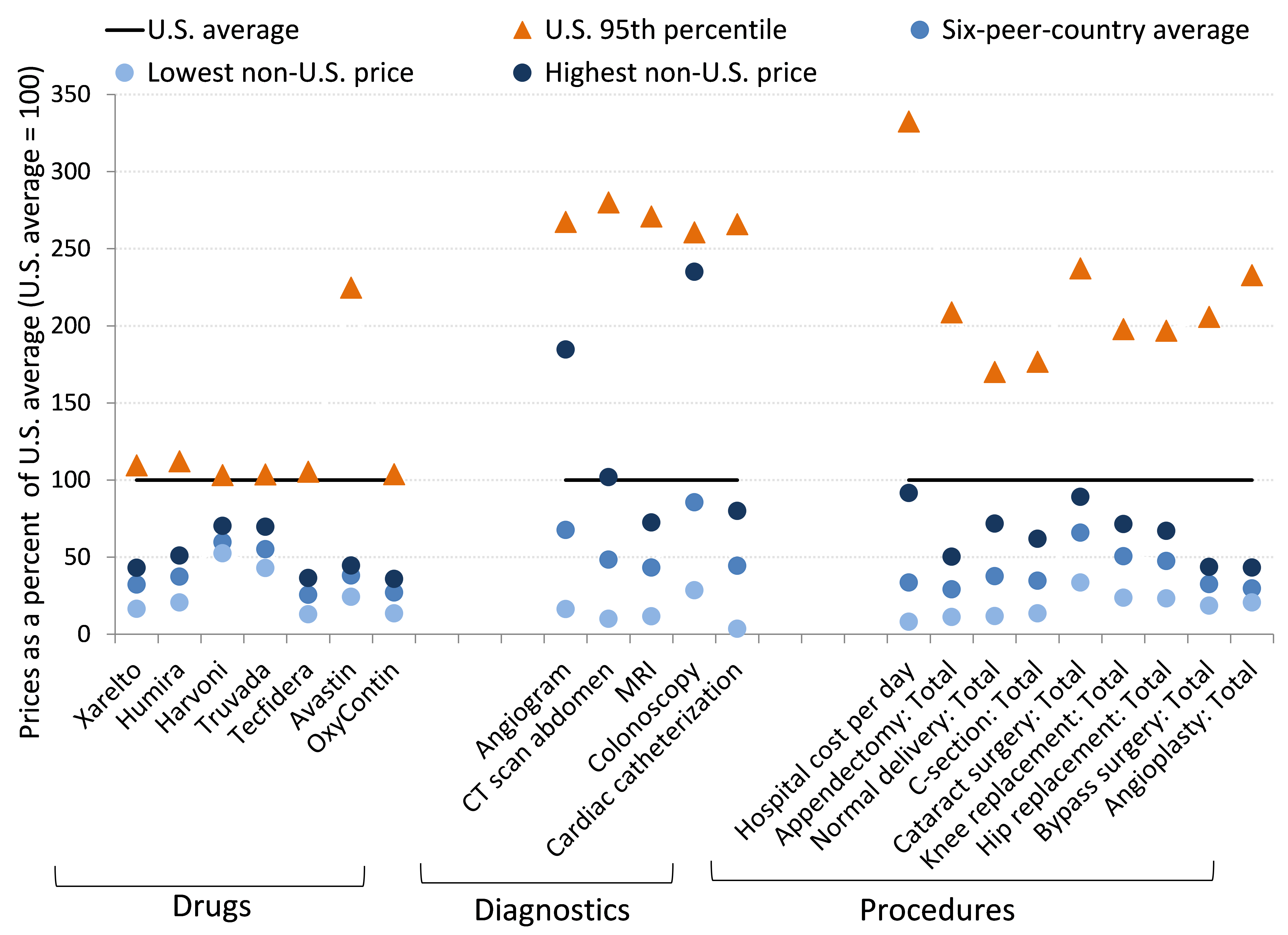

While utilization in the United States is typically lower than utilization levels for its industrial peers, prices in the United States are far above average. Figure L shows the findings of the latest International Federation of Health Plans Comparative Price Report (CPR). The CPR shows the prices of various medical goods and services in the United States compared with prices for the same goods and services in a number of other advanced countries.

