[THIS TESTIMONY WAS GIVEN BEFORE THE U.S. SENATE COMMITTEE ON HEALTH, EDUCATION, LABOR, AND PENSIONS ON MAY 26, 2005.]

The 21st century workplace

Preparing for tomorrow’s employment trends today

By Jared Bernstein

I thank the committee for the opportunity to testify today, and applaud you for addressing the challenges facing our workforce both now and in the coming decades.

My testimony will focus on these challenges through the lens of globalization. The term, according to the International Monetary Fund, refers to the increasing integration of economies around the world, particularly through trade and financial flows.1

There can be no doubt that our economy is far more globally integrated than ever before. Thirty years ago imports plus exports amounted to 10% of our gross domestic product. Now they amount to 25% of GDP. Like other large forces of change, globalization is an inevitably evolving part of our economic lives. Advances in technology, most recently the decline in the cost of transmitting information, have diminished barriers between nations and expanded the US marketplace far beyond our borders.

Economists and policy makers have stressed the opportunities embedded in these developments, and the danger of pushing back against them. Like others in my field, I agree with these sentiments: when the global economy calls, you’d better pick up the phone!

The benefits of globalization include the growth-enhancing ability of countries to tap their comparative advantages, the expansion of our export markets, and the price savings associated with imports. Similarly, the expansion of financial and labor markets has the potential to create greater competition, more efficient markets, and lower prices.

Yet, it is surely the case that globalization creates both winners and losers, both here and abroad. Many in our manufacturing workforce have watched their jobs and even their factories leave for other countries, and now, in an era where white-collar jobs can increasingly be offshored, even our most skilled workers face competition from workers with similar skill sets yet far lower wages.

As we discuss these matters today, tens of millions of workers go without health insurance, see their pensions erode, and watch their incomes stagnate while the benefits of economic growth flow freely to those at the top. We are just now coming out of the longest jobless recovery on record, and for many in the working class, wage growth continues to lag inflation, even while profits and productivity soar.

In such a climate, the view that forward-looking people must happily embrace whatever outcomes globalization yields is not productive. While the benefits of globalization are prodigious, many who have been hurt by trade competition feel devalued when elites stress solely those benefits and ignore the negative impact of these trends on working families. Moreover, if policy makers do not acknowledge and try to address these costs, we will increasingly encounter a public that views protectionism as the best way to insulate themselves from the downside of global competition.

I believe this committee is well aware of this danger, and that deriving a policy framework that addresses both the upsides and downsides of globalization is a main reason for today’s hearing. Toward that end, I begin by presenting a set of economic outcomes that have evolved over the past few decades, as our economy has become more global. I stress that correlation is not causation, and that increased exposure to global competition is but one of many factors responsible for these changes. Where possible, I try to quantify its role.

Following that, I assess the policy responses offered to strengthen the competitiveness of our 21st century workforce. Two common lines of argument are skill enhancement and further deregulation of US labor, product, and financial markets are the necessary components of a more competitive workforce. While improving access to educational opportunities is critical to improving living standards to many who currently lack such access, further deregulation—for example, reducing our labor standards—is likely to be counterproductive. Instead of making us more competitive, it will have the effect of shifting more economic risk onto our workforce, thereby amplifying the negative effects of globalization.

My testimony ends with a set of policy ideas designed to enhance our competitiveness while helping to provide a greater safety net to those whose economic fortunes have been subjected to greater risk. The goal of this policy set to harness the benefits of globalization in order to address its costs. Washington Post columnist E.J. Dionne, put it well in a recent piece, when he noted that the challenge for policy makers in this area is “…how to create enough security so that Americans can embrace a dynamic economy without fear. Paradoxically, throwing more risk onto individuals leads to risk-avoidance. Risk-taking requires a certain amount of risk-sharing.”2 These sentiments guide the policy ideas I offer below.

The Challenges Facing Today’s Workforce

In order to best plan for strengthening the workforce of the future, we need to understand the challenges facing today’s workers. This section briefly touches on the most relevant examples.

Employment Trends: As we show in State of Working America, 2004/05 (Table 2.32—hereafter, referred to as SWA), over the last business cycle (1994-2000), 77% of the jobs lost to trade were held by those with non-college educations, but half of the jobs paid in the top half of the wage scale. Thus, as intuition would suggest, jobs lost to trade, particularly those in manufacturing, are good jobs for those without college educations. And a simple, but underappreciated fact is worth noting here: only a minority of our workforce, 30%, has a college degree or higher in 2004.

The loss—in some recent periods, the hemorrhaging—of manufacturing employment is one of the most frequently cited costs of our protracted trade deficit in manufactured goods. Most recently, manufacturing employment peaked in March of 1998; since then, the sector has shed 3.3 million jobs, including an unprecedented period of 43 consecutive months of job losses. Since that peak, manufacturing as a share of total employment has fallen from 14.1% of total employment to 10.7%. While this is a continuation of a very long trend—manufacturing has been shrinking as a share of total employment for decades—that trend accelerated over this period, as did our manufacturing trade deficit.

