According to today’s data release from the Bureau of Economic Analysis, gross domestic product (GDP)—the broadest measure of the nation’s economic activity—grew at an annualized rate of 2.0 percent in the third quarter of 2012, a slight acceleration from the previous quarter’s 1.3 percent growth rate. Since the beginning of 2011 the economy has grown at an average annualized rate of less than 2 percent, a pace slightly below the sum of trend growth in the labor force plus productivity. This is a rate of growth that has historically put no sustained downward pressure on the unemployment rate.

MORE: State of Working America graphs with latest GDP data

Further, there’s little evidence in today’s data that we should expect higher growth rates anytime soon. While personal consumption expenditures (PCE) rose slightly faster than in the previous quarter (2.0 percent relative to 1.5 percent) and changing business inventories reduced the third quarter’s growth rate slightly, there was also a large boost to growth from a 13.0 percent increase in federal defense spending. This increased defense spending accounted for 0.6 percentage points of the quarter’s total 2.0 percent growth rate. It seems unlikely that such steep defense spending increases can be relied on in years to come.

Further, perhaps the most worrisome aspect of the third quarter’s data is the continued deceleration of business investment in equipment and software, with spending essentially flat in the third quarter. This category of business spending had been a source of strength in the U.S. economy for most of the recovery, but has begun decelerating in the last year. Worse, it’s hard to make the case that this slowdown in spending is likely to be reversed by any policy changes besides boosting other components of demand. Indeed, from the time the recovery began until recently, equipment and software spending had been so strong that it’s unlikely firms will need to expand capacity in the near term unless there is a big uptick in overall sales.

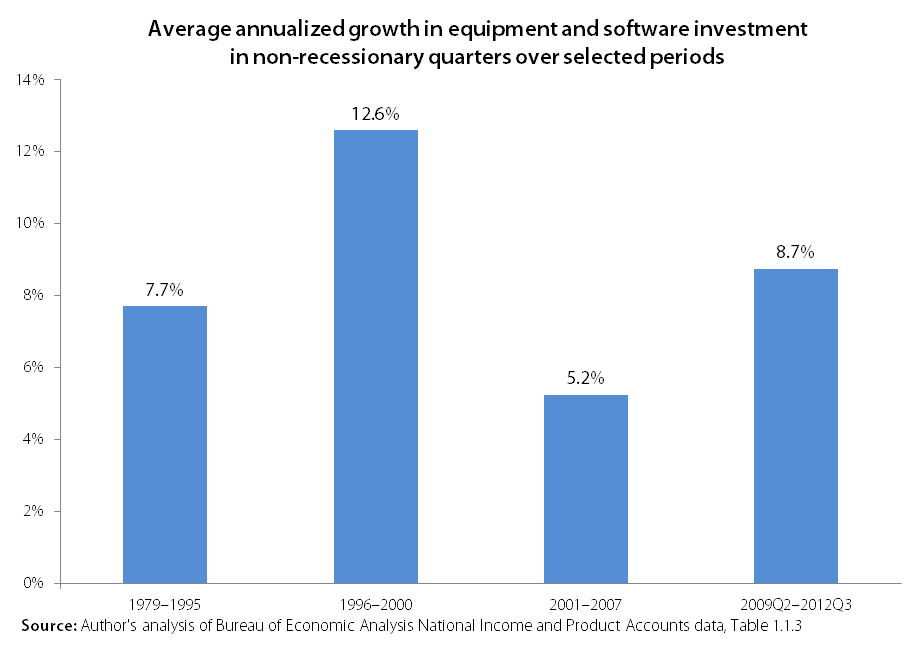

The overall strength in equipment and software spending during this recovery can be seen in the figure below, which compares average annualized growth rates in non-recessionary quarters across different time periods. Equipment and software investment since the recovery began in the middle of 2009 has actually outperformed the post-1979 average considerably, with only the burst of spending associated with the information and communications technology boom of the late 1990s resulting in higher investment rates.1

Net exports fell slightly in the third quarter, subtracting 0.2 percentage points off the quarter’s growth rate, after two quarters of adding slightly to growth.

State and local government spending continued to drag on growth, but this drag has greatly moderated in recent quarters. In the third quarter this spending subtracted only a trivial amount (0.01 percentage point) off of the quarter’s growth rate.

Other good news is that residential investment shows no sign of reversing its recent strong contributions to growth. It contributed roughly 0.33 percentage points to the quarter’s growth rate, right in line with its performance over the past year.

Inflation-adjusted personal disposable income rose at just a 0.8 percent rate in the quarter, and the personal savings rate fell from 4.0 percent to 3.7 percent. In short, consumption growth over the quarter was purchased not just through rising household incomes, but with a decline in savings as well. Thus, it is unclear whether even this quarter’s unimpressive PCE growth of 2.0 percent can be sustained going forward.

Motor vehicle output subtracted strongly from growth in the quarter (contributing -0.5 percentage points to the quarter’s growth rate), its first negative contribution to growth since the end of 2010. While it seems unlikely that this category will continue to provide such a large drag in the future, it is true that motor vehicle sales have been quite strong throughout the recovery. There may well come a time when demand slows as consumers’ demand for new cars has been slaked.

Price growth remains tame; the market-based price deflator for “core” PCE expenditures (which strip out price growth in food and energy sectors) grew by just 1.7 percent relative to the same quarter last year. This is a widely watched measure of price pressures in the U.S. economy, and it remains extraordinarily low.

In sum, the U.S. economy is steadily growing, but nowhere near fast enough to reliably lower today’s unemployment rates. “Steady growth” might not sound like an economic disaster, but the failure to address chronically high rates of joblessness deprives the U.S. economy of literally hundreds of billions of dollars each quarter. Further, even this slow-but-steady growth could be threatened by federal spending cuts mandated under current law. The evidence is clear that should they happen, these cuts would slow growth even further—and would likely throw the U.S. economy into recession.

Endnotes

1. Further, this investment category has actually performed better in the first 13 quarters of the current recovery than in any recovery since the one following the steep recession of the early 1980s. Therefore, this comparison is not just reflecting that investment grows more rapidly in the earlier stages of recovery.