Economic Snapshot for April 8, 2009

Housing collapse drives up consumer bankruptcies

by Nooshin Mahalia

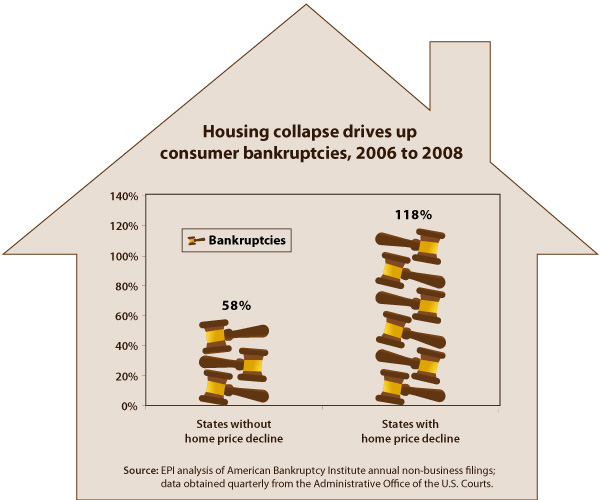

The bursting of the housing bubble, which led to a foreclosure crisis and economic downturn, is also likely triggering a surge in bankruptcies. Consumer bankruptcy filings hit more than 1 million in 2008, up from just under 600,000 in 2006.

Since falling home prices reduce an owner’s ability to use home equity to manage financial distress and debt-related difficulties, we would expect bankruptcies to be more common in states with declining home values. The latest data show how strong that connection is.

Between 2006 and 2008, personal bankruptcies rose 58% in states without declines in the Home Price Index (HPI)1 but rose 118%—more than twice as fast—in the 16 states with HPI declines (see Chart).

Other factors contributing to bankruptcies include job losses, high credit card balances, and costly medical expenses.

This finding supports the notion that people were using home equity as part of their personal safety net in times of crisis. With this option quickly disappearing, more people will be forced into bankruptcy court.

Note

1. The Office of Federal Housing Enterprise Oversight publishes the Home Price Index by tracking housing values for individual single-family residential properties. States with declines in home price were California, District of Columbia, Florida, Michigan, Massachusetts, Arizona, New York, Nevada, New Jersey, Ohio, Maryland, Minnesota, Rhode Island, Connecticut, New Hampshire, and Hawaii.