More recently, the sharp decline in the price of accurately transmitting information to far-away places has created the potential to bring millions of skilled workers from abroad into competition with our white-collar workforce. The implicit supply shock from bringing these workers “online” is likely to create the opportunity for “global labor arbitrage,” in the words of Morgan Stanley’s chief economist Stephen Roach, creating downward pressure on white-collar wages.3

In the globalization debate, these issues have been discussed under the rubric of “offshoring.” At this point, there is little solid evidence of the offshoring’s impact on jobs and wages, though anecdotes abound, particularly regarding the slow recovery in our IT sector. It is important to note that the lack of evidence at this point is due to the inability of our statistical system to capture this dynamic. Below, I suggest some ways

in which we might do a better job of keeping track of how many jobs are “offshored.”

Most economists believe that even with increased offshoring, IT will again be a strong job-growth sector (hiring in IT has been depressed since 2001 due largely to the bursting of the tech bubble). In this regard, offshoring is likely to show up more in the compensation trends of our domestic workers in affected sectors than in their employment trends.

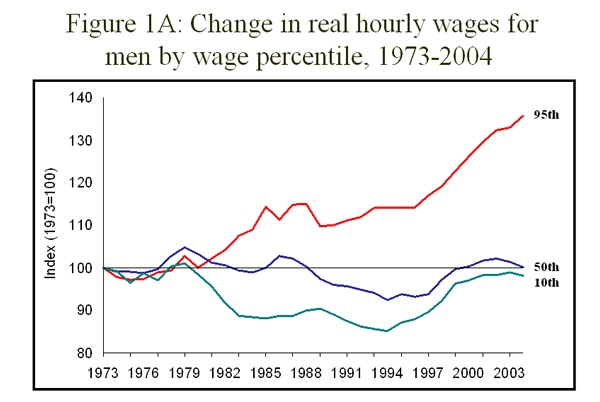

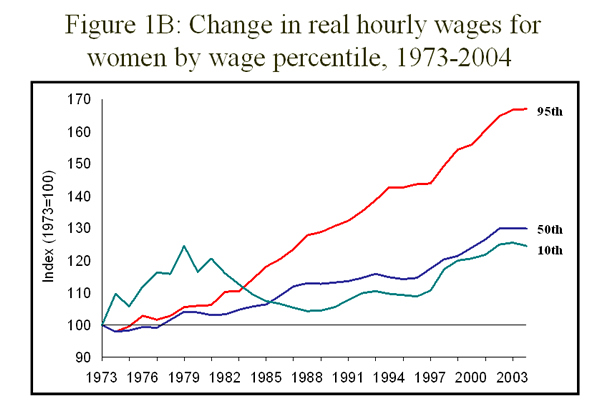

Wage Trends: Figures 1A and 1B show real hourly wage trends for men and women at various wage percentiles. For men, note the long-term decline in the real value of middle- and low wages, while the 95th percentile wage climbed fairly steadily.

Relative to the role of globalization, two important points can be drawn from the trends in 1A. First, over a period where our economy consistently expanded, became far more productive, and became far more globally integrated, the hourly wage of the median male—historically a building block for the living standards of middle-income families—was unchanged over thirty years! In 2004 dollars, it started at $15.24 in 1973 and ended up at $15.26 in 2004. At the same time, the 95th percentile ended the period over 30% above its 1973 level. To the extent that increased globalization was improving economic outcomes over this period, by this measure, its benefits eluded low- and middle-wage men.

Recent work by my EPI colleague Larry Mishel has examined these male wage changes from the perspective of increased trade. A consensus figure from the inequality literature finds that trade explains about 20% of the increase in wage inequality. Between 1979 and 2004, the male median wage fell 4% while the 95th percentile male wage was up by 32%. In today’s dollars, this amounts to a growth in the hourly wage gap between these two percentiles of about $12. Taking 20% of that gap and assuming full-year work translates into an income loss of $4,700, a significant loss for these workers and their families.4

Second, notice that for middle and low-wage women, as well as for men throughout the pay scale, real wages climbed steeply from 1995-2000, before flattening most recently. Prior to this period, most economic analysts argued that the limited skills of these workers were responsible for their weak wage outcomes. Yet skills had nothing to do with the wage acceleration of the latter 1990s; it was largely a demand-side phenomenon, as the unemployment rate headed for a thirty year low and the job market tightened up for the first time in decades.

The period serves as a critical reminder that policy makers must not limit their analysis to the supply-side, as in skill-based solutions, but consider the host of other factors that influence the opportunities for work and the quality of jobs. Over this period, taxes became more progressive, yet contrary to supply-side lore, investment soared and productivity accelerated. The minimum wage was increased and the Earned Income Tax Credit, a generous wage subsidy to low-wage workers, was significantly expanded. The Federal government balanced its budget for the first time in thirty years, and the signal of fiscal rectitude was reassuring to financial markets, helping to push down the long-term borrowing rate, further boosting investment and productivity (Blinder and Yellin, 2001). Again, I note that none of these policies targeted alleged skill deficits, yet together they had a demonstrably positive affect on our workforce, reconnecting, albeit for too few years, the fortunes of many in the working class to the overall growth in the economy.

