Issue Brief #266

Senate Majority Leader Harry Reid’s recent announcement that he will push for a public insurance option to be included in the upcoming health care overhaul legislation, as well as House Speaker Nancy Pelosi’s release of an updated House health bill are both important steps forward for reformers. It now appears that both House and Senate bills will include provisions for a new national public insurance option. This is an essential component of reform, holding out the promise of controlling costs, keeping private insurers in check, and serving as a backstop source of insurance to Americans.

But it is important to keep recent news regarding the public insurance option in context. There are many other important components in the bill that could determine the success (or failure) of the public insurance option, and reform in general. These include:

- The structure of health insurance exchanges (where the public option would be offered)

- The structure of the public plan itself, including how it will build its provider networks and how it will set its reimbursement rates

- How much private health insurance companies are required to spend on actual medical care out of premiums relative to profits and administrative costs (known technically as the minimum medical loss ratio)

Structure of health insurance exchanges and the public plan option

Whether the new insurance exchanges and public plan option are state-based, regional, or national are key to their success. The insurance exchange—and the public insurance option—work best when they are open to the broadest pool of individuals possible. There are significant efficiency gains to having as large a base of consumers as possible. Moreover, a key goal of the public insurance option is cost control. This is sacrificed when a public plan is state or regionally based. A key driver of health care cost growth is the rising consolidation of medical providers and insurers. A public insurance plan could theoretically help in both of these markets, using its size to negotiate lower and more efficient payments from providers while also keeping insurers competitive. But this ability only works if the public plan is sufficiently large enough to be a market force, which is unlikely to happen if it is state-based. Most insurers are regional, not state-based, so it is unlikely that a state-based public insurance plan could act as an effective competitive check against existing private insurers.

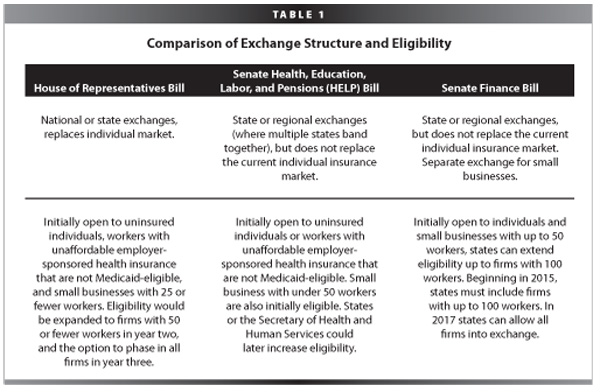

The public insurance option, as it is designed in current legislation, will exist in health insurance exchanges that are initially open to a very small number of people. Only the uninsured, those with unaffordable employer-sponsored health insurance, and those in small firms will be initially eligible to shop for coverage on the exchange. Even after firms of all sizes are included in the exchange, individuals are still limited by their employer’s decision for coverage. An individual working in a firm with private coverage cannot, as an individual, choose to enroll in the public insurance option unless they can demonstrate that their employer’s plan is unaffordable. Table 1 compares the access to the exchange (and thus the public insurance plan) across the three bills under consideration by Congress. The exchanges (and thus the public insurance option) ought to be open to all individuals, not just those who are uninsured or with low incomes.

Another important element in health insurance exchange structure is its ability to act as a “prudent purchaser”—that is, to screen insurers and their plans before allowing them into the exchange to make certain that they meet requirements for cost-effectiveness and quality. This provision has been essential in Massachusetts’ health reform, which created a state-wide insurance exchange called the Commonwealth Connector.

In a recent interview, Jon Kingsdale, the current director of the Massachusetts Health Insurance Connector, stated that new exchanges must “be selective in the plans that [they] offer.” Kingsdale estimates that having the ability to screen plans in the Massachusetts exchange has accomplished “about 6% reduction in premiums and saved about $140 million a year on subsidized care for about 180,000 people.” The House legislation includes a “prudent purchaser” clause in its exchange, as does the Senate Health, Education, Labor, and Pensions (HELP) bill, but the Finance bill does not. Final Senate merged legislation ought to include similar language to ensure cost and quality control for consumers seeking coverage in the exchange.

