One year in, the American Rescue Plan has fueled a fast recovery: Policymakers should use remaining ARPA funds in 2022 to make transformative investments that will build a more equitable economy

March 11 marks the one-year anniversary of the signing of the American Rescue Plan Act (ARPA). This $1.9 trillion dollar relief package was both an emergency measure to help the nation through the worst pandemic in a century and an ambitious catalyst to jump-start efforts to redress the staggering economic inequalities in our economy. In its first year, ARPA helped the economy recover at a tremendous pace and aided working families through difficult times. In the year to come, state and local policymakers will have critical opportunities to use their substantial remaining ARPA funds to rebuild the public sector, support low-wage workers, and target systemic inequities.

ARPA supported a year of strong growth

A full labor market recovery took more than a decade after the Great Recession began in late 2007. Federal stimulus, needed to restart the economy in times of recession, was inadequate to circumstances throughout the 2010s. The slow recovery of the economy during the Great Recession also gave ammunition to political forces that supported austerity, the dismantling of labor unions, and the continued weakening of the social safety net.

With inadequate federal fiscal aid, many states faced large budget shortfalls in the wake of the Great Recession, and many state and local lawmakers responded by dramatically slashing budgets and cutting jobs. These cuts to state and local government had a disproportionate impact on women and Black and Hispanic workers, who are more likely to be employed in the public sector. This austerity was not only unnecessary, it also directly contributed to the slow pace of the economic recovery.

This long period of anemic growth also meant a lost decade of potential wage growth for low-income and middle-income workers, and racial employment and wage gaps continued to expand.

Along with COVID-related legislation like the Coronavirus Aid, Relief, and Economic Security (CARES) Act passed in 2020, ARPA has gone a long way to making sure the mistakes of the Great Recession were not repeated. Tens of millions were kept out of poverty because of social insurance programs from CARES, ARPA, and other relief legislation. Despite a catastrophic cratering of the economy in March 2020—with more than 20 million jobs lost—the country is on track to return to pre-COVID levels of employment before the end of 2022 (Figure A).

Federal fiscal relief at the scale of the problem led to a faster recovery from the pandemic recession: Private-sector employment change since business cycle peak, December 2007 and February 2020