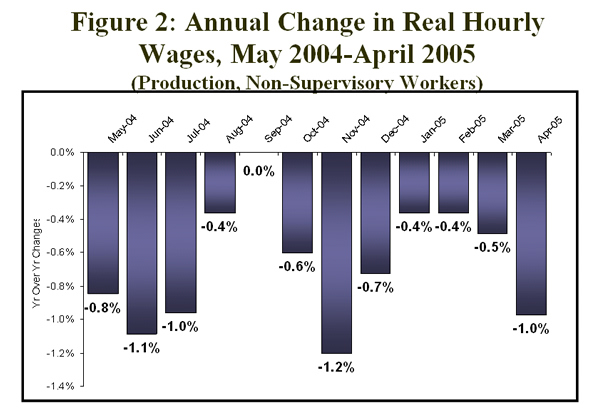

The momentum of the formerly full-employment job market kept real wages rising through mid-2003, but since then, the combination of slower nominal wage growth and faster inflation have led to declining real wages, particularly for less advantaged workers. For example, as shown in Figure 2, on a year-over-year basis, the hourly wages of blue-collar manufacturing workers and non-managers in services have failed to beat inflation for 12 months running.

Unlike wages, compensation growth has been beating inflation, but this is due to the rising costs faced by employers of providing healthcare and pension coverage. Even so, as shown in Mishel and Bernstein (2005), compensation significantly lags productivity, especially compared to prior periods.5 We show, for example, that in past recoveries, real compensation grew 72% as fast as productivity, suggesting the benefits of greater efficiency were more broadly shared with the workforce. This time around, compensation has been rising 37% as fast as productivity.

Of course, the gap between workers real wages and productivity is far greater. Data from the Employment Cost Index—a closely watched source of compensation and wage data for all civilian workers (and thus more comprehensive than the production worker series in Figure 2)—reveals that while benefit costs have been driving compensation ahead of inflation, wages have grown far more slowly. In fact, the year-over-year growth of the ECI wage and salary component has been 2.4% (nominal) for the past three quarters, the lowest growth rates for this series since its inception in the early 1980s. Since 2001q1, real ECI wages have grown at an annual rate of 0.7% while productivity has expanded 4% per year, an historically unprecedented gap between paychecks and productivity.

Where, then, if not into compensation, has the growth been going? It has largely flowed to profits, which have soared since the recession, creating a historically unique pattern. Over prior business cycles, profits (including interest income) have accounted for 23% of the growth in corporate-sector income, on average, with total compensation accounting for the remaining 77%. In the current business cycle, the distribution is almost reversed: profits have claimed nearly 70% of total growth in the corporate sector, while increases in compensation (from increased employment and higher hourly compensation) have received just over 30% of total income growth.

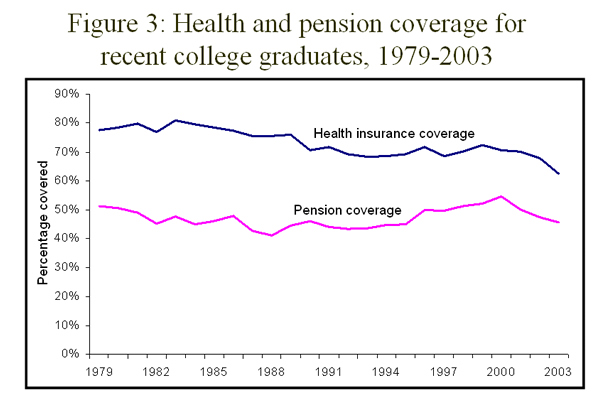

Employer-Provided Pension and Health Coverage: Figure 3 plots the receipt of employer-provided health care and pension coverage for and college graduates starting out in the workforce. The group is chosen for the analysis because as newly-minted college grads in the workforce, they presumably suffer less from an alleged skills’ deficit than those with terminal high-school degrees. Yet, these workers’ skills have failed to insulate them from the loss of pension and health coverage, as the share with employer-provided health care has been drifting downward for decades, while the trend in pension coverage has been stagnant or falling with the exception of the latter 1990s. Most recently, a decline in pension coverage for young college graduates is evident at the end of the figure.

To make matters worse, due to the shift from defined benefits (DB) to defined contributions (DC), pensions have become less secure for those who still have them. In the early 1980s, those who received pension coverage were about four times more likely to have a guaranteed pension benefit upon retirement than one subject to the outcome of the employee’s investments and the employer’s match. This ratio flipped in the mid-90s and DC pensions are now more prevalent the DBs. The fact that these trends are befalling skilled workers suggests that policy makers need to think beyond skill-enhancement to re-secure health and pension coverage for these workers.

Balancing Work and Family: The challenges of globalization must also be viewed in the context of changes in the composition of our workforce over time, particularly regarding the pressures of balancing work and family. As is widely recognized, the share of women in the job market has about doubled since we started tracking the statistics in the late 1940s, while that of men has consistently fallen. In 1950, women were 30% of the workforce, now they account for just under half. Today, about two-thirds of mothers with children work in the paid labor market; even among moms with kids under six, a solid majority work, with employment rates just below 60%.

