Opinion pieces and speeches by EPI staff and associates.

[ THIS POLICY MEMORANDUM WAS PREPARED ON MARCH 30, 2004 ]

Reed Act distributions won’t provide unemployment

insurance benefit extensions to workers

By Amy Chasanov

In late December 2003, Congress failed to extend the Temporary Extended Unemployment Compensation (TEUC) program, despite a weak economy and an unprecedented number of workers who had been unemployed for six months or more. This Wednesday, March 31, final unemployment insurance (UI) checks will be sent to thousands of workers who have been unemployed for 8 months or more. The expiration of the TEUC program makes no sense—unemployment spells are at their longest average duration in 20 years, more than 1.1 million workers will have exhausted their benefits by the end of March, and U.S. job creation is the worst it has been since the 1930s.

A federal law called the Reed Act allows Congress to transfer money from the federal UI trust funds to the individual state accounts; however, Congress may limit how states can use those funds. The last Reed Act transfer was in March 2002 for $8 billion. Some states have been pressing Congress to enact a special Reed Act distribution from the federal UI trust funds by June 30, 2004. In fact, the National Association of Workforce Security Administrators (NAWSA) passed just such a recommendation at their recent March meeting, assuming that Congress will not pass a federal extension of unemployment insurance benefits by the end of June. Providing a future Reed Act distribution to stimulate state-financed benefit extensions is a bad idea that won’t work for a number of reasons.

- First, the severity of this labor market slump and lack of job creation is a national phenomenon, not a state issue. There is approximately $14.3 billion in the federal unemployment insurance trust fund, and that balance is projected to grow to $20 billion by the end of fiscal year 2004. Therefore, there is ample money to pay for another TEUC extension, which would cost less than $1 billion a month and would last for a limited period of time.

- Second, the money is needed now, when so many of the long-term unemployed are exhausting benefits with nowhere to turn. Any Reed Act distribution would be months away and would not help the workers who need it right now.

- Third, Economic Policy Institute analysis indicates that under state law most states would not even have the option of using Reed Act funds distributed on or after June 30, 2004 to pay for benefit extensions—even if a new federal law explicitly permitted the use of Reed Act funds to pay for such extensions. (The March 2002 Reed Act distribution explicitly forbade funds from being used in lieu of TEUC benefits.)

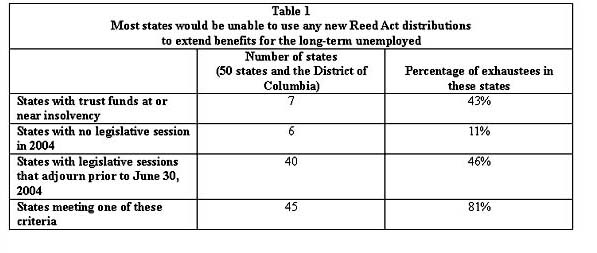

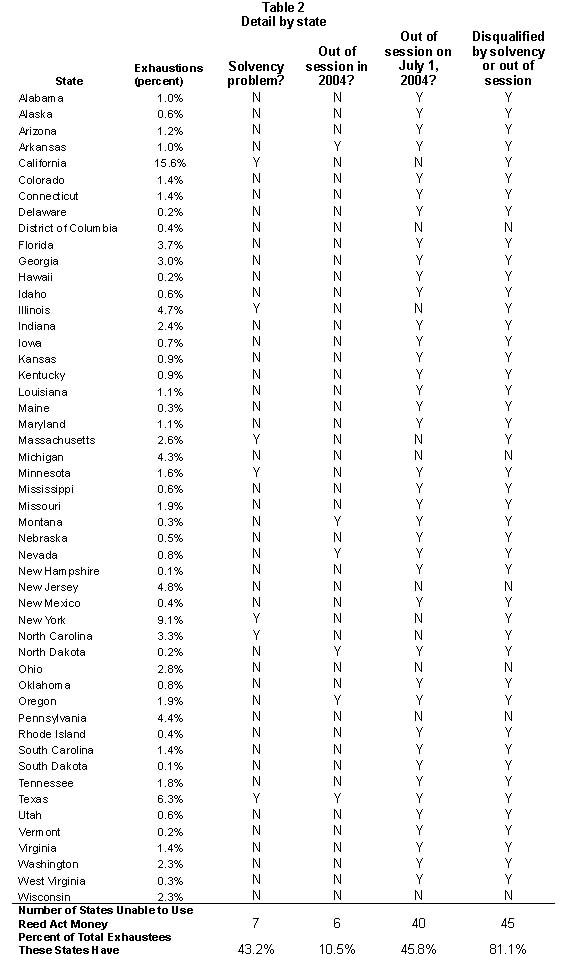

As shown in Table 1, the UI trust funds of at least seven states are at or near insolvency. These states could not reasonably afford to use any new Reed Act monies to pay for additional extended benefits. These seven states have 43% of all the individuals who have exhausted benefits since December 2003. Six states do not even hold legislative sessions in 2004. Because states must enact special legislation to appropriate the Reed Act monies they receive from the federal government, it would be impossible for these states to use the Reed Act monies in a timely manner to help unemployed workers. About 11% of the individuals who have exhausted benefits since December 2003 are in the six states without legislative sessions in 2004. Finally, if the Reed Act monies were distributed on June 30, 2004, the date currently being discussed, the legislative sessions would already be adjourned in another 34 states, making it unlikely that unemployed workers would be helped in these states (see Table 2).

Thus, when considering both the trust fund solvency problems that states face and the inability of state legislatures to designate Reed Act monies for benefit extensions, it appears that only six states would even have the possibility of using the proposed Reed Act distributions to pay extended benefits to the long-term unemployed. And, certainly, just because a state could use a Reed Act distribution to finance a benefit extension does not mean that it would. Another Reed Act distribution would fail to get weekly benefits to the vast majority of the long-term unemployed in time to make a difference in their lives.

Amy Chasanov is Deputy Director of Policy at the Economic Policy Institute in Washington, D.C.

[ POSTED TO VIEWPOINTS ON MARCH 30, 2004 ]