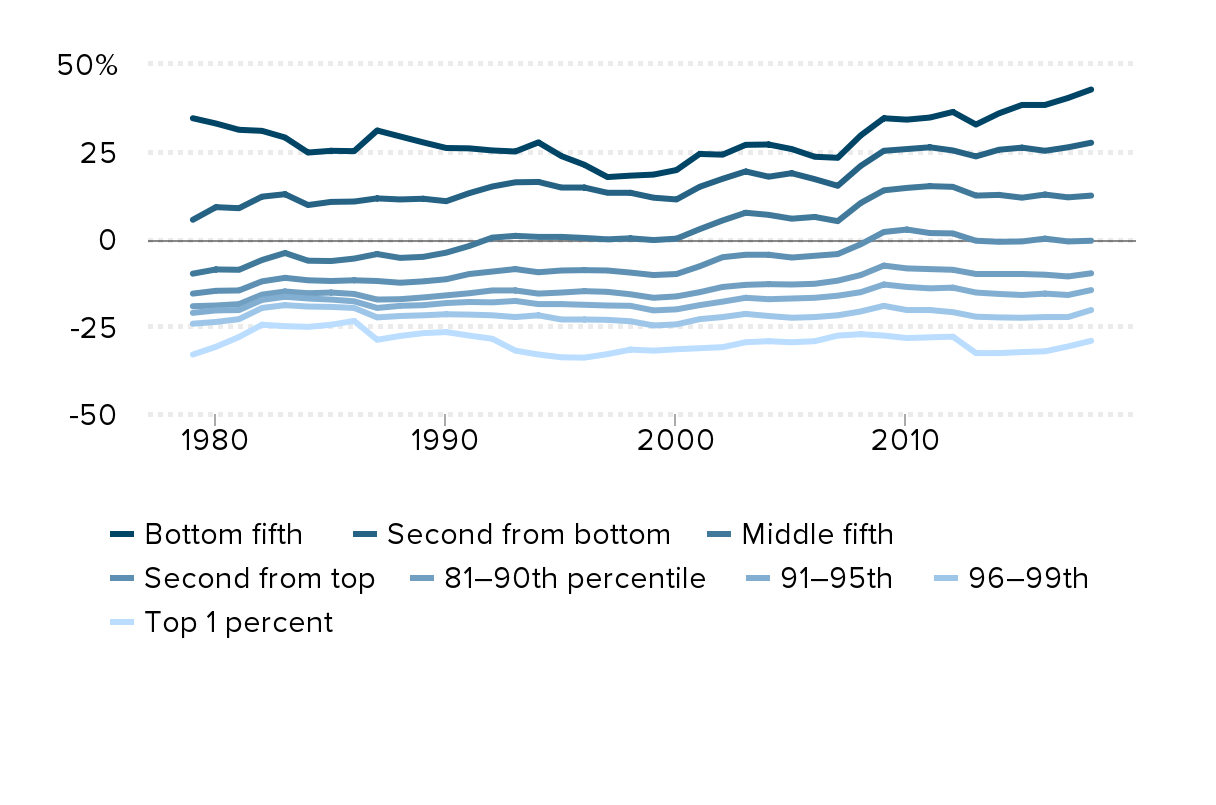

For the bottom 60% of households—particularly the bottom fifth—the boost from government taxes and benefits has increased as share of income in recent decades: Overall transfer rate by household income group, 1979–2018

| Bottom fifth | Second from bottom | Middle fifth | Second from top | 81–90th percentile | 91–95th | 96–99th | Top 1 percent | |