In fact, given male wage stagnation (see Figure 1A), extra work by wives has been a critical factor in preventing the decline of incomes among middle- and low-income married families with children. As we show in SWA, low and moderate-income wives (in the first two income quintiles) increased their hours of work by between 60 and 70 percent between 1979 and 2000, while middle income wives increased their hours by about half.6 Higher income wives started from a significantly higher base and their hours grew less in percentage terms. They too, however, increased their hours by about one-third over the 1980s and 1990s combined.

Translating these large percentage increases into the equivalent of full-time work gives a sense of how much more time these working wives spent in the paid labor market. Moderate- and middle-income wives added over three months, while wives from low and high income families added over two-months.

In the absence of these added hours of wives’ work, family incomes would have fallen for the bottom 40% of married couple families with children, and would have risen only 5% for middle-income families over the two decades from 1979-2000. Instead, thanks to wives’ contributions, their incomes rose, by 8% for the bottom fifth, 16% for the second fifth, and 24% for the middle fifth.

These gains, of course, did not come without putting considerable stress on working families. From the perspective of workforce policy, the relevant question becomes: which policies can help families balance their need and desire to work and pursue careers, while giving them the time and resources they need to raise their families. I address these issues in the policy section below.

Income inequality: As noted in the introduction, the economic dynamics associated with globalization creates winners and losers. One way this has played out in recent years is through increasing inequality, as workers in sectors and occupations more complementary with increased global integration have claimed far more of the economy’s output than those in competing sectors. For example, managers in manufacturing may benefit through outsourcing work to cheaper overseas platforms while blue collar workers may be displaced.

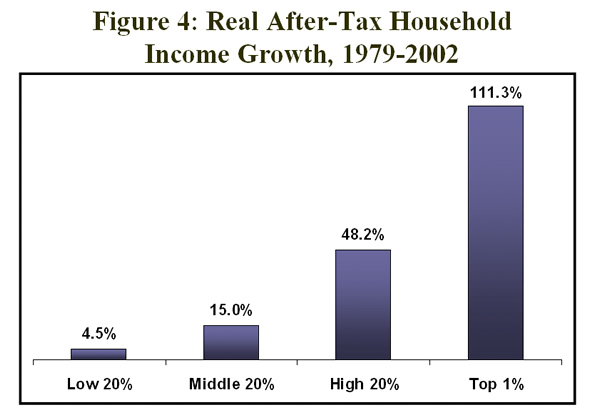

According to the most comprehensive income data, developed by the Congressional Budget Office, the after-tax, inflation-adjusted incomes of the bottom fifth of households grew 5% between 1979 and 2002. For households in the middle fifth, the average gain was 15%; for the top fifth, 48%, and for the top 1%, 111% (see Figure 4 ). Over this same period, our economy has become increasingly more productive, and while technological advances are the main factors cited for these gains, some economists credit trade as well, particularly for generating lower prices. In fact, productivity increased 53%, 1979-2002, but as these inequality statistics reveal, the benefits of this greater efficiency eluded most in the working and middle classes.

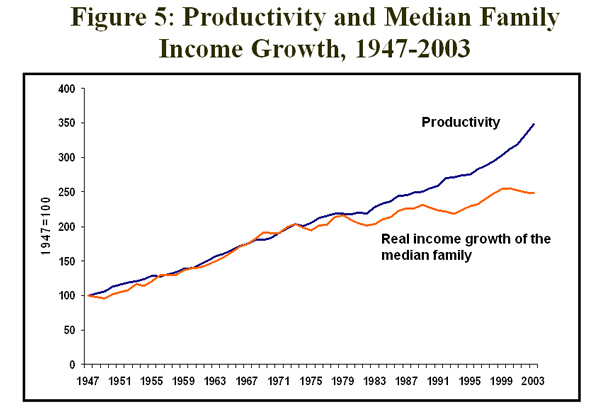

This evolving gap is shown in Figure 5, which plots the relationship between productivity growth and the real income of the median family. From the late-1940s to the mid-1970s, the living standards of middle-income families increased in lock-step with productivity growth, as the benefits of the expanding economy were shared evenly by all who played a role in that expansion. Since then, the wedge of inequality has severed this relationship, despite the fact that middle-income families are working harder than ever before.7 As can be seen at the end of the figure, this problem has worsened in recent years. Between 2000 and 2003 (the most recently available income data), productivity expanded by 12% while median family income fell by 3%. In fact, the gap between the two series in 2003 is the largest on record, going back to 1947.

