The Obama legacy on wages

The closing days of the Obama years give us a chance to assess the president and his administration across a range of issues. Given that we at EPI have repeatedly called broad-based wage growth the central economic challenge of our time, it seems appropriate for to assess the administration’s performance in pushing policies to generate this growth.

We have generally organized the policies that would boost wages for most workers into three broad buckets: generating full employment and a “high-pressure” labor market, supporting or creating institutions and standards that boost workers’ bargaining power, and providing a countervailing force against the power of the top 1 percent to claim excess shares of economic growth.

Economic and political context

Before we assess the Obama administration along the key dimensions highlighted above, it’s crucial to provide the larger economic and political context of the past eight years. Even if an administration did everything right on policy efforts to boost wages, wages still might not rise if the overall economy was damaged when the incoming administration inherited it. This is clearly the case for the Obama administration. In February 2009, the first full month of the Obama administration, the economy had been in recession for 13 months, and the severity of the economic crisis was accelerating. In the six months ending in February 2009, the economy lost 650,000 jobs each month on average.

The economy has made great strides since the recession began, but there is still work to be done

Today’s jobs report gives us an opportunity to compare how the economy is treating Americans today compared with December 2007, when the recession began. As the recovery has strengthened we’ve seen improvements in all measures of employment, unemployment, and wage growth. All measures indicate a consistent story—an economy on its way to full employment, but not there yet. Taking a data-driven approach to policymaking would mean continuing to push, keeping interest rates low and letting the economy recover for Americans across genders, races, ethnicities, and levels of educational attainment.

In December, the unemployment rate edged up slightly to 4.7 percent because of a small but positive increase in the labor force participation rate. The unemployment rate peaked at 10.0 percent during the recession, and at 4.7 percent it is now below where it was before the recession began (5.0 percent). Meanwhile, the unemployment rate for black workers hit 7.8 percent in December. This is its lowest point so far in the recovery, but it’s still slightly above its pre-recession low in August 2007 (7.6 percent). Likewise, the unemployment rate for Hispanic workers (5.9 percent) has stagnated for much of the year and remains significantly above its pre-recession low point of 4.7 percent in October 2006. The underemployment rate—which adds in workers who are part-time for economic reasons and those marginally attached—was 9.2 percent in December and still hasn’t reached its pre-recession level (8.8 percent). So, while the economy is the strongest it’s been in years, there are still a lot of workers sitting on the sidelines and underutilized, and a lot of communities that are not feeling the full extent of the recovery.

What to watch on Jobs Day: The year in review

The last jobs report for 2016 comes out tomorrow, giving us a chance to step back and put the entire year in context. Because there is always a bit of volatility in the monthly data—especially in the household series—taking a year-long approach allows us to smooth out the bumps and take stock of all the key measures: payroll employment growth, the unemployment rate, the employment-to-population ratio, and nominal wage growth.

This week’s jobs report will also give us a great vantage point to compare December 2016 to December 2007, the last peak year before the Great Recession hit. The unemployment rate continues to fall, and is now far below where it was at its peak (10.0 peak), and even below where it was when the recession began (5.0 percent). The prime-age employment-to-population ratio has been digging its way out of a deep hole over the last several years as well, but progress in this measure has been slower. It is expected to improve as the economy strengthens and more would-be workers return to the labor market and find jobs. Nominal wage growth has also seen some improvements recently, increasing from an average rate of growth of about 2.0 percent in the first few years of the recovery to 2.5 percent average growth over the last year, but it’s still well below levels consistent with the Fed’s target inflation and trend productivity growth.

If December’s numbers are in line with payroll employment growth over the last several months, it will be further evidence that the economy is continuing its march towards full employment. Unfortunately, the return to a full employment economy—one where additional demand in the economy will not create more employment—has been slower than necessary. It faces an uphill battle against a relentless pursuit of austerity at all levels of government and, after rightfully holding off for the most part, Federal Reserve policymakers appear to be putting on the brakes prematurely. For the recovery to truly reach all workers and their families across the country—across race, ethnicity, and levels of education—we need to get back to full employment.

