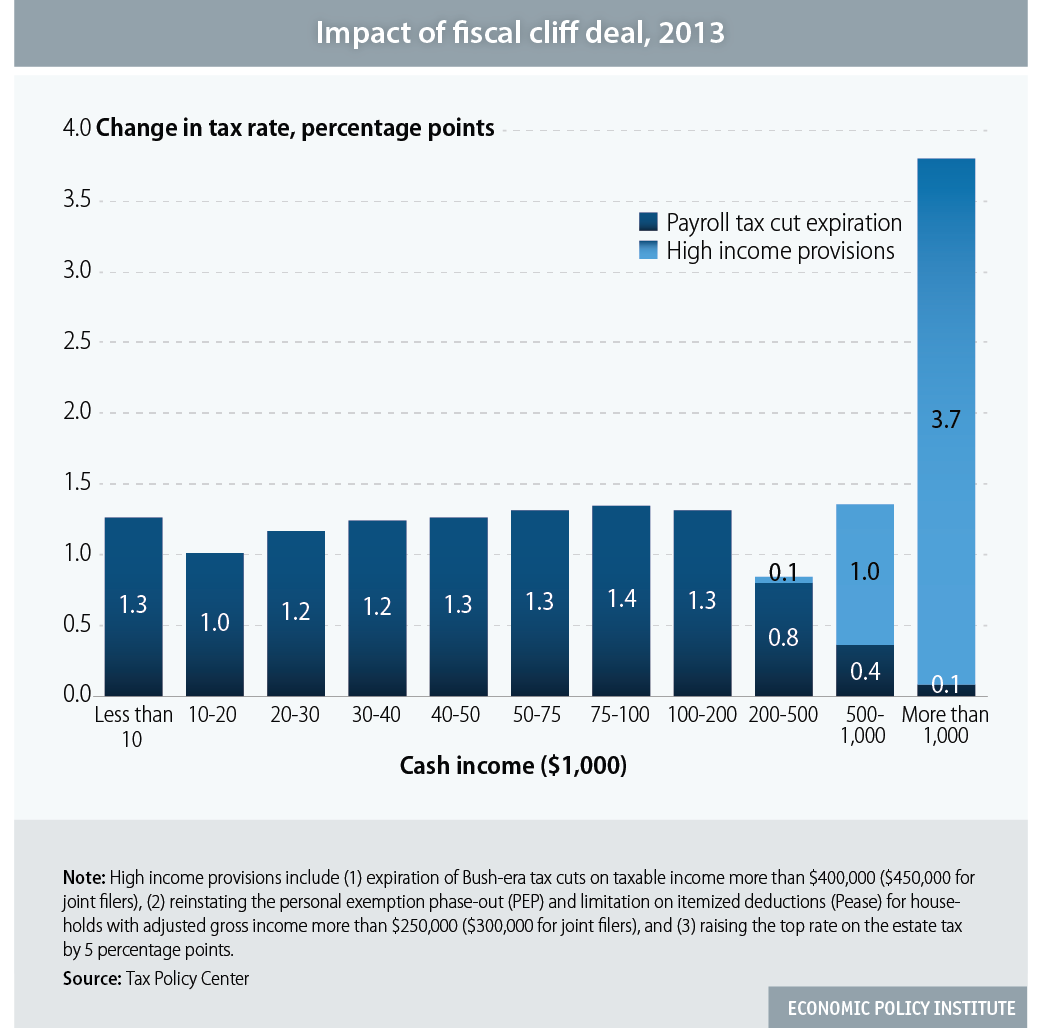

While the “fiscal cliff” budget deal included provisions that increased taxes on high-income households, it failed to extend the payroll tax cut, a 2-percentage-point tax cut on wage and salary income that went into effect in 2011. This cut—which replaced the better-targeted Making Work Pay tax credit—was subsequently extended through 2012. Congress’ failure to extend it further in the cliff deal causes a high tax increase on middle-class households.

According to the Tax Policy Center, this tax increase (as measured by impact on effective tax rates) is roughly equal to the tax increase on households with cash income between $500,000 and $1 million. Worse yet, it exceeds the relative tax increase on households earning between $200,000 and $500,000.