|---|---|---|---|---|---|---|---|---|

| 1979 | 34.5% | 5.5% | -9.9% | -15.6% | -19.2% | -21.1% | -24.2% | -33.0% |

| 1980 | 33.0% | 9.1% | -8.7% | -14.8% | -19.0% | -20.4% | -23.7% | -30.8% |

| 1981 | 31.2% | 8.8% | -8.8% | -14.7% | -18.6% | -20.3% | -22.9% | -28.0% |

| 1982 | 30.9% | 12.1% | -6.0% | -12.1% | -15.9% | -17.4% | -19.7% | -24.5% |

| 1983 | 29.0% | 12.8% | -4.0% | -11.1% | -15.0% | -16.5% | -18.9% | -24.9% |

| 1984 | 24.7% | 9.7% | -6.2% | -11.8% | -15.5% | -17.0% | -19.3% | -25.1% |

| 1985 | 25.2% | 10.6% | -6.3% | -12.0% | -15.3% | -17.3% | -19.4% | -24.5% |

| 1986 | 25.1% | 10.7% | -5.6% | -11.8% | -15.7% | -17.8% | -19.7% | -23.4% |

| 1987 | 31.0% | 11.6% | -4.3% | -12.0% | -17.3% | -19.7% | -22.4% | -28.8% |

| 1988 | 29.3% | 11.3% | -5.4% | -12.5% | -17.2% | -19.1% | -22.0% | -27.7% |

| 1989 | 27.6% | 11.5% | -5.1% | -12.1% | -16.7% | -18.9% | -21.8% | -26.9% |

| 1990 | 26.0% | 10.8% | -3.9% | -11.5% | -16.1% | -18.3% | -21.5% | -26.6% |

| 1991 | 25.9% | 13.1% | -2.0% | -10.0% | -15.5% | -18.0% | -21.6% | -27.6% |

| 1992 | 25.3% | 15.0% | 0.4% | -9.3% | -14.7% | -18.1% | -21.8% | -28.5% |

| 1993 | 25.0% | 16.2% | 0.9% | -8.6% | -14.7% | -17.7% | -22.3% | -31.9% |

| 1994 | 27.6% | 16.3% | 0.6% | -9.5% | -15.6% | -18.6% | -21.8% | -33.0% |

| 1995 | 23.7% | 14.7% | 0.6% | -9.0% | -15.3% | -18.6% | -23.0% | -33.8% |

| 1996 | 21.2% | 14.7% | 0.3% | -8.9% | -14.9% | -18.8% | -23.0% | -33.9% |

| 1997 | 17.7% | 13.2% | -0.1% | -9.0% | -15.1% | -19.0% | -23.1% | -32.9% |

| 1998 | 18.1% | 13.2% | 0.2% | -9.6% | -15.8% | -19.1% | -23.5% | -31.6% |

| 1999 | 18.4% | 11.8% | -0.3% | -10.3% | -16.8% | -20.4% | -24.7% | -31.9% |

| 2000 | 19.7% | 11.3% | 0.1% | -10.0% | -16.4% | -20.1% | -24.4% | -31.5% |

| 2001 | 24.3% | 14.9% | 2.8% | -7.8% | -15.2% | -18.9% | -22.9% | -31.2% |

| 2002 | 24.1% | 17.2% | 5.3% | -5.2% | -13.7% | -17.9% | -22.3% | -30.9% |

| 2003 | 26.9% | 19.3% | 7.5% | -4.5% | -13.1% | -16.8% | -21.4% | -29.5% |

| 2004 | 27.0% | 17.8% | 6.9% | -4.5% | -12.9% | -17.2% | -22.0% | -29.2% |

| 2005 | 25.7% | 18.8% | 5.8% | -5.3% | -13.0% | -17.0% | -22.5% | -29.5% |

| 2006 | 23.5% | 17.1% | 6.3% | -4.8% | -12.8% | -16.8% | -22.3% | -29.2% |

| 2007 | 23.2% | 15.2% | 5.1% | -4.3% | -11.9% | -16.2% | -21.8% | -27.6% |

| 2008 | 29.6% | 20.9% | 10.3% | -1.5% | -10.3% | -15.2% | -20.7% | -27.2% |

| 2009 | 34.5% | 25.2% | 13.9% | 2.0% | -7.6% | -13.0% | -19.1% | -27.6% |

| 2010 | 34.1% | 25.7% | 14.6% | 2.7% | -8.4% | -13.7% | -20.3% | -28.3% |

| 2011 | 34.7% | 26.2% | 15.1% | 1.7% | -8.6% | -14.1% | -20.3% | -28.1% |

| 2012 | 36.3% | 25.3% | 14.9% | 1.6% | -8.8% | -13.9% | -20.9% | -27.9% |

| 2013 | 32.7% | 23.6% | 12.4% | -0.5% | -10.0% | -15.3% | -22.2% | -32.6% |

| 2014 | 35.9% | 25.5% | 12.6% | -0.8% | -10.0% | -15.7% | -22.4% | -32.6% |

| 2015 | 38.3% | 26.1% | 11.8% | -0.7% | -10.0% | -16.0% | -22.5% | -32.3% |

| 2016 | 38.3% | 25.2% | 12.7% | 0.1% | -10.2% | -15.6% | -22.3% | -32.1% |

| 2017 | 40.3% | 26.2% | 11.9% | -0.7% | -10.7% | -16.0% | -22.3% | -30.7% |

| 2018 | 42.7% | 27.5% | 12.4% | -0.5% | -9.8% | -14.6% | -20.3% | -29.1% |

Notes: The overall transfer rate is the share by which pre-tax-and-transfer income is raised or lowered by taxes and transfers. It is calculated by dividing what a household receives in government benefits and tax credits minus any tax payments by pre-fiscal income (income before taxes and benefits). Although transfer rates are calculated as a share of pre-fiscal income, we rank households by post-fiscal income.

Extended notes: We subtract the total federal tax rate from the sum of the total means-tested transfer rate and the share of social insurance benefits in order to obtain the overall transfer rate for each household income group. Total means-tested transfers include Medicaid and the Children’s Health Insurance Program (CHIP), the Supplemental Nutrition Assistance Program (SNAP), Supplemental Security Income (SSI), and other transfers. Social insurance benefits include Social Security benefits, Medicare benefits, unemployment insurance, and workers’ compensation. Federal taxes incorporate individual income taxes, payroll taxes, corporate income taxes, and excise taxes. Rates are calculated as a share of pre-fiscal income (technically, market income plus non-means-tested social insurance benefits in keeping with the CBO’s dataset). We rank households by post-fiscal income (income after taxes, tax credits, and transfers).

Source: Congressional Budget Office household income data (CBO 2021).