Recent Trends: Most recently, the formerly jobless recovery has left us with a labor market that remains slack, and while we’ve achieved some decent growth numbers in terms of GDP and especially productivity, the incomes of middle-income families fell each year between 2000 and 2003. As shown in SWA, Table 1.2, the post-2000 income losses are more than explained by the decline in annual hours worked, a function of the protracted labor market contraction. Poverty also rose over these years, and rose most for the least advantaged, like single-moms who are more vulnerable now that our safety net seems better designed for booms, not busts.8

On the plus side, our economy is steadily creating jobs again, albeit at a rate which jobs lags past recoveries. Over the past 12 months, for example, employment has been expanding, on net, at an average rate of 181,000 per month. In the last recovery, the monthly figure for the comparable point in the business cycle was 300,000. The current unemployment rate stands of 5.2% is low in historical terms, but that figure presents far too rosy a picture of the job market—it is biased downward by the fact that millions gave up the job search due to perceived lack of demand and are thus not counted among the unemployed. This bias is also evident in the extent of long-term unemployment, which currently looms as a much larger problem than we would expect, given an unemployment rate in the low fives.9 A better measure of current demand—employment rates—remain quite depressed, especially for African-Americans, males in particular.10

These are some of the problems facing many in the current workforce. Surely, some of them are more closely linked to global competition than others. For example, the slump in manufacturing employment is closely linked to the expanding trade deficit, while the slow growth in IT employment has more to do with the bursting of the tech bubble. Declining real wages amidst strong profit growth may well relate to the global wage arbitrage noted above, but it is equally a function of the slack leftover from the j

obless recovery.

The larger point is that a policy framework for the 21st century workforce needs to grapple with these realities. The question for policy makers is then how, in an increasingly global economy, do we meet these challenges while enhancing our competitiveness? How can we harness the economic benefits of globalization in such a way as to pushback against greater inequality, ensuring that the living standards of working and middle-class families benefit from advances in trade and technology as much as those at the pinnacle of the income pyramid?

Demographics Are Destiny…Not!

Interestingly, many who consider these questions focus less on direct policies to insulate our workers from shouldering more of the risk inherent in expanded globalization, and more on the prospective difficulties facing future employers (Hudson Institute, 1987 and 1997). Here, I briefly discuss two threads of their concerns: the future skills shortage, and the challenge of future demographic trends.

The Skills of Our Current and Future Workforce are Important, But They’re Not the Whole Story.11

No serious analyst could question the value and importance of a skilled workforce. Years of economic research has established that an increasing supply of skilled workers is a critical input into production, leading to higher productivity growth and better living standards throughout the economy. Great innovations that have helped to establish our world-class economy are clearly linked to the quality of our workforce.

Many critics of the American education system, however, argue that we already fail to produce enough skilled workers to meet employers’ demands and that this shortfall will only worsen. And few who have examined this issue can doubt that access to quality education is blocked for many deserving, yet disadvantaged, Americans. In fact, the mantra of a skills-shortage is so often repeated it seems churlish to question it.

Yet, in an economy with scarce policy resources, it is essential to examine the evidence for and against the alleged coming skills shortage. There’s little question that the Federal government will remain in the business of investing in workers skills, of course, but should these investments crowd out other, more direct ways of enhancing the security of our workforce? Here are a number of reasons to question the existence of a skills mismatch of a magnitude that would lead us to that conclusion:

• The most frequently cited evidence for a skills shortage over the past few decades is the increase in the college wage premium. But the rise in the college premium has been partly driven by shift in economic structures that have served to lower the wages of less educated workers, such as the loss of manufacturing jobs, fewer unions, lower minimum wages, and, excepting the latter 1990s, high average unemployment rates. When many of these factors pushing down low wages were reversed in the latter 1990s, the growth college wage premium decelerated.

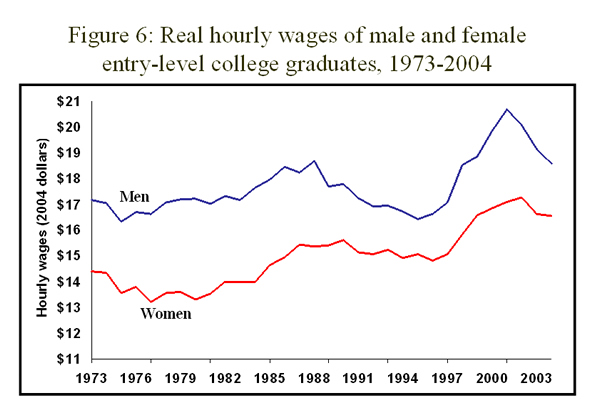

• Contrary to the skills’-deficit argument, the real wages of college graduates have not been consistently bid up. Figure 6 shows that for about 10 years, from the latter 1980s through the mid-1990s, the real wages of young college graduates were flat. Their premium may have been rising over this period, but as just noted this was partly due to the structurally-induced decline in wages of less-educated workers. Presumably, a true skills shortage should lead to rising absolute wage levels, not simply relative wage gains. As in the wage percentile figures above (1B and 1B), this figure also reveals the boost these workers got from the full-employment labor market of the latter 1990s, and the reversal of that positive trend in recent years. Once again, the importance of demand as a wage determinant is evident, though this emphasis is generally absent from the supply-side skills discussion.

• Occupational employment shifts show steady, not accelerating growth of skill demands. It is critical to note that skill demands have always risen over time and will continue to do so. However, the “skills mismatch” claim argues that the rate of skill demands has increased. In Bernstein and Mishel (2001), we present an index of occupational skill demands and show that it has proceeded at a steady pace over the past 25 years.