| months since peak | 2007 | 2020 |

|---|---|---|

| 0 | 100 | 100 |

| 1 | 99.99913805 | 98.88601736 |

| 2 | 99.90604744 | 83.78707811 |

| 3 | 99.84140119 | 86.1978785 |

| 4 | 99.62849952 | 89.67714561 |

| 5 | 99.44749 | 90.67463838 |

| 6 | 99.27079024 | 91.61041466 |

| 7 | 99.05788857 | 92.35024108 |

| 8 | 98.8191284 | 92.96663452 |

| 9 | 98.44848986 | 93.27984571 |

| 10 | 98.02354848 | 93.19652845 |

| 11 | 97.38742932 | 93.52285439 |

| 12 | 96.78234037 | 94.05747348 |

| 13 | 96.08674666 | 94.55891996 |

| 14 | 95.4489036 | 94.72246866 |

| 15 | 94.77313474 | 95.01639344 |

| 16 | 94.07323128 | 95.40829315 |

| 17 | 93.83016136 | 95.90048216 |

| 18 | 93.46297062 | 96.28389585 |

| 19 | 93.21731485 | 96.59942141 |

| 20 | 93.04578679 | 97.13481196 |

| 21 | 92.91218453 | 97.61851495 |

| 22 | 92.67773411 | 98.05130183 |

| 23 | 92.68031996 | 98.39691418 |

| 24 | 92.49241484 | 98.90144648 |

| 25 | 92.48638119 | |

| 26 | 92.42001103 | |

| 27 | 92.53982209 | |

| 28 | 92.69497311 | |

| 29 | 92.79237347 | |

| 30 | 92.89322162 | |

| 31 | 92.96821128 | |

| 32 | 93.09233209 | |

| 33 | 93.1854227 | |

| 34 | 93.37332782 | |

| 35 | 93.48969108 | |

| 36 | 93.56985243 | |

| 37 | 93.59312509 | |

| 38 | 93.81292236 | |

| 39 | 94.03530548 | |

| 40 | 94.3128534 | |

| 41 | 94.44731761 | |

| 42 | 94.62056958 | |

| 43 | 94.77141084 | |

| 44 | 94.90759895 | |

| 45 | 95.13773962 | |

| 46 | 95.30064819 | |

| 47 | 95.43769825 | |

| 48 | 95.62646532 | |

| 49 | 95.93849124 | |

| 50 | 96.16346021 | |

| 51 | 96.37377603 | |

| 52 | 96.45479934 | |

| 53 | 96.55823335 | |

| 54 | 96.60477865 | |

| 55 | 96.75044821 | |

| 56 | 96.89611778 | |

| 57 | 97.04954489 | |

| 58 | 97.20555785 | |

| 59 | 97.35726107 | |

| 60 | 97.55981934 | |

| 61 | 97.7399669 | |

| 62 | 97.96924562 | |

| 63 | 98.09853813 | |

| 64 | 98.26403255 | |

| 65 | 98.45969521 | |

| 66 | 98.63639498 | |

| 67 | 98.75448214 | |

| 68 | 98.94928286 | |

| 69 | 99.10701972 | |

| 70 | 99.30526824 | |

| 71 | 99.52161771 | |

| 72 | 99.60091711 | |

| 73 | 99.75693008 | |

| 74 | 99.89053234 | |

| 75 | 100.1025721 |

Source: EPI analysis of Bureau of Labor Statistics' Current Employment Statistics public data series.

Crucial elements of ARPA included maintaining expanded unemployment insurance benefits and eligibility until the late summer of 2021. With these expansions, UI benefits as a share of wage and salary income provided an economic boost roughly four times as great during the pandemic as during any previous recession. ARPA also provided an additional $1,400 Economic Impact Payment (or stimulus check) and introduced an expanded Child Tax Credit. All of these measures gave families the buying power to preserve their own security while jump-starting the economic recovery—2021’s record 6.6 million new jobs is testimony to how well this approach worked.

ARPA also provided state and local governments with essential funds to avert the same harmful austerity that hampered the last recovery—a critical piece of the law discussed more below.

ARPA most likely prevented a year of catastrophe

Without the stimulus provided by ARPA and other measures, we would be in much worse shape today.

In December 2020, we saw payrolls fall again, by 115,000 jobs, as the terrible first winter of COVID hit. At the beginning of 2021, the United States was 9.9 million jobs below pre-pandemic levels. That’s worse than the employment picture at the depths of the Great Recession. And the economic stimulus bills passed in 2020 were running out of steam as 2021 began. The paid leave provisions of the CARES Act had expired. The expansion of UI benefits that provided additional support to millions of Americans—including gig workers and the self-employed, who previously had not been covered—were set to expire as well. There were no more stimulus checks.

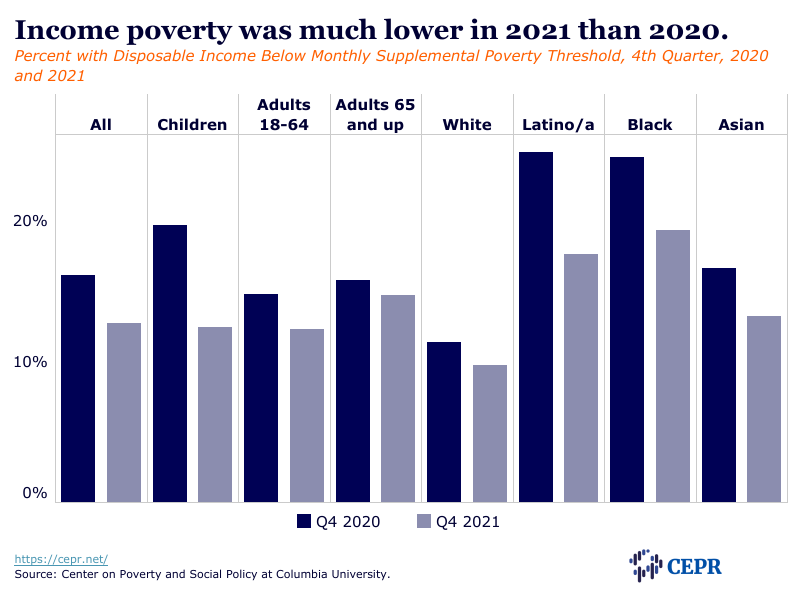

If ARPA had not been enacted, the macroeconomic consequence would have been a substantially more sluggish recovery. This is not a hypothetical or theoretical position, and the real-world dangers alleviated by ARPA are enormous. Some 3.2 million households received emergency rental assistance from January to November of 2021; a substantial portion of them would otherwise have lost their homes. The $1,400 stimulus checks in March of 2021 and the beginning of Child Tax Credit (CTC) payments in July caused a nearly 50% drop in food insecurity. The child poverty rate in the last quarter of 2021 was 7.5 percentage points below what it was in the last quarter of 2020, a reduction of nearly 40%, according to the Center for Economic and Policy Research (Figure B).

