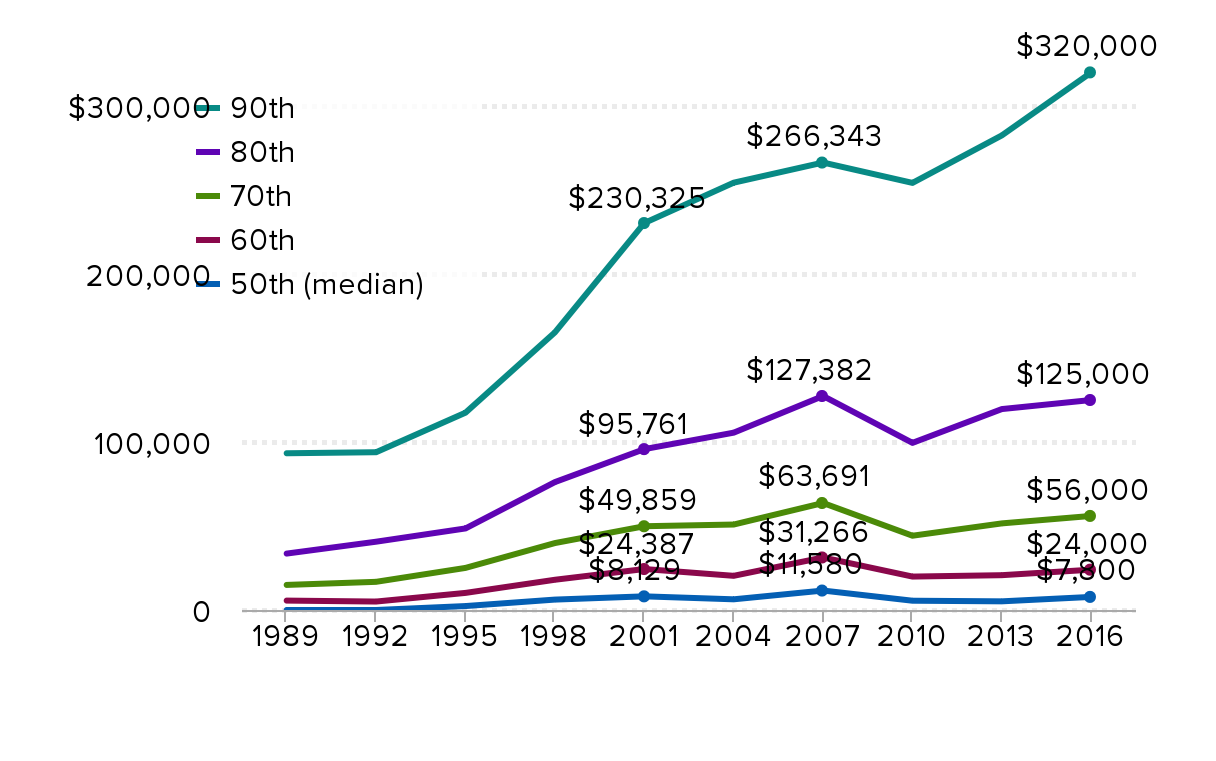

The gap between the retirement ‘haves’ and ‘have-nots’ has grown since the recession: Retirement account savings of families age 32–61 by savings percentile, 1989–2016 (2016 dollars)

| 50th (median) | 60th | 70th | 80th | 90th | |

|---|---|---|---|---|---|

| 1989 | $0 | $5,598 | $14,927 | $33,585 | $93,293 |

| 1992 | $0 | $5,031 | $16,771 | $40,652 | $93,916 |

| 1995 | $2,349 | $10,179 | $25,056 | $48,546 | $117,450 |

| 1998 | $6,197 | $18,001 | $39,837 | $76,134 | $165,251 |

| 2001 | $8,129 | $24,387 | $49,859 | $95,761 | $230,325 |

| 2004 | $6,359 | $20,349 | $50,871 | $105,558 | $254,356 |

| 2007 | $11,580 | $31,266 | $63,691 | $127,382 | $266,343 |

| 2010 | $5,527 | $19,896 | $44,213 | $99,480 | $254,226 |

| 2013 | $5,156 | $20,725 | $51,555 | $119,608 | $282,523 |

| 2016 | $7,800 | $24,000 | $56,000 | $125,000 | $320,000 |

Note: Retirement account savings include funds in 401(k)-style defined contribution plans and in IRAs. Scale changed to accommodate larger values.

Source: EPI analysis of Survey of Consumer Finance data, 2016.