• The quality of our labor supply has increased significantly, and will continue to do so. We have doubled the share of college educated workers, including those with advance degrees, from 14.6% in 1973 to 29.5% in 2004. Conversely, we have cut the share of high-school dropouts from 28.5% in 1973 to 10.3% in 2004.

Still, it is possible to accept that while the case for skill shortages in our current economy is weak, given increased globalization, future skill demands will outpace the supply of skilled workers.

Given the ongoing upwards shift in the share of the workforce that is college-educated, recent BLS projections of job growth by occupation do not paint a picture of difficult-to-meet skill demands. While most of the fastest growing occupations call for at least a college degree, these occupations are growing from a low base and are thus not contributing the most jobs to the future economy. Conversely, of the 30 occupations adding the most jobs over the next decade, only eight call for a college degree. Summing over all the occupations, they are expected to add 12.6 million jobs over the next decade, yet only 28% are expected to require at least a college degree.12 As we show in SWA, Table 2.48, these predicted occupational shifts should raise the demand for workers with at least a college degree by one percentage point over 10 years. Given the expected continued increase in the supply of college graduates, we are very likely to meet these projected skill demands.

A final point here is that it is very hard to square concerns regarding our present and future skills mismatch with the post-1995 productivity acceleration—a trend unforeseen by any of the futurists who were warning of skill shortages years back. This is a particularly steep challenge for the skill-shortage adherents, since productivity growth, more so than test scores or educational attainment, is prima facie the best measure of the extent to which the skills of the workforce are promoting or hindering economic growth. Trend productivity growth accelerated by about 1% per year in the latter half of the 1990s—from 1.5% to 2.5% per year—and has since accelerated about another 1% (though many experts suspect that this added boost is less sustainable). Contrary to a skills deficit story, the acceleration of this most important economic indicator suggests that the skills of our workforce in tandem with capital investment and technological innovation appear to have given rise to a new golden era of accelerated productivity growth. Productivity experts expect this accelerated trend to continue into the future. 13

What about an Older, Slower-Growth Labor Force?

A related set of concerns reflects the fact that our workforce is increasingly older, and, as the baby boomers begin to age out of the system and are followed by smaller birth cohorts, will grow more slowly than in the past. Like the case for skills mismatch, there is a grain of truth here. In fact, one of the fe

w things we can predict with a modicum of accuracy is the demographic composition of the future population (though that of the workforce is a tougher call), since we know the age and demographics of those alive today, and have some ideas about immigration (though, as shown below, this is an area that has proved hard to predict).

However, those who intend to shape workforce policy based on these predictions should know that the past is littered with widely inaccurate claims based on demographic projections, because, contrary to the oft-made claim, demographics are not destiny. Too many other factors can and do intervene such that demographic change always explains a relatively small share of future outcomes.

Take, for example, an unrelated prediction I raise here because it is quite instructive in this regard. Based on the age structure of groups in the population with higher than average propensities to commit crimes, criminologists in the 1980s warned that crime rates in the 1990s would accelerate. In fact, crime rates plummeted in the 1990s, once again taking demographers by surprise. 14

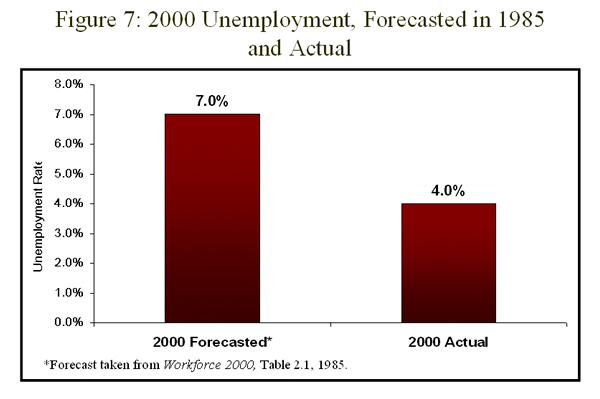

Closer to home, let us briefly look at some of the predictions made in the mid-1980s in the Hudson Institute’s influential publication Workforce 2000. Warning that skill demands would mean higher unemployment for less-skilled workers, the base-case prediction by these forecasters for unemployment in 2000 was 7%. In fact, the unemployment rate that year was 4% (see Figure 7 ). Moreover, as shown in Bernstein and Baker, 2003, the rate was driven down largely by the tightest low-wage labor market in decades.

This is not to fault the Hudson Institute’s forecasters—no one else saw the unemployment rate headed for a thirty-year low. The point is that by focusing on the static demographic, economic, and policy data they had at hand, they missed a set of developments that swamped these factors. These include the acceleration of immigration—they assumed that Hispanics would grow by 22% as a share of the labor force, 1985-2000; the actual figure was 33%. They further assumed that Hispanic employment would fall from 6.4% of total employment to 5%; instead, it rose to 11.5%. They (and everyone else) failed to foresee that faster productivity growth that allowed the Federal Reserve to let unemployment fall below the consensus rate for full employment; they could not account for policy changes like welfare reform and the expanded Earned Income Tax Credit that sharply raised the labor force participation rates of single mothers.

Phenomena like these, and each period is replete with them, consistently foil demographic-based forecasts.