Health care prices are almost uniformly higher in the U.S.—sometimes staggeringly so: Prices of various health care goods and services in the United States compared with prices among advanced peer countries, 2015

| Six-peer-country average | Lowest non-U.S. price | Highest non-U.S. price | U.S. average | U.S. 95th percentile | |

|---|---|---|---|---|---|

| Xarelto | 32 | 16 | 43 | 100 | 110 |

| Humira | 37 | 21 | 51 | 100 | 112 |

| Harvoni | 60 | 53 | 70 | 100 | 103 |

| Truvada | 55 | 43 | 70 | 100 | 104 |

| Tecfidera | 26 | 13 | 36 | 100 | 105 |

| Avastin | 38 | 24 | 45 | 100 | 225 |

| OxyContin | 27 | 14 | 36 | 100 | 104 |

| Angiogram | 68 | 16 | 185 | 100 | 267 |

| CT scan abdomen | 48 | 10 | 102 | 100 | 280 |

| MRI | 43 | 12 | 72 | 100 | 271 |

| Colonoscopy | 86 | 29 | 235 | 100 | 261 |

| Cardiac catheterization | 44 | 4 | 80 | 100 | 266 |

| Hospital cost per day | 33 | 8 | 92 | 100 | 333 |

| Appendectomy: Total | 29 | 11 | 50 | 100 | 209 |

| Normal delivery: Total | 38 | 12 | 72 | 100 | 170 |

| C-section: Total | 35 | 14 | 62 | 100 | 177 |

| Cataract surgery: Total | 66 | 34 | 89 | 100 | 237 |

| Knee replacement: Total | 51 | 24 | 71 | 100 | 198 |

| Hip replacement: Total | 47 | 23 | 67 | 100 | 197 |

| Bypass surgery: Total | 33 | 19 | 44 | 100 | 206 |

| Angioplasty: Total | 30 | 21 | 43 | 100 | 233 |

Notes: For listed procedures, “Total” refers to the total cost of hospital and physician services. Comparison countries are Australia, New Zealand, Spain, South Africa, Switzerland, and the United Kingdom. Price data are not available for all goods and services in all countries (e.g., prices for Xarelto are available only for South Africa, Spain, Switzerland, the United Kingdom, and the United States, not for Australia or New Zealand).

Source: Author’s analysis of International Federation of Health Plans (2016) Comparative Price Report

For the 21 goods and services surveyed in the CPR, average prices in the United States are higher than the non-U.S. average for all 21 and are the highest among all the countries (that is, the U.S. average exceeds the non-U.S. maximum) for 18. Averaged across the non-U.S. mean prices, prices in the United States are more than twice as high as prices in peer countries. And even when averaged across the non-U.S. maximums, average U.S. prices are more than 40 percent higher. Notably, a number of these goods and services are highly tradeable—particularly pharmaceuticals. The fact that international tradeability has not eroded enormous price differentials between the United States and other countries should be a red flag that something strikingly inefficient is happening in the U.S. health care market.

Figure M shows some specific measures of utilization that correspond to the price data highlighted in Figure L: the incidence of angioplasties, appendectomies, cesarean sections, hip replacements, and knee replacements, normalized by the size of the country’s population. On two of the five measures, the United States has either a typical (angioplasties) or relatively low (appendectomies) utilization rate relative to other countries’ averages. On two more measures (C-sections and hip replacements), the average of other countries’ utilization levels is roughly three-quarters of the United States’s utilization level. For all four of these measures, the United States is well below the highest utilization rate. The United States is only the highest-utilization country—by a small margin—when it comes to knee replacements. In short, if one were looking only at the data charting health care utilization, one would have little reason to guess that the United States spends far more than its advanced country peers on health care.

