Opinion pieces and speeches by EPI staff and associates.

[ THIS TESTIMONY WAS GIVEN BEFORE THE LABOR-HHS EDUCATION SUBCOMMITTEE, APPROPRIATIONS COMMITTEE, U.S. HOUSE OF REPRESENTATIVES ON FEBRUARY 15, 2007. ]

Testimony before the Labor-HHS Education Subcommittee, Appropriations Committee, U.S. House of Representatives

Thank you.

Allow me to make two general, contextual points before I specifically address education and training issues. First, it seems that there is unlikely to be much new Federal investment in our human resources over the next few years. In fact, at a time when there is an urgent need to build an early childhood education system to provide extensive compensatory programs to disadvantaged students in our K-12 systems and to ensure greater access to college, it seems that potential funding for such initiatives is barely on the nation’s radar screen. This is especially true when one looks at the gap between providing training and income assistance to those hurt by our so-called ‘dynamic economy’ and the rhetorical fealty to such efforts.

This funding scenario, however, is the direct consequence of maintaining other priorities. Some people are wedded to maintaining the recent tax cuts. Many more believe we have to spend whatever it takes for the wars in Iraq and Afghanistan but seem unwilling to raise revenues to cover the expenses. Others believe that moving toward a balanced budget is essential. Whatever one thinks of these positions it is clear that the result is that human capital investments get the leftover fiscal scraps. Without directly saying so, our nation’s policymakers seem to be saying that $10 billion dollars for either deficit reduction or the wars is more important for the nation’s future than what we are gathered here today to discuss.

The Productivity-Pay Gap

My second contextual point is that our policy discussion must be situated in the reality that our nation is not generating broadly shared prosperity even though we have seen relatively fast productivity growth that provides the basis for rapidly rising incomes. It is easy to see that the group that has benefited most from economic growth has been the top 1%, who obtained about 10% of all market-based incomes in 1980 but who by 2004 (the latest data) had doubled their income share to about 20%.1 Income inequality has certainly risen substantially since 2004, so we probably have the most income inequality since before the great depression, seventy-seven years ago. In contrast, the typical working family has less income now than it did in 2000, as their incomes have fallen $3000, or 5.4%.2

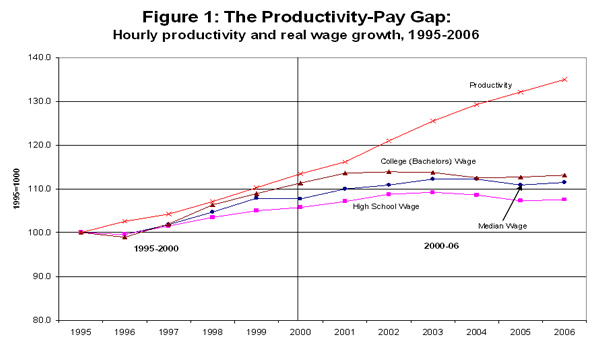

This disparity of results reflects the fundamental economic challenge of our time: to repair the disconnect between growing productivity and the pay of the vast majority of the workforce. Since 1995 we have enjoyed a historically fast growth in the goods and service produced per hour worked—or productivity. As Figure 1 shows, the hourly wages for the median worker (who earns more than that of half the workforce but less than the other half) grew in the 1995-2000 period as did the hourly wages of high school and college –educated workers (those with a bachelors degree but no further education). The momentum of the late 1990s wage growth carried over until about 2002 but stalled thereafter. In particular, the inflation-adjusted hourly wages of the typical median worker as well as those of both high school and college-educated workers have been stagnant over the last four years while productivity grew by 11.5%.

Middle-class economic anxieties are also being fueled by an erosion of employer-provided health and pension benefits. In 2005, only 44.1% of the workforce had an employer-provided pension plan, a drop from the 48.3% who did so in 2000. The share of the workforce that had employer-provided health insurance in 2005 was 54.9 % in 2005, lower than the 58.9% share in 2000 and far below the 69.0% who received such coverage in 1979. The extent of the erosion of benefits can most readily be seen in the fact that only about a third of the jobs obtained by recent high school graduates provide health insurance; in contrast, in 1979 about two-thirds of recent high school graduates received health insurance in their early jobs. This erosion of benefit coverage can also be seen among recent college graduates: only 63.5% of recent college graduates received health benefits in their entry level jobs, down from over seventy percent (70.6%) in 2000. This erosion of benefit coverage is at the core of the eroding quality of jobs for the vast majority and signals that we can no longer develop health and retirement policies as if we are building on the employment based systems for the simple reason that these systems are unraveling.