Most recently, along with skill shortages, demographic forecasters have added the slower growth of the future labor force to their list of concerns.15 In large part, this concern stems from the economic identity noting that the rate of GDP growth equals the rate of productivity growth plus that of the labor force. Thus, if the labor force grows less quickly, it implies slower GDP growth, ceteris paribus.

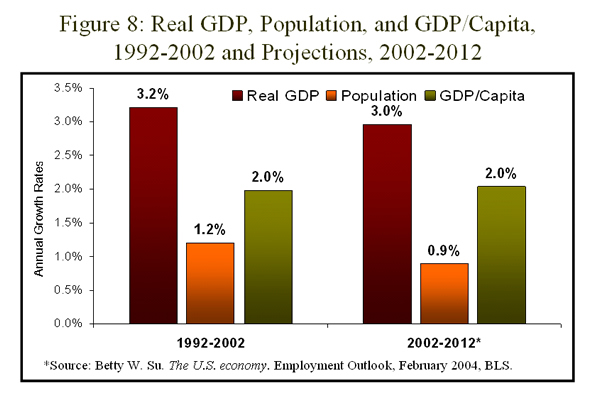

Yet what determines future living standards, on average, is GDP per capita (of course, the living standards of families at different income percentiles is very much a function of how average growth is distributed). If GDP and population both grow more slowly, the outcome for GDP per capita is an empirical question.

An instructive short-run prediction comes again from the economic assumptions behind the BLS projections for growth over the next ten years. As shown in Figure 8, GDP is expected to grow more slowly in the forecast years, by 0.2%. Yet population growth will slow by slightly more than this, by 0.3%, from 1.2% per year to 0.9%. The outcome is that GDP/capita will grow at the same rate over the two periods.

This is but one short-term forecast and as such, may not change the minds of those convinced of a coming labor shortage in the more distant future. But here again, the point is that there are “many moving parts” to consider when deciding where to place scarce policy resources. The labor force may well grow more slowly in decades to come, but that will not necessarily lower GDP per capita. Faster productivity growth is already helping to offset the slower growth of the labor force. Finally, important shifts are underway regarding the age at which people leave the job market. Between 2000 and 2004, the only age cohort with an increasing rate of employment was those age 55 and up. Their employment rates grew by 3.4 percentage points, while those of 16-24 year-olds fell by 5.8 points and those of 25-54 year-olds fell by 2.5 points. Such changes can be unforeseen by demographically-driven forecasters.

Policy Recommendations: Not Walls, But Nets

How can we best use the information presented thus far to frame the policy debate over how to amplify the benefits of globalization without ignoring the costs? The purpose of any policy set in this area is to strengthen the ability of our 21st century workforce to compete without forcing its participants to shouldering a disproportionate share of the risks embedded in a more dynamic, competitive global economy.

Too often, even the mildest forms of worker protections are criticized by their opponents as a destructive response to globalization. These same opponents point to existing regulations like overtime rules, minimum wages, and various types of social insurance, already weakened by years of attack and neglect, as hurting our ability to compete.

There is simply no evidence to support these claims. The history of such labor protections shows no correlation between them and any of the important macro-economic indicators of our competitiveness, including investment, productivity, or the growth of real national income. These protections are, however, more closely related to how both the fruits of that growth and the degree of economic risk are shared.

Under the guise of “flexibility,” it is argued that in an increasingly global economy we can no longer afford labor protections that date back to an era when our economy was far less globally integrated. To help our workforce compete, the argument goes, we must dismantle policies wherein the government attempts to internalize some of the risk inherent in market outcomes, even while the degree of risk has been ratcheted up by globalization.

This strategy threatens to take workforce policy in exactly the wrong direction. As the Dionne quote presented earlier stressed, we cannot both shift more risk onto our workforce in an era of increasing economic inequality and insecurity and expect them to embrace globalization. Neither, of course, can we build walls around our economy.

Instead, we must think in terms of terms of providing our workforce with both the skills and the security they need to maximize the benefits of globalization. To do so implies the creation of a broad safety net that ensures that the living standards of all working families grow with the overall economy. Our policy set should be designed to diminish the growing gap between productivity and the wages, incomes, and economic security of our workforce.

Here are some ideas consonant with that goal:

Expand Tra

de Adjustment Assistance to workers in all sectors and covering all countries with whom we normally trade;

Protect and enhance workers’ right to organize as articulated in the Employee Free Choice Act;

Take the responsibility for health insurance coverage out of the workplace; establish an employer/labor commission with the assignment of recommending a single-payer, universal approach to healthcare, based on expanding Medicare to the non-elderly;

Raise the minimum wage;

Modernize the Unemployment Insurance system with the goal of increasing eligibility and coverage for those with shorter and more interrupted work histories;

Get better information on the extent of offshoring;

Remove tax incentives for companies to ship jobs overseas;

Ensure universal access to pre-kindergarten so every 3 or 4-year old in the nation has a quality learning environment and arrives at kindergarten prepared to learn;

Ensure access to higher education for all who want to attend college by paying the costs of post-secondary education for every child in America who can qualify: require the student to pay back over time from increased wages;

Provide scholarships to any low-income individual who studies science, math, engineering or technology, both for undergrad and post-secondary education;

Help working parents balance work and family by implementing paid family and medical leave, paid vacation and sick days;

The theme behind these ideas is that preparing for tomorrow’s workforce calls for a balanced approach. Policies of this ilk acknowledge the importance of improving preK-12 education and providing access to higher education. But they also take as a given that the set of challenges facing our workforce now and in the future cannot be met by a skills agenda alone. A large majority—70% of our current workforce—is not college educated, and these workers continue to make vital contributions. Yet, for many, living standards have fallen even while the economy expands.