FIGURE B

Given how weak the economy still was in the beginning of 2021, the best-case scenario without ARPA was a weak recovery like the one after 2007–2008. The worst-case scenario is one I don’t want to contemplate.

ARPA isn’t responsible for inflation, no matter what the critics say

While inflation has been more significant in the past 6–10 months than at any point in the last few decades, it’s not being driven by government spending, and certainly not by ARPA. As EPI’s Director of Research Josh Bivens has shown in multiple pieces, the primary driver of inflation is COVID-19. As service-based businesses closed, spending shifted to goods.

This, in turn, led to supply-chain bottlenecks and port congestion that pushed up inflation significantly around the world and would have pushed up U.S. inflation with or without ARPA.

There’s every reason to believe that inflation will trend back toward more usual levels in the coming months, as people shift spending back to services and bottlenecks slowly clear. Policy interventions—like the Federal Reserve increasing interest rates—could raise unemployment, damage the economic recovery, and reduce the chance that a relatively tight labor market could help close racial wage gaps.

It’s now mostly up to state and local governments to use ARPA resources

At this point, most of the supports that ARPA provided directly to households—the Child Tax Credit, stimulus checks, and extended UI benefits—have all ended. However, state and local officials still have enormous capacity, thanks to ARPA’s $350 billion State and Local Fiscal Recovery Fund (SLFRF), to implement state and local policies that help working families and transform communities—if they choose to act. It would be a major mistake for state and local policymakers to act as if the economic crisis is over. Now is the time for these policymakers to make transformative investments in a stronger, more stable, and more equitable economy.

State and local governments should invest in the public sector

A good place to start is in rebuilding public services at the state and local level. There are 681,000 fewer public-sector jobs compared with before the pandemic. Nearly two-thirds of the job losses are in state and local governments. Public employment has not only declined abruptly since the beginning of the pandemic, it has also never fully recovered from the huge job cuts following the Great Recession more than a decade ago. Women and Black workers are typically hit hardest by public-sector jobs cuts, contributing to the ongoing gaps in wages and employment.

These aren’t just statistics; they have real-world consequences. In schools, for example, shortages of teachers, bus drivers, and custodians are reaching crisis levels (Figure C).

Bus drivers, teachers, and school custodians have experienced particularly large declines in employment during the pandemic: Percent change in employment levels from October 2019 to October 2021 for select K–12 public education occupations

| Occupations | Percent Change, Oct 2019 – Oct 2021 |

|---|---|

| All public K–12 employment | -4.7% |

| Teaching assistants | -2.6% |

| School custodians | -6.0% |

| Teachers | -6.8% |

| Bus drivers | -14.7% |

Notes: Data reflect the 12-month average in employment ending in October 2021 relative to the 12-month average of employment ending in October 2019.

Source: Economic Policy Institute analysis of BLS Current Employment Statistics series and Current Population Survey microdata.

Other government services are suffering as well. Despite two years of a pandemic proving the necessity of robust state and local public health departments, more than 220 such departments told the New York Times in October that they have had to abandon many other core functions (such as testing for lead in water and monitoring sexually transmitted diseases) to fight COVID, and more than 100 departments still do not have enough personnel to perform contact tracing.

State and local governments are seeing widening cracks in public services across the board, from criminal justice to mental health treatment to public transportation. SLFRF allocations can and should be used to raise the wages of public employees and attract more applicants. The ARPA final rule also authorizes the use of these funds for retention incentives to keep good employees in their jobs. The devastation of the pandemic has shown all too clearly that the public sector needs to be strengthened, and ARPA funds can and should be used to help.

