In a letter to Republican House leaders, EPI’s Research and Policy Director John Irons defends the science used to project that widespread job loss would result from proposed cuts in domestic spending. “The use of macroeconomic analysis as conducted by EPI and many others to describe the impact of fiscal policy on jobs is very standard economic science,” Irons writes.

Read the letter in printer-friendly PDF

Dear Majority Leader Cantor and Chairman Camp,

In recent days your offices have issued “fact check” press releases that have criticized EPI’s analyses of how domestic appropriations cuts would affect jobs.[1] Our analysis finds that the proposed $100 billion cut in domestic spending through the 2011 Continuing Resolution would reduce employment by 994,000 jobs.[2] Furthermore, our analysis also finds that the American Recovery and Reinvestment Act has led to higher employment levels. A recent report that surveyed independent forecasters found that employment was up to 3.4 million jobs higher than what would have been the case without the Recovery Act.[3]

At a time when unemployment remains at 9% and the economy needs to create millions of jobs to catch up to pre-recession levels, we welcome a vibrant discussion of the effect fiscal policy can have on jobs.

We thought we would take this opportunity to explain in more detail our approach. EPI has a 25-year history of independent, data-driven economic analysis. Our labor market analyses are used by researchers and reporters across the spectrum, even by those who disagree with us. A recent example: Mitt Romney cited EPI’s figures to support a claim about the number of people unemployed.[4] We welcome scrutiny into our work.

Our estimates on the job impact of various fiscal policies—including the American Recovery and Reinvestment Act, and other proposed changes in tax and budget policy—are produced by Ph.D. economists using very standard macroeconomic tools. Our methodologies and estimates are consistent with the approach and results produced by private- and public-sector forecasters, including Goldman Sachs, Global Insight, JP Morgan, Macroeconomic Advisors, Moody’s Economy.com, and even the Congressional Budget Office. Agencies from the International Monetary Fund (IMF) to the Council of Economic Advisors (CEA) to the Federal Reserve invoke the concept (and often estimates) of multipliers to assess the impact of fiscal policies on stabilizing economies that have been hit by a negative demand shock.

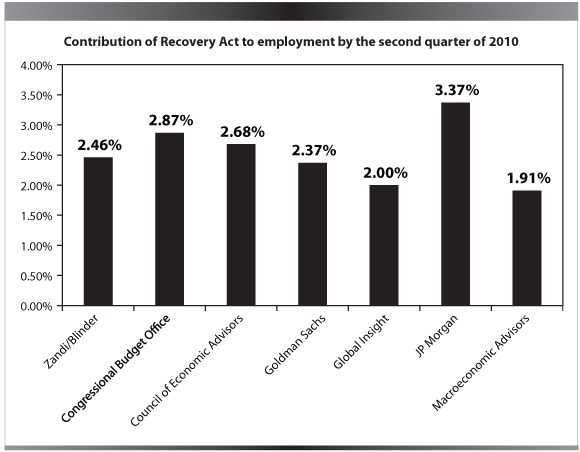

The private-sector forecasting firms—staffed by economists whose salaries depend on high-quality empirical assessment of economic trends—rely heavily on macroeconomic models that yield fiscal multipliers. These results and the implied multipliers are used by independent analysts (including EPI) to help evaluate policy change. These forecasters have generally found significant economic and job impacts resulting from changes in federal spending, such as those that were part of the American Recovery and Reinvestment Act (ARRA). These results mirror those of the CBO and other government agencies as well as EPI statements on the issue. The chart below shows a comparison of recent estimates of the impact of ARRA on employment.

The clear agreement between these assessments of the impact of ARRA and EPI’s own estimates is, of course, not a coincidence. EPI uses consensus models designed to gauge the effect of fiscal policy on economic outcomes.

The widespread use of multiplier analysis and macroeconomic modeling persists because they are tools that are extremely well-founded in both theory and in empirical evidence.

Critics of studies that invoke multipliers often, and incorrectly, imply that these multipliers reflect arbitrary assumptions made with no analytical discipline by the modeler. Assigning a multiplier of, say, 1.7 to increased funding for unemployment insurance isn’t an arbitrary assumption – it is the best empirical estimate, based on historical relationships identified by sophisticated econometric models, of what past expansions of unemployment insurance undertaken in similar economic environments[5] have implied for future gross domestic product performance.

It should also be noted that fiscal support (i.e., increased spending or reductions in revenue), according to the standard economic analysis, is extraordinarily effective in economies with high rates of unemployment, very low rates of inflation and interest rates, and a Federal Reserve ready to accommodate the fiscal support by not tightening monetary policy (a situation sometimes called a “liquidity trap”). This point is made in recent academic papers released by researchers at Columbia, Stanford, Princeton, the University of California-Berkeley, the London School of Economics, the University of Maryland, and the New York Federal Reserve Bank. These papers include: Almunia et al. (2009); Ceoen et al. (2010); Eggerston (2010); Eggerston and Krugman (2010); Freedman et al. (2009); Hall (2009); Ilzetzki et al. (2009); and Woodford (2010). In fact, it is no exaggeration to say that the overwhelming majority of academic papers that have looked at fiscal support find that such policies can increase spending in an economy, and will be extraordinarily effective in boosting spending in an economy mired in a liquidity trap. We are not aware of any study that has looked at fiscal support in such an environment and not arrived at this conclusion. It may exist, but it would constitute a very lonely finding in what is now a voluminous body of research.[6]