Balancing the needs of workers and employers means rejecting calls that invoke globalization as a rationale for greater risk shifting. Cutting social insurance benefits, shifting retirement savings into the stock market, pushing back on overtime protections and minimum wages, ignoring the glaringly obvious need to protect and expand our health care and pension systems—these harmful trends have all been rationalized under the guise of preparing our workforce to compete in the global economy.

The reality is that such policies can only lead to greater economic insecurities while dispiriting and devaluing one of our national treasures: the American workforce. Instead, the future demands a progressive policy set that harnesses our great resources to propel our workforce forward with a both the skills and the security they need.

Endnotes

1 See http://www.imf.org/external/np/exr/ib/2000/041200.htm.

2 Washington Post, May 20, 2005.

3 See, for example, http://www.globalagendamagazine.com/2004/stephenroach.asp

4 The hourly gap grew by $11.82. This figure times .20*2000=$4,728

5 See: http://www.epi.org/content.cfm/webfeatures_snapshots_20050421

6 See pages 100-106.

7 Between 1979 and 2000, the annual hours of work of middle-income, married-couple families increase by over 500 hours, largely due to the contribution of working wives (Mishel et al, 2004).

8 See Greenberg and Bernstein, 2004.

9 See http://www.epi.org/content.cfm/webfeatures_snapshots_20050518.

10 See: http://www.epi.org/content.cfm/webfeatures_snapshots_20050406

11 Some of this text is adapted from Bernstein (2004).

12 See http://www.bls.gov/emp/mlrtab4.pdf

13 See Jorgensen et al, http://www.newyorkfed.org/research/current_issues/ci10-13.pdf

14 A number of reasons have been offered for the divergence between the predicted and actual outcomes, including a surprisingly strong economy, heightened punitive measures, and, according to controversial work by Leavitt and Donahue, (2000), more abortions decades hence (see Bernstein and Houston, 2000, re the other factors).

15 See, for example, http://www.aspeninstitute.org/AspenInstitute/files/CCLIBRARYFILES/FILENAME/0000000225/DSGBrochure_final.pdf

Bibliography

Aspen Institute. 2003. Grow faster together. Or grow slowly apart. How Will America Work in the 21st Century? New York, NY: Frankfurt Balkind.

Bernstein, Jared and Dean Baker. 2003 The Benefit of Full Employment: When Markets Work for People. Washington, DC: Economic Policy Institute.

Bernstein, Jared. 2004. “The Changing Nature of the Economy: The Critical Roles of Education and Innovation in Creating Jobs and Opportunity in a Knowledge Economy.” Testimony, Committee on Education and the Workforce, U.S. House of Representatives.

http://www.epi.org/content.cfm/webfeatures_viewpoints_changing_economy_testimony

Bernstein, Jared and Lawrence Mishel. 2001. “Seven reasons for skepticism about the technology story of U. S. wage inequality.” In Berg, Ivar and Kalleberg, Arne. I. eds. Sourcebook of Labor Markets: Evolving Structures and Processes. New York, New York: Kluwer Academic/ Plenum Publishers.

Bernstein, Jared and Ellen Houston. 2000. Crime and Work. Washington, D.C.: Economic Policy Institute.

Blinder, Alan and Janet Yellin. 2001. The Fabulous Decade: Macroeconomic Lessons from the1990s. New York, New York: The Century Foundation Press.

Donohue, John J. and Levitt, Steven D., “The Impact of Legalized Abortion on Crime” (2000). Quarterly Journal of Economics http://ssrn.com/abstract=174508

Johnston, William B. 1987. Work Force 2000. Indianapolis, Indiana: Hudson Institute.

Jorgenson, Dale W., Mun S. Ho, and Kevin J. Stiroh. 2004. “Will the U.S. Productivity Resurgence Continue?” Volume 10, Number 13 – December 2004. New York, NY: Federal Reserve Bank of New York

Judy, Richard W. and Carol D’Amico. 1997. Work Force 2020. Indianapolis, Indiana: Hudson Institute.

Mishel, Lawrence, Jared Bernstein, and Sylvia Allegretto. 2005. The State of Working

America, 2004/ 2005. Ithaca, New York: Cornell University Press.

U.S. Department of Labor, BLS. 2004. Monthly Labor Review, February 2004. Washington, D.C.: Bureau of Labor Statistics.

Jared Bernstein is a senior economist at the Economic Policy Institute in Washington, D.C.

[ POSTED TO VIEWPOINTS ON MAY 27, 2005 ]