It remains to be seen what, if anything, President-elect Trump will do to strengthen the economy for working people. On net, it could go either way. But all measures, the next president is inheriting an economy far stronger than the last and one that, if left alone, will continue to heal.

401(k)s are an accident of history

401(k)s were never intended to replace pensions, so it should be no surprise that they aren’t up to the task. This has been pointed out before, but it’s nice to be reminded that even the people who came up with the 401(k) concept now “lament the revolution they started,” to quote an excellent article by the Wall Street Journal’s Timothy W. Martin.

This is the kind of negative coverage that keeps the folks at the Investment Company Institute busy. Students of spin may want to check out the industry lobby’s latest effort, which obscures the dismal record of 401(k) plans by lumping them in with traditional pensions. It also focuses on retired seniors, ignoring the growing number who can’t afford to stop working.

Careful readers will note that even the ICI’s rosy report shows that decades into the 401(k) revolution seniors received $105 billion dollars in pension income and only $29 billion from 401(k)-style plans in 2014. Admittedly, this is based on somewhat unreliable household survey data and ignores the fact that many well-off 401(k) and IRA participants treat retirement savings plans as tax shelters and avoid withdrawing money from them as long as possible. Still, it’s a stretch to suggest that the looming retirement crisis is a mirage caused by poor data (see also here and here).

Why unemployment will keep dropping in 2017

This post originally appeared on Fortune.com.

The economy has been steadily recovering from the 2007–08 Great Recession and is expected to continue heading toward full employment in the next year or two. Many signs suggest that we are not there yet—notably below-target wage growth and still-depressed labor force participation. The prime-age labor force participation rate—the share of the population 25–54 years old that is either working or looking for work—remains 1.7 percentage points below its pre-recession level.

Unfortunately, the return to a full employment economy—one where additional demand in the economy will not create more employment—has been slower than necessary, as it faces an uphill battle against the relentless pursuit of austerity at all levels of government. But if the economy continues growing anywhere near its current rate of about 175,000 to 200,000 additional jobs per month, the labor market in 2017 will absorb new and returning workers and the unemployment rate could easily get below 4.5% for the year.

Over the last several years, the unemployment rate has seen a steady fall from a high of 10% in 2009 down to a recent low of 4.6% last month. In recent months, there has been a tug of war between a lower unemployment rate and an increase in labor force participation. For instance, last month, the drop in the number of unemployed workers was mostly due to a fall in the size of the labor force. As the economy gains strength, more would-be workers are expected to return (or enter) the labor market as job prospects improve. Over the past year, slight improvements in unemployment have been made even as participation has increased.