Lastly, it is important to note that this belief in the efficacy of fiscal policy as a stabilization tool during episodes like the Great Recession is not based solely on assessments that use previously estimated multipliers. This finding comes through other modeling techniques as well, such as vector autogression (VAR) estimates of scenarios with and without fiscal support (see Kuttner and Posen (2002) and Auerbach and Gorodnichenko (2010), as well as the Council of Economic Advisors (2010)) and even many classes of dynamic stochastic general equilibrium (DSGE) models that are calibrated to match current circumstances (see Christiano et al. (2009)). This support for fiscal stimulus even from DSGE models that are correctly calibrated is important because some leading skeptics of fiscal policy as a stabilization tool use DSGE models and often seem to imply that they universally rule-out fiscal policy effectiveness. They do not.

Simply put: the use of macroeconomic analysis as conducted by EPI and many others to describe the impact of fiscal policy on jobs is very standard economic science.

To specifically address the concerns cited in your press releases:

- The trade-induced job-loss estimates by EPI[7] differ from the administration simply because the administration’s figures as cited in your press release measure only one side of the equation – jobs gained from increased exports. EPI’s figures are a more complete analysis that includes the potential job loss from import competition. This calculation is imputed from the potential impact on the

trade deficit as a result of the pending trade agreement.

- On the January 2009 report discussing the job impact of the Recovery Act: [8]

- The analysis was an estimate of the impact of the Recovery Act on employment, not an economic forecast as suggested by your press release.

- According to a wide range of private and public analysts and forecasters, the Recovery Act prevented an even worse outcome than the 9% unemployment we see today (see above).

- Initial forecasts made by EPI and others in early 2009 have turned out to be optimistic in retrospect – the jobs hole was much deeper than anyone though at the time. In fact, the economy lost over 2.3 million jobs in just the three months after the report was released (January –March 2009) and before the Recovery Act took effect. In fact, the report states that unemployment was set to reach “over 10 percent” without the package, even before this bad news was fully known.

- Finally, the job estimate was based on an early, more potent version of the Recovery Act, which was significantly watered down in Congress; taking this into account, the initial estimates in the EPI discussion are consistent with more recent impact analyses by private forecasters and the CBO.

Finally, we fully welcome the scrutiny our methodology has received. We believe that an open and honest assessment of the job impact of fiscal policy is essential to an informed policy debate.

We also encourage all parties who make job claims in relation to policy to quantify the impact and back up their analysis with rigorous independent analyses, as we have done throughout EPI’s 25-year history.

In particular, claims have been made that cuts to domestic non-security appropriations would lead to more job creation. Suggested cuts have included reductions to, among others, transportation, education, community policing, and scientific research. It is incumbent upon proponents of these reductions to outline precisely how those specific reductions would impact job creation, and to present independent estimates that are backed by sound, empirically-driven economic science.

The U.S. public deserves transparent analyses, not ideologically driven rhetoric. We look forward to an economically grounded debate on the job impact of fiscal policy alternatives.

Sincerely,

John Irons

Director of Research and Policy

Economic Policy Institute

[1] See “FACT CHECK: Economic Policy Institute Analysis of the CR: What’s One More Wildly Inaccurate Prediction?”

Wednesday, February 16, 2011 at http://waysandmeans.house.gov/News/DocumentSingle.aspx?DocumentID=225364; and “Jobs & H.R. 1: A Few Quick Facts in Response to Democrat Allegations” February 15, 2011.

[2] Republican-proposal to ‘right our fiscal ship’ throws more workers overboard. Rebecca Thiess, February 9, 2011.

[3] Rebuilding Green. Josh Bivens, Ethan Pollack, and Jason Walsh, February 17, 2011.

[4] See PolitiFact.com: As for the U.S., Romney cited statistics from a paper by economist Heidi Shierholz of the Economic Policy Institute, a liberal, labor-backed think tank.

[5] The assessment of the impact will depend upon the broader economic environment in which the fiscal change happens.

[6] Two examples of flawed assessments of fiscal spending that do not take into account the current economic environment, and thus err by not differentiating the effects of fiscal support in different economic and policy regimes are Cogan, Cwik, Taylor and Wieland (2009) and Barro and Redlick (2009). In the first study the authors assume that fiscal policy support only weakly affects output because the Federal Reserve tightens in response to the fiscal expansion to head off expected inflation. There is no monetary tightening happening today (and there was certainly none over the past two years) and there has been no increase in expected inflation over this time-period either. In the second study the authors look at large fiscal deficits run during World War II—a time of more-than-full employment where private spending was actually suppressed as a matter of policy. The fact that fiscal policy will have much smaller effects during periods when unemployment is in the low single-digits is not in dispute.

[7] Trade policy and job loss. Robert E. Scott, February 25, 2010.

[8] Recovery plan creates millions of jobs by any estimate. John S. Irons, January 14, 2009.