‘Wage Deficits’ not ‘Skill Deficits’

It is important to note that these wage and income problems faced by the vast majority do not come because they have skill deficits or because of skill shortages that have hampered our competitiveness. After all, we have had rapid productivity growth for the last ten years with the very same workers who now do not participate in economic growth. Moreover, it is hard to claim that the stagnant wages of college graduates and the failure of new college graduates to locate jobs with benefits is the result of their deficient skills. I have appended a recent paper I wrote with my colleague Jared Bernstein that addresses the false claim that a growing wage gap between college-educated and other workers is somehow responsible for the recent growth of income inequality.

No, America’s workers do not face a “skills deficit”: rather, they face a deficit in the wages and benefits that employers provide. This gap between pay and productivity growth is the result of economic and employment policies that shift bargaining power away from the vast majority of us and toward employers and the most well-off. A multitude of factors have contributed to stagnant wages and growing inequality: the steep drop in unionization rates (from 25% in the late 1970s to under 13% today); the failure to raise the real value of the minimum wage, let alone raise it in accordance with productivity (its value has declined by over 25% since the late 1960s); macroeconomic policy that has kept the unemployment rate too high for most of the last 30 years; unfettered globalization and offshoring that increasingly puts U.S. workers in competition with workers around the world; economic deregulation and the privatization of government services; and escalating pay for CEOs. An agenda of accelerated globalization and greater national saving, as some urge, or simply improving skills and education will neither bring the growth needed nor reconnect pay and productivity.

Education Challenges and Accomplishments

To say that skill deficits are not responsible for the growth of wage inequality does not downplay the critical importance of education and training in the past and for our future.

It is important to note that we have seen a tremendous growth in the educational attainment of the workforce over the last thirty years or so:

• More College Education: Since 1973 we have doubled the share of the workforce with a college degree (but no degree beyond that), rising from 10.1% to 19.8%. Similarly, we have doubled th

e share with an advanced degree beyond college, from 4.5% to 9.8%.

• Educational Attainment Today: In 2005, more than 30% of the native-born workforce has a college degree or an advanced degree. Another 10.6% have an associate’s college degree. Another 22% of the workforce went to some years of college, although they did not complete any degree.

• More High School Graduates: Only 7% of today’s native-born workers have not completed high school, though as much as 5-8% has completed high school with a GED. In contrast, about 25% of the workforce in 1973 had not completed high school.

• African-American Progress: The share of young (ages 25-29) African-Americans that has completed high school has doubled between the early 1960s and today, from the low forties to over 85%. Roughly three out of four black students now receive a regular high school diploma and of those that do not roughly half obtain a GED.

• Hispanic progress: Similarly, there have been improvements in the high school completion among Hispanics, from about 68% in 1984 to 81% in 2002 (about 4% with a GED).

Many challenges remain. One is to eliminate the racial, ethnic and class gaps in educational achievement. For, instance, there is still a roughly ten percentage point gap in the graduation rates (with regular diplomas) between whites and either blacks or Hispanics. A particular problem, in this regard, is the failure of the black male high school graduation rate to grow in recent years, in part due to the imprisonment of many young black men. It is both morally and economically necessary to close these education gaps.

The education and achievement gaps can only be surmounted by a full scale assault starting with broad-based access to early childhood education (starting at a very young age and going through kindergarten) and including comprehensive compensatory programs for disadvantaged students (summer and after-school programs, smaller class sizes, high quality teachers, excellent school leadership and facilities). We must also address the lives of students beyond the school hours. That means working to substantially reduce poverty, providing stable and affordable housing, and affordable, accessible health care. To effectively address these issues we will need to find a way to integrate social and health services with schooling. We will not be able to bring all students to a high standard unless we simultaneously provide great schools, provide extensive compensatory programs for disadvantaged students and also ameliorate the conditions facing low-income students.