Structure of public plan payment and provider networks

One reason that the private insurance market is typically dominated by just two or three firms is that the costs of starting up an insurance company are quite large. This is because new insurers must rapidly build extensive networks of doctors, clinics, and hospitals to compete against well-established insurers—a difficult task since individuals and employers have come to expect broad provider participation. This will be a key challenge for the new public insurance option. One way to make sure that a public plan has a chance to build the necessary provider networks from the start is to piggy-back on Medicare’s network of doctors and providers. All of the providers that currently choose to participate in the Medicare program could be assumed to participate in the new public plan, unless they explicitly state otherwise. Neither House nor Senate legislation includes explicit provisions to tie provider participation to existing networks, such as Medicare. The House bill, however, does leave provider enrollment at the discretion of the Secretary of Health and Human Services.

Payment rate levels are another important area where the public insurance option could offer substantial cost control. Tying the public insurance plan’s provider payment levels to Medicare (or Medicare plus some additional amount), at least initially, could generate significant savings while reducing the administrative costs associated with rate-setting. The need for a Medicare-linked public insurance option and its potential cost savings are reflected in the Congressional Budget Office’s scoring of House legislation. A nationally based, robust public plan using Medicare rates would save $110 billion over 10 years, whereas a nationally based public plan that would have to negotiate payment rates on a provider-by-provider basis would save much less. Both Senate and House legislation, as they are currently drafted, would have the public insurance plan negotiate payment rates on a provider-by-provider basis, reducing the plan’s ability to control costs.

Politicians have often cited the fear that Medicare rates are “too low” for prov

iders, and therefore a public insurance plan that is tied to Medicare rates will drive many providers out of business. It is true that, on average, Medicare reimburses at lower rates than private insurers. But a broad body of research suggests that it is not that Medicare rates are “too low,” but that private insurers’ rates are higher than they need to be in a competitive market. This belies notions of a “cost-shift” from Medicare to private insurance. The nonpartisan Medicare Advisory Panel (MedPAC), for example, has found that efficient hospitals make a profit from Medicare payments, while less efficient hospitals demand higher rates from private insurers relative to Medicare payments because they face no incentive or pressure from insurers to become more efficient.

Furthermore, rates of Medicare provider participation are relatively constant over time; there is no mass exodus of doctors or hospitals from the program. Most doctors and medical facilities accept Medicare patients, and studies report that Medicare patients have less difficulty in finding a provider that accepts their coverage than those in private insurance.

Requirements for private insurance minimum spending on health care (medical loss ratio)

A final component critical to the success of the public insurance plan, and health reform in general, is the establishment of a minimum medical loss ratio—or the minimum amount that private insurers must pay in actual medical spending out of premiums.

A minimum medical loss ratio requirement is important because it is likely that the public plan will attract enrollees who are, on average, less healthy than the average private enrollee (see, for example, the explanation for this from the CBO and in the Lewin Group’s scoring of EPI’s own public insurance plan). Private insurers will also likely engage in “cream skimming,” where they attempt to attract only the healthiest enrollees, pushing sicker individuals into the public insurance plan. This sort of behavior has been well-documented in the Medicare program. Private Medicare insurance plans (through the Medicare Advantage program) have been found to enroll healthier individuals and also kick off the roll the sicker individuals at much higher rates than individuals of average health. If the public insurance plan has a relatively sicker pool of enrollees, its premiums will likely be higher, limiting its ability to expand its market share and control costs. Private insurers can engage in cream-skimming behavior through selective advertisement (for example, advertising heavily in gyms or markets with young and healthy individuals) or through plan design, discouraging the sort of coverage needed by sicker and older individuals.

Requiring private insurers to pay out a certain amount of their premiums in medical payments will reduce their incentive to cream skim, since they will not be able to recoup the profits associated with enrolling healthier individuals. This, in turn, will allow the public option to compete on level terrain with private insurers.

Current House legislation requires all private insurers to spend at least 85% of premiums on actual medical care (as opposed to profits or administrative costs). This percent is known within the insurance industry as the “medical loss ratio.” If insurers do not meet the 85% requirement, they must give their enrollees a rebate of the difference. Neither the Senate HELP nor Finance committee legislation includes similar requirements, though both would require insurers to collect and publish these rates publicly. Several states already require that their insurers meet these requirements and have had relative success with regulation. Final legislation ought to include a minimum medical loss requirement of at least 85%, a crucial step to ensure that private insurers are competing against each other and against a public insurance plan on cost and quality, rather than simply their ability to attract the healthiest and lowest-risk individuals.