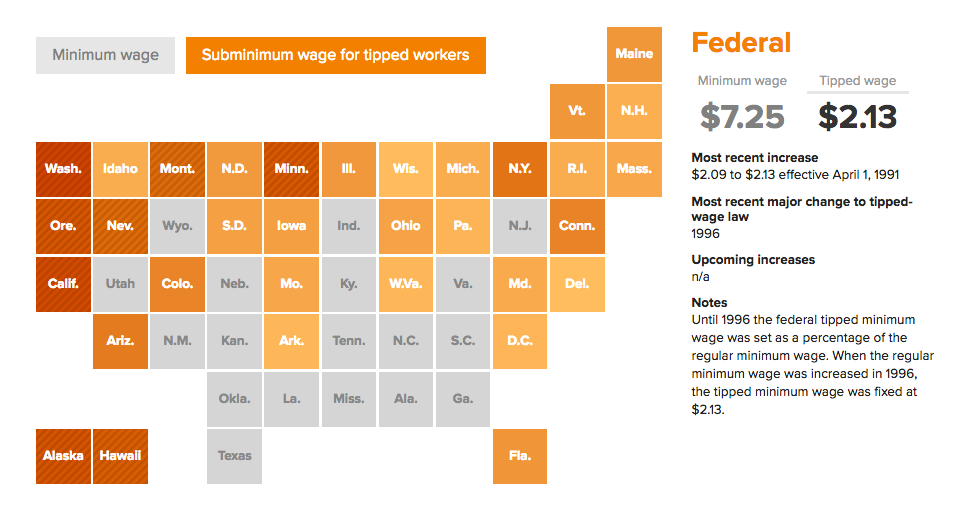

The new year brings higher wages for 4.3 million workers across the country

At the start of the new year, 19 states increased their minimum wages, lifting the pay of over 4.3 million workers.[i] This is the largest number of states ever in a given year to increase their minimum wages absent an increase in the federal minimum wage. In seven of these states (Alaska, Florida, Missouri, Montana, New Jersey, Ohio, and South Dakota) the increases were due to inflation indexing, where the state minimum wage is automatically adjusted each year to match the growth in prices, thereby preventing any erosion in the real value of the minimum wage. The increases in the remaining 12 states were due to legislation or ballot measures approved by voters.

The table below shows the values of the minimum wage increases and the number of workers directly affected in each state. Due to relatively low inflation in 2016, small inflation-linked increases of only 5 cents will occur in four states (Alaska, Florida, Missouri, and Ohio). The largest increases were the result of ballot measures passed in Arizona (a $1.95 increase) and Washington (a $1.53 increase). In these and other states instituting legislative increases, a significant portion of the wage-earning workforce will directly benefit from the increase in the minimum wage: Arizona (11.8 percent), California (10.7 percent), Washington (10.7 percent), Massachusetts (9.2 percent), and Connecticut (7.6 percent). It should be noted that these estimates likely understate the total numbers of affected workers, because they do not include workers who are paid just above the new minimum wage. Many of these workers will also receive a wage through “spillover effects,” as employers adjust their overall pay ladders.

The Obama legacy: creating more, better jobs

This post originally appeared on TalkPoverty.org.

During his 2016 presidential campaign, president-elect Donald Trump promised that if he was elected, “the American worker will finally have a president who will protect them and fight for them.” Creating good-paying and high-quality jobs is definitely a worthwhile goal for the president to increase Americans’ living standards and decrease poverty.

Despite the president-elect’s claim that there are “no jobs,” the labor market has improved at a remarkably steady rate as the country worked its way out of the deep recession. During the past six years, there has been job growth each and every month, and a 5 percentage point drop in the unemployment rate. In part, that’s due to President Obama’s Recovery Act, which stimulated growth, provided aid to states, and invested in infrastructure. The rescue of the auto industry saved at least 1 million jobs, and kept an entire region out of a severe depression.

In 2015, most Americans finally started to feel the benefits of the recovery. Income rose for the typical American household, and the poverty rate saw one of the largest single-year declines in almost 50 years—primarily due to improvements in the labor market.

UN Special Rapporteur offers sharp criticism of American temporary foreign worker programs

On December 19, one day after International Migrants’ Day, Maria Grazia Giammarinaro, the United Nations Special Rapporteur on Trafficking in Persons, Especially Women and Children, issued a statement regarding her official visit to the United States to assess the country’s state of affairs on human trafficking. During her trip, Giammarinaro met with government officials, diplomats, trafficking survivors, and representatives from civil society. While she praised the United States for developing “an impressive number of laws and initiatives which focus on the protection of victims,” especially the Victims of Trafficking and Violence Protection Act and its subsequent reauthorizations, she offered up sharp and insightful criticisms of the nonimmigrant visa programs that temporarily authorize migrants to work in the United States:

The legal framework governing temporary visas for migrant workers, especially H-2A visa for temporary or seasonal agricultural work and H-2B visa for temporary or seasonal non-agricultural work visas, is of particular concern as it exposes applicants to the risk of exploitation, including human trafficking. Workers holding these temporary visas are tied to a specific employer who can exercise extensive control over them. Employers often confiscate passports, withhold wages, terminate contracts arbitrarily and threaten employees with job loss and deportation. Some live in deplorable housing conditions, commute long distance and enjoy low benefits. This is a serious problem in itself, but it is exacerbated by the fact that concerned workers may fear that if they report abuses, they will be deported or denied future visa applications. This situation creates vulnerabilities to labour exploitation, such as unsafe working conditions and isolation, especially in rural areas where there are fewer service providers. In order to prevent further harm, it will be essential to amend the regulation governing these temporary visas, as well as to those of Exchange visitor (J-1) and domestic workers (G-5) visas, and make visa “portable” to allow workers to change abusive employers.

In time for Christmas: a “progressive” Social Security plan Scrooge would love

Donald Trump ran a campaign that rejected Republican orthodoxy on a variety of issues. He consistently and emphatically rejected the party line on slashing social insurance programs like Medicare and Social Security. And yet, Congressional Republicans are ploughing ahead with plans to gut these benefits. The latest proposal, from House Social Security Subcommittee Chairman Sam Johnson (R-Texas), actually slashes benefits even more than would be sufficient to close Social Security’s projected shortfall. The extra savings generated by these cuts is used to reduce taxes on higher-income households.

Johnson attempts to camouflage the draconian nature of his plan with targeted benefit increases for low earners. Despite this window dressing, as many low earners will see cuts as will see increases, according to the Social Security Actuary’s analysis of the plan. This hasn’t stopped budget hawks from touting its supposed progressivity, pointing to a benefit formula more tilted in favor of low earners and an increase in the special minimum benefit going to those with steady work histories. However, for most workers, including many low earners, these provisions are more than offset by benefit cuts.

The first major plank of the Johnson plan revises the overall benefit formula for retirees. By itself, this provision would increase benefits for roughly half of workers (the 51 percent with earnings below 90 percent of the average wage index) while reducing them by a greater amount for the other half. Johnson also introduces a revised special minimum benefit that would increase benefits for around 37 percent of workers. However, other provisions increase the normal retirement age (equivalent to an across-the-board cut) and enact a range of other cuts. On net, only one in four workers (26 percent) would come out ahead from Johnson’s plan, while 70 percent would see benefit cuts, with some workers seeing cuts of up to 74 percent based on the examples modeled in the Chief Actuary’s analysis.

Criminal justice policy is education policy

In a new report, Mass Incarceration and Children’s Outcomes, we argue that criminal justice policy is education policy, and should be high on educators’ lists of concerns.

Several police killings of young men in African American neighborhoods, as well as the national racial polarization exposed in the recent presidential campaign, have called increased attention to our unresolved racial inequalities, including the disproportionate numbers of African American men who are in jail or prison. In the last months of his administration, President Obama responded to excessive federal prison sentences with a stepped up rate of commutations.

President-elect Trump, in contrast, has advocated a nationwide policy of “stop-and-frisk,” a police practice concentrated in low-income minority neighborhoods that invariably leads to the arrest and eventual imprisonment of men, African American men in particular, for non-violent victimless crimes.

“Stop and frisk,” as well as excessive sentencing for minor crimes, are not primarily federal policies, and once in office, Mr. Trump will have little influence over them. These are policies and practices of local and state governments, and reform is no less realistic or urgent now than it was before the presidential election.

SoftBank: Great press, bad for manufacturing, services, and the economy

Last week, President-elect Donald Trump took to Twitter to claim that Masayoshi Son, CEO of SoftBank of Japan, had agreed to invest $50 billion in the United States toward businesses and create 50,000 new jobs, and that “Masa said he would never do this had [Trump] not won the election!” As usual, the claim that Trump negotiated this deal is disputed, since SoftBank had announced plans to create a $100 billion technology investment fund, together with a public investment fund of Saudi Arabia, in October, before the election.

Worse yet, this deal is lose, lose, lose for the domestic economy. First, this inflow of foreign capital will bid up the U.S. dollar, which will reduce the competitiveness of U.S. manufacturing by making imports cheaper and exports more expensive. This will increase the U.S. trade deficit and reduce employment in U.S. manufacturing. The U.S. dollar has gained about 25 percent in the past two-and-a-half years, and one-fifth of that increase has occurred since the election. As a result, the trade deficit in manufactured goods increased sharply in 2015 and is poised for another increase after the recent run-up in the dollar. Meanwhile, the United States has lost 78,000 manufacturing jobs since the first of the year due, in part, to the rising trade deficit.

Second, foreign investment in the U.S. economy is dominated by foreign purchases of existing U.S. companies. Between 1990 and 2005, foreign multinational companies (MNCs) acquired or established domestic subsidiaries that employed 5.25 million U.S. employees. The vast majority (94 percent) of jobs associated with those investments were in existing firms acquired by foreign MNCs. However, 4 million of those jobs disappeared through layoffs or divestiture of part or all of those companies, as shown in my 2007 paper, The Hidden Costs of Insourcing. A classic example was the acquisition of IBM’s PC business by Chinese computer maker Lenovo in 2005. Lenovo shut down PC production in the United States and substituted PCs made in China and elsewhere in Asia. So PC production jobs in the United States disappeared.

We can’t meaningfully integrate schools without desegregating neighborhoods

This article first appeared on the NAACP Legal Defense Fund‘s website.

A bill introduced in the New York City Council proposes to establish “an office of school diversity within the human rights commission dedicated to studying the prevalence and causes of racial segregation in public schools and developing recommendations for remedying such segregation.”

But it is not reasonable, indeed it is misleading, to study school segregation in New York City without simultaneously studying residential segregation. The two cannot be separated.

School segregation is primarily a problem of neighborhoods, not schools. Schools are segregated because the neighborhoods in which they are located are segregated. Some school segregation can be ameliorated by adjusting school attendance boundaries or controlling school choice, but these devices are limited and mostly inapplicable to elementary school children, for whom long travel to school is neither feasible nor desirable. We have adopted a national myth that neighborhoods are segregated “de facto;” i.e., because of income differences, individual preferences, a history of private discrimination, etc. In fact, neighborhoods in NYC are segregated primarily because of a 20th century history of deliberate public policy to separate the races residentially, implemented by the city, state, and federal governments. Just a few examples:

How the Fed can fix one way the economy really is rigged: Restore the pursuit of full employment as their job number one

The election of Donald Trump alerted many to what should have been obvious long ago: the U.S. economy has failed to deliver the goods to vast swathes of American families for decades. In the context of Trump’s election, this economic failure was often characterized as being unique to white working-class voters in the upper Midwest. But this is wrong. Income growth has been sluggish, and hourly wage growth near-zero, for low and middle-income families across-the-board in recent decades. And many measures of racial income and wage gaps have actually worsened in recent years. In short, the income not going to white working-class residents of the upper Midwest has not been accruing to black and Latino workers; it’s instead just been funneled to the very top of the income distribution.

It’s not just politically important to realize that the economy’s failure to deliver income growth is not just a niche problem of white working-class voters in former manufacturing regions. This realization should also tell us something important about the economics of how to fix this. Too many have jumped to the conclusion that there’s just not much we can do for those workers that have been left behind in recent decades, because their troubles are mostly driven by huge, untamable forces like technological change and globalization. Here’s the astute economics writer Adam Davidson on Slate’s Political Gabfest podcast:

I know Hillary Clinton’s economic team fairly well, and I’m very impressed by them. They really are top-notch economists and economic policy thinkers. They don’t have anything for a 55-year-old laid-off factory worker in Michigan or northeastern Pennsylvania. Or