The Bureau of Labor Statistics (BLS) reported earlier this month that, while the nationwide unemployment rate fell slightly to 9.7%, there was effectively no job growth in May, aside from temporary hires. In fact, 95% of the 411,000 jobs that were added in May were temporary U.S. Census jobs. The 41,000 jobs the private sector added in May represented the slowest pace of growth seen over the past few months, when the average was 146,000 new private-sector jobs per month.

Record numbers face long-term unemployment

In an analysis of the BLS monthly jobs data, Economist Heidi Shierholz said the May report was disappointing and underscores the need for additional government action to create jobs, provide aid to the long-term unemployed, and assist state and local governments.

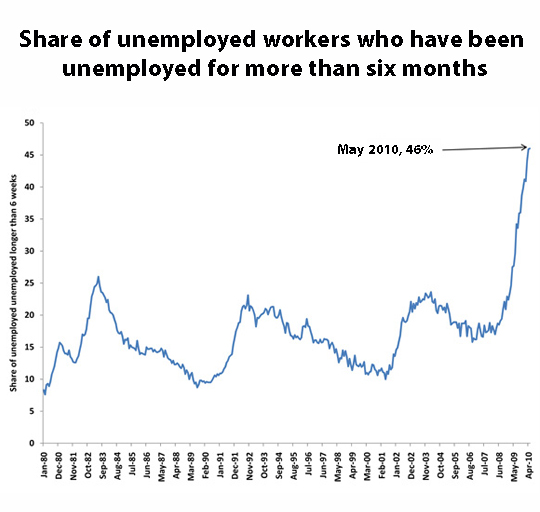

Shierholz’ analysis highlighted the continued rise in long-term unemployment. The median unemployment spell lasted a record 5.4 months in May, and the portion of unemployed workers who have been out of work for more than six months reached a record 46%. The sharp rise in long-term unemployment means that many workers will exhaust their standard six months of unemployment insurance before they find a job and could lose benefits altogether if lawmakers fail to approve extended benefits. House lawmakers last month voted to extend unemployment benefits to millions of long-term unemployed workers who have been jobless longer than 26 weeks. But the Senate has still not voted on the measure, and tens of thousands of workers have already exhausted their benefits.

Shierholz stressed that even under a best-case scenario, it will take years to return to pre-recession levels of employment. The labor market is currently 7.4 million payroll jobs below where it was at the start of the recession in December 2007, and when population growth is factored in, it means that a staggering 10.4 million new jobs are needed to return the country to the pre-recession unemployment rate of 5.0% — not counting the Census jobs that will end this summer. She offered some perspective on how long it would take to achieve that goal by showing that during the boom of the late 1990s, the fastest rate of employment growth seen was 2.6%, in 1998. “If we could achieve that same extremely strong level of growth from this point forward, we would still not get down to pre-recession unemployment rates until January of 2015,” Shierholz wrote.

Mishel testifies before Congress

EPI President Lawrence Mishel highlighted some of these details in a June 10 testimony before the House Ways and Means Subcommittee on Income Security and Family Support, where he said that the jobs crisis was “catastrophic” and that jobs creation efforts need to take priority and are complementary to deficit reduction, since adding jobs creates more taxpayers and reduces safety net spending. Mishel stressed that private employers alone would not create all the jobs needed in the short-term since many of them were trying to increase productivity from their existing workforces while resisting new hiring, in order to maintain or increase their profits.

Mishel urged Congress to pass three key pieces of jobs legislation, including the American Jobs and Closing Tax Loophole Act of 2010, which would extend unemployment insurance and COBRA health care subsidies for the long-term unemployed; legislation from Senator Tom Harkin (D-Iowa) to preserve education jobs; and the Local Jobs for America Act, introduced by Rep. George Miller (D-Calif.), which authorizes $100 billion over two years to create and save jobs in local communities around the country.

Mishel said that the passage of these three pieces of legislation could create more than 2 million jobs. Many of these jobs are already assumed in projections of unemployment showing that we will have roughly the same unemployment a year from now. Mishel said, “I fear that our elected leaders . . . are accepting the unacceptable. That is, unemployment will be unacceptably high for the foreseeable future in my view, and very little is being done to alter that reality.”

EPI, Mark Zandi, and governors make case for aid to states

Lawrence Mishel moderated a teleconference on June 9 with Moody’s Analytics Chief Economist Mark Zandi and Governors Jim Doyle (Wisc.), Chris Gregoire (Wash.), Mark Parkinson (Kan.), and Ed Rendell (Pa.) to urge Congress to restore the Medicaid matching funds that were stripped from the American Jobs and Closing Tax Loopholes Act by the House earlier this month. Mishel explained that depriving states of the $24 billion in funding aid could cost 162,000 jobs in the private and public sectors.

Given the tenuousness of the economic recovery, Zandi argued that Congress should not allow concerns about the deficit to stand in the way of approving the Medicaid funding. The governors explained the significant budget challenges they face, and said that the loss of Medicaid matching funds would result in layoffs in their states. According to the governors, affected workers would likely include teachers, firefighters, police officers, and nursing home workers, among others.

Unemployment varies by race, and region

While every major metropolitan area in the United States has suffered from the jobs crisis, some have been hit harder than others. Uneven Pain, a new Briefing Paper by Algernon Austin, director of EPI’s Program on Race, Ethnicity, and the Economy, looks at 2009 unemployment rates by race in 50 major cities. It shows jobless rates range from a high of 15.1% in Michigan’s Detroit-Warren-Livonia metropolitan area, to a low of 5.9% in Oklahoma City. The paper also shows how racial minorities have suffered particularly high rates of joblessness. While only one metro area had a white unemployment rate above 11.3% (Detroit, 13.8%), nine metro areas had a Hispanic unemployment rate above 11.3%, and 14 had a black unemployment rate above that level, which is 2 full percentage points above the nationwide unemployment rate of 9.3% in 2009.

Eisenbrey on immigration, retirement

EPI Vice President Ross Eisenbrey was the featured discussant of a new paper by U.C. Davis economist Giovanni Peri, measuring the impact of immigration on the U.S. labor market during periods of economic expansion and downturn. The paper, presented at a June 7 forum by the Migration Policy Institute, shows that while the long-term impact of immigration is positive for both wages and employment, immigration can also have a negative impact during periods of economic contraction. Eisenbrey said he supported Peri’s recommendation for the formation of a commission empowered to change the numbers of visas granted depending on economic circumstances.

Eisenbrey also participated in a June 8 panel on retirement security at the America’s Future Now conference, and presented data showing that the existing retirement savings system fails to provide secure and adequate retirement income for many workers. As traditional pensions become rarer and more workers are forced to rely on higher-risk 401(k) plans, he said, retirees will be increasingly challenged to maintain a decent standard of living when they stop working.

EPI joining 2010 CFC Campaign

EPI is pleased to announce it has joined the Combined Federal Campaign (CFC), the only authorized method for soliciting contributions from employees of the federal government. CFC is the world’s largest and most successful annual workplace charity campaign. Beginning with the 2010 Campaign, federal employees will be able to contribute to EPI using the CFC code: 10173.

EPI in the news

EPI’s analysis of the latest unemployment data received widespread coverage. Heidi Shierholz was featured on CBS Evening News, where she said the job growth seen in May was “nowhere near” the level of growth needed to put America’s 15 million unemployed back to work. New York Times columnist Bob Herbert quoted Lawrence Mishel saying the latest jobs data “offer nothing even closely resembling the job growth we need to dig us out of this very deep hole.” The Associated Press also quoted Mishel discussing the growing problem of long-term unemployment.