U.S. residents aren’t undergoing more health procedures than residents of typical peer countries: Utilization level for various medical interventions, U.S. compared with 30 advanced peer countries, 2015

| U.S. | OECD minimum | OECD maximum | 30-OECD-peer-country average | |

|---|---|---|---|---|

| 1 | ||||

| Angioplasty | 0.19 | 2.15 | 1.03 | |

| Appendectomy | 0.79 | 2.03 | 1.39 | |

| C-section | 0.41 | 1.92 | 0.76 | |

| Hip replacement | 0.12 | 1.49 | 0.76 | |

| Knee replacement | 0.03 | 0.93 | 0.47 | |

| 1 |

Notes: Utilization measures are normalized by population. U.S. levels are set at 1, and measures of utilization for other countries are indexed relative to the U.S. Comparisons are with 30 OECD (Organisation for Economic Co-operation and Development) countries.

Source: Author’s analysis of OECD 2018a

Figure N shows another set of international comparisons of health care inputs and prices, from Laugesen and Glied (2008). Laugesen and Glied compare physician services’ utilization and salaries in Australia, Canada, France, Germany, and the United Kingdom with those in the United States (in the figure, the U.S. level of each is set to 1). They find that utilization of primary care physicians by patients is higher in all of these countries, by an average of more than 50 percent. Yet salaries of primary care physicians are higher in the U.S., by roughly 50 percent. The utilization measure they use for orthopedists is hip replacements. Hip replacements (normalized by the population) are a bit rarer in Canada than the United States, with Canada undertaking 74 hip replacements for every 100 in the United States. They are roughly as common in Australia (94 to 100) and the United Kingdom (105 to 100), and they are more common in France and Germany. Orthopedist salaries are much higher in the United States than in any peer country—more than twice as high on average.

The salary comparisons in Figure N are net of doctor’s debt service payments for medical school loans, so this common explanation for high American physician salaries cannot explain these differences.

Physician salaries in the U.S. are dramatically higher than in other countries. Use of their services is not.: Comparisons of primary care and orthopedic utilization and salaries, U.S. compared with five other countries, 2008

Primary care physicians’ and orthopedists’ salaries

| U.S. = 1 | Primary care physicians’ salaries | Orthopedists’ salaries | |

|---|---|---|---|

| 1 | |||

| Australia | 0.50 | 0.42 | |

| Canada | 0.67 | 0.47 | |

| France | 0.51 | 0.35 | |

| Germany | 0.71 | 0.46 | |

| United Kingdom | 0.86 | 0.73 | |

| Non-U.S. average | 0.65 | 0.49 | |

| 1 |

Primary care and hip replacement utilization

| U.S. = 1 | Primary care utilization | Hip replacement utilization | |

|---|---|---|---|

| 1 | |||

| Australia | 1.61 | 0.94 | |

| Canada | 1.53 | 0.74 | |

| France | 1.84 | 1.33 | |

| Germany | 1.95 | 1.67 | |

| United Kingdom | 1.34 | 1.05 | |

| Non-U.S. average | 1.65 | 1.15 | |

| 1 |

Notes: Utilization measures are normalized by population. U.S. levels are set at 1, and measures of utilization for other countries are indexes relative to the U.S. The data source uses incidence of hip replacements as the comparative utilization measure for orthopedists.

Source: Data from Laugesen and Glied 2008

As we have noted, many rightfully argue that most Americans would not want to trade the health care available to them today for what was available in decades past, even as official price data indicate that all that has changed is the price. However, the international evidence indicates clearly that most Americans should be willing to trade the health care available to them today for what is available to the residents of most other advanced economies. This health care available abroad is far cheaper and yet of at least as high quality. The relatively low level of utilization and very high price levels in the U.S. provide suggestive evidence that the faster rate of health care spending growth in the United States in recent decades has been driven on the price side as well. This inference is supported with some more specific evidence in Appendix C, which provides indirect estimates of the rise in hospital prices across countries over time.

The appropriate policy focus going forward: Price, not utilization

It is clear that the United States is an outlier in international comparisons of health care costs. It is also clear that the United States is an outlier not because of overuse of health care but because of the high price of its health care.