A second challenge is the increasing share of workers who are immigrants who have little formal education. For instance, roughly half the Hispanic population ages 25 to 29 were not present in this country for at least fifteen years and therefore are not really the product of our school systems. If the nation is to rely on this workforce, hopefully as citizens not as ‘guests’, then we must provide ways for them to gain English language and other skills that will make them productive workers and citizens.

A third challenge is to make access to higher education widely accessible. For reasons explained below, the nation’s economy will require an increasing share of the workforce to have a college degree or an even higher degree. I do not feel that we face a large challenge in raising the share of the workforce that holds such degrees. It is a major challenge, however, to ensure broad and fair access to such degrees and the employment opportunities that follow. A startling fact is that student from high income families who have low test-scores are more likely to complete college than the high-testing students from lower-income families. There are tremendous race, ethnic and income gaps in the access to and completion of college. For instance, it is twice as likely that a white person will become a college graduate as a black person will and it is even less likely that an Hispanic will become a college graduate. Such inequities must end, something that will require extensive improvements in schooling and publicly financed subsidies so that everyone capable of going to college has that opportunity.

Jobs of the Future

It is important to be clear about the types of jobs that will be available over the next ten years and the skill and education requirements necessary for those jobs. The simple truth is that employers require a wide array of jobs with many different levels of skills and education required, both very modest and extensive, and this will not change dramatically over the next ten years. It is true that the jobs of the future will require more education and skill than jobs available today, as today’s jobs do relative to those available ten years ago. But there is no qualitative leap ahead of us.

This can be seen by looking at the Bureau of Labor Statistics’ occupational employment projections for over 700 occupations and determining how the growing and declining importance of particular occupations affects the overall demand for education and skills. Table 1 shows the results of such an analysis. BLS rates each occupation as having one of eleven different education and skill requirements ranging from ‘work experience in a related occupation’ or ‘short-term on-the-job training’ to ‘first professional degree’ or ‘master’s degree’. The first thing to note is that occupations requiring ‘moderate on-the-job training’ or less (the top three categories) will comprise 61.6% of the jobs in 2014, a bit less than the 63.1% of jobs these occupations provided in 2004. This is because the economy today needs tax preparers, correctional officers, janitors, cooks, sales representatives and sales clerks, bookkeepers, painters, waiters and waitresses, truck drivers, and office managers and the economy will continue to need such jobs far into the future. While those occupations that need modest amounts of training will shrink a bit, the occupations requiring a bachelor’s degree or more will grow a bit from 27.7% to 28.7% of employment. If the growth in the share of the workforce which has a college degree continues to grow as it has (it grew by four to five percentage points over the last ten years and for natives is about 30% now) then we will have a ready supply of college graduates to fill these jobs. That is why I say that the policy challenge is not generating a much faster growth of college-educated workers; rather, the policy challenge is about equity, trying to ensure that low and middle-income students have a fair shot at a college education and an opportunity for these jobs.

I take it as a corollary to this finding that whether there is a growing middle class or not and whether there are broad-based improvements in wages and benefits depend greatly on what happens to the wages and benefits earned by the workers in the particular occupations rather than education and skill upgrading and the shifting occupational composition of the economy.

Conclusion

Thank you for the opportunity to share my views. I look forward to your questions.

Endnotes

[1] This is a bit less than the extraordinarily high shares in 2000 which were fueled by realized capital gains at the height of the stock market boom. The income share of the top 1% was just 15% or so at the start of the productivity boom in 1995. All indications are that income inequality has grown substantially since 2004 and, in my view, probably exceeds the prior heights on inequality reached in 2000. Pikkety and Saez,(2006) table 3.

[2] This

refers to the median income of families in the working age-population, with the head of household less than sixty-five years old.

Lawrence Mishel is president of the Economic Policy Institute in Washington, D.C.

[POSTED TO VIEWPOINTS ON FEBRUARY 16, 2007. ]