Funds should target inequities

ARPA’s final rule notes that the pandemic has “disproportionately impacted some demographic groups and exacerbated health inequities along racial, ethnic, and socioeconomic lines.” SLFRF funds can and should be used to target those inequities wherever possible.

Disparities in employment and wages remain tremendous barriers to equity. Black workers are twice as likely to be unemployed as white workers, a disparity that persists even when controlling for education, and the Black–white wage gap has widened from 9% to 15% in the past 40 years (Figure D).

Black–white wage gaps are wider now than 40 years ago and largely unexplained by factors associated with individual productivity: Average and regression-adjusted Black–white wage gaps, 1979–2019

| Black–white gap (average) | Black–white gap (regression-based) | |

|---|---|---|

| 1979 | 17.30% | 8.60% |

| 1980 | 17.40% | 8.60% |

| 1981 | 17.40% | 8.20% |

| 1982 | 19.10% | 9.90% |

| 1983 | 18.20% | 9.30% |

| 1984 | 19.00% | 10.20% |

| 1985 | 20.00% | 10.60% |

| 1986 | 20.30% | 10.40% |

| 1987 | 20.20% | 10.50% |

| 1988 | 19.70% | 9.80% |

| 1989 | 20.50% | 10.70% |

| 1990 | 21.20% | 10.90% |

| 1991 | 20.60% | 10.80% |

| 1992 | 20.40% | 10.80% |

| 1993 | 20.00% | 10.80% |

| 1994 | 20.00% | 10.70% |

| 1995 | 20.90% | 10.70% |

| 1996 | 23.00% | 12.90% |

| 1997 | 22.80% | 12.10% |

| 1998 | 21.80% | 10.50% |

| 1999 | 22.10% | 10.70% |

| 2000 | 21.80% | 10.20% |

| 2001 | 23.10% | 11.50% |

| 2002 | 23.20% | 11.30% |

| 2003 | 22.00% | 10.70% |

| 2004 | 22.10% | 10.50% |

| 2005 | 23.50% | 12.30% |

| 2006 | 22.10% | 11.40% |

| 2007 | 23.50% | 12.20% |

| 2008 | 24.10% | 12.60% |

| 2009 | 24.00% | 11.70% |

| 2010 | 23.90% | 11.90% |

| 2011 | 23.70% | 12.40% |

| 2012 | 24.60% | 12.70% |

| 2013 | 24.80% | 13.10% |

| 2014 | 24.80% | 13.90% |

| 2015 | 26.10% | 14.50% |

| 2016 | 26.20% | 13.60% |

| 2017 | 27.50% | 15.50% |

| 2018 | 27.50% | 16.20% |

| 2019 | 26.50% | 14.90% |

Source: Economic Policy Institute (EPI). 2020. Current Population Survey Extracts, Version 1.0.4, https://microdata.epi.org.

The inequities became more pronounced during the pandemic. Black and Hispanic workers, even before the pandemic, were more likely to work in dangerous jobs. When COVID hit, Black workers in particular were overrepresented in essential occupations most exposed to infection risk. It is saddening, but not surprising, that COVID death rates in Black, Hispanic, and American Indian communities are 70%–120% higher than in white communities when adjusted for age.

Low-wage workers and their families in general have struggled to be safe in the pandemic. Americans “with household incomes less than $25,000 were 3.5 times as likely to report missing an entire week of work” due to COVID, in part because two-thirds of low-wage workers don’t have access to paid sick days. Similarly, low-wage workers, irrespective of their political beliefs, are less likely to be vaccinated against COVID, because they lack paid leave to help them through the vaccine’s side effects and may have greater distrust of our health care system, borne out of years of neglect by a for-profit industry that leaves millions out in the cold.

ARPA provides many useful options for state and local policymakers when it comes to addressing inequities like these. Two are worth highlighting here. The first is premium pay for essential workers. The COVID-19 pandemic has demonstrated the vital importance of front-line workers, from grocery clerks to nurses. Many of these jobs are woefully underpaid, including school employees and home health care and child care workers. Black and Hispanic workers in essential jobs are paid less than white men in those same jobs. An allowed use of SLFRF funds is to provide premium pay, also sometimes called hazard pay or hero pay, to these essential workers.

The ARPA rule states that both private- and public-sector workers can receive premium pay, capped at $25,000 per worker, while workers making over 150% of the state’s median wage are generally not eligible. This means that premium pay will go in the pockets of the workers who need it the most. Minnesota’s House of Representatives just passed a plan to spend $1 billion to cover $1,500 payments for more than 600,000 essential workers; hopefully the Minnesota Senate, and other state and local governments, will follow that lead. There are few uses of ARPA dollars that will do more good, with greater speed, than putting money in the pockets of low-wage workers.

Housing is another area where inequities have grown and where ARPA spending could make an immediate difference. Harvard’s Joint Center on Housing Studies demonstrated, for example, that renters of color were more likely to see their landlords increase their rent, file for eviction, defer property maintenance, and charge late fees for overdue rent during the pandemic. Those same landlords were less likely to grant extensions or forgive missed payments in neighborhoods with more renters of color.

SLFRF funds can be used in many ways to help remedy inequities in housing. The SLFRF rules designate certain communities as “impacted” and “disproportionately impacted” by the pandemic, based on the level of economic stress a community has suffered and the presence of preexisting economic inequities (see pages 16–20). In impacted communities, the funds can be used to provide emergency rental assistance, eviction counseling, and services for people experiencing homelessness. In disproportionately impacted communities, the funds can even be used to demolish abandoned properties and build new housing or convert existing dwellings into affordable housing.

It is important for state and local policymakers to set strong labor standards when investing SLFRF funds in construction to expand affordable housing, water and sewer infrastructure, or broadband (all allowed uses of ARPA dollars). ARPA rules encourage major capital projects to incorporate project labor agreements (PLAs), community benefits agreements, local hire provisions, and prevailing wage standards to provide good jobs at good wages.

The U.S. Department of the Treasury further encourages state and local governments to prioritize contractors who meet high safety and training standards, hire local workers from historically underserved communities, directly employ their workforce (and require subcontractors to do the same), and do not have a recent record of violating federal or state labor and employment laws. These measures are designed to ensure federal funds support equitable recovery goals, including the creation of high-quality jobs and transformational new training pathways into construction careers for Black, Brown, and women workers historically excluded from these opportunities.

Some critics claim that since many state and local governments have overall rosy financial pictures, there is no need for SLFRF funds. This argument paints the wrong picture. State and local governments have maintained relatively strong fiscal positions—many with budget surpluses—because ARPA and other federal COVID response measures kept the economy strong and tax revenues rolling in. SLFRF funds, precisely because they are a one-time influx of money, are perfectly positioned to do the work that needs to be done now. Some of these needed investments will require ongoing funding after the funds are exhausted, and states should use the additional fiscal space they have now to jump-start local economies so that future revenues remain strong. Spending ARPA funds now to rebuild the public sector and address systemic inequities will create more stable communities going forward.

Celebrate the successes of ARPA, and don’t let this moment slip away

In one year, the American Rescue Plan Act has surpassed expectations. The year 2021 was the best year for job growth in our nation’s history. Millions of people were kept out of poverty. Our recovery from the worst economic crisis of our lifetime has been astounding, to say the least.

At the same time, recent history shows that state and local governments do not always invest in growth and prosperity. Instead, we are once again hearing calls for ARPA funds to be spent in ways that do nothing to enhance economic security for working families, like wasting billions to refill unemployment insurance trust funds. The communities most in need of increased public investment too often lack a seat at the table, and spending choices are made that only consider the interests of those already well-resourced and well-connected to policymakers.

This is disappointing. The success of ARPA has shown that poverty and inequity are policy choices, not inherent conditions. Targeting resources to workers, families, and communities that need them is both possible and desirable. On issues ranging from wages to housing to medical care to food, ARPA made measurable and significant improvements.

A return to the pre-pandemic status quo is not sufficient. The example set by ARPA can and should be continued. State and local governments should seize the opportunity to ensure that the economic recovery is equitable and just, that workers have access to well-paid and safe jobs, that communities have good public services, and that children and families remain safe from future economic distress.

A decade from now, it is our hope that we will look upon this as a time when state and local governments learned the right lessons from the success of ARPA, built capacity, helped the economically vulnerable, and set the stage for long-run economic growth to benefit all children and their families. That’s the opportunity before us in the next year.

Enjoyed this post?

Sign up for EPI's newsletter so you never miss our research and insights on ways to make the economy work better for everyone.