As discussed above, the United States is decidedly unremarkable on health outcome measures (see Figure D) and is even toward the low end of many crucial health measures.23 On measurable utilization of health care, consistent with our findings, most studies similarly find the United States to be below average on broad measures of utilization when compared with its advanced country peers.24 Finally, the indirect evidence on hospital prices presented in Appendix C suggests that prices have likely been rising faster in the U.S. than in the vast majority (18 of 21) of peer countries. All of this evidence strongly indicates that getting U.S. health care prices more in line with international peers could have significant success in relieving the pressure that rising health care costs are putting on American incomes.

Attacking utilization is a dangerous strategy

Even though many health researchers have noted that price—not utilization—is the clear source of the dysfunction of the American health system, it is striking how much attention has been paid to reducing utilization, rather than reducing prices, when it comes to making health policy in the United States in recent decades.

In the years leading up to the passage of the ACA, many policymakers cited the Dartmouth Atlas of Health Care and its research spinoffs (e.g., Skinner et al. 2009) to claim that up to a third of American health spending was wasteful; hence, they concluded, great opportunities abounded to squeeze out this waste by targeting lower utilization. These findings were a great source of temptation for policymakers, and they were incredibly influential in the American policy debate in the run-up to the ACA. The problem is, even if the Dartmouth research was entirely correct, it was always going to be hard to figure out how to operationalize these findings for policy. The most obvious complication was how to construct policy levers to precisely target which third of health care spending was wasteful.

Further, subsequent research in recent years has highlighted additional reasons to think that the Dartmouth findings would be difficult to translate into policy recommendations. The earlier Dartmouth Atlas findings were largely gleaned from looking at regional variation in spending by Medicare. The Atlas found large regional variations in costs and found that high-cost regions did not seem to produce better health outcomes. The authors of the Atlas hypothesized that regional differences in physician practice drove price differentials that were not correlated with quality improvements. Policymakers and analysts have often made the argument that if the lower-priced, but equally effective, practices of more efficient regions could be adopted nationwide, then a large chunk of wasteful spending could be squeezed out of the system. However, research by Doyle (2011) and Sheiner (2014b) indicates that the noncorrelation between spending and outcomes found in the Dartmouth research may well be driven by a failure to fully control for the socieoeconomic and health characteristics of patients. Further, Cooper et al. (2018) study the regional variation in spending on privately insured patients and find that it does not correlate tightly at all with Medicare spending. This finding casts doubt on the hypothesis that regional variation in practice is driving trends in both spending and quality, as these type of region-specific practices should affect both Medicare and private insurance payments.

Policies to increase cost sharing are a cost blunderbuss—A scalpel is needed

The evidence reviewed above casts doubt on the potential to rein in health costs on the utilization side. And it’s certainly not possible to eliminate wasteful and unproductive care simply by raising the patient cost of care across the board, as we show below. Yet this blunderbuss approach of increasing “cost sharing” indiscriminately is by far the most common theme in policy proposals aimed at reducing the growth rate of health spending.

On the conservative side, the last couple of decades have seen much writing from policy analysts about “consumer-directed health care” and efforts to put health care consumers’ “skin in the game” as a strategy to constrain costs.25 The rhetoric from the center left rejects this view, but their actions tell a different story: Perhaps the single most-trumpeted cost-containment device included in the ACA was the so-called Cadillac Tax, which seeks to contain costs precisely by forcing health care consumers to face a higher share of marginal costs. This excise tax would be levied on employer-provided health benefits above set limits, thus incentivizing employers to offer less expensive health plans, which would in turn translate into higher out-of-pocket costs for workers.26

The logic of forcing health consumers to face higher marginal costs of buying health care is based in the economics of moral hazard: If people do not face the marginal cost of undertaking a behavior, they’ll do more of it. In the case of health care, insured consumers pay fixed premiums every month regardless of whether or not they visit a doctor. Then, when they do visit a doctor’s office or go to the hospital, insurance pays for some (often even most) of the marginal cost of this visit. Once the fixed cost of paying a premium is met, each subsequent visit to a health provider is then partially to fully subsidized by the insurance company, and this means that the patient does not face the full marginal cost of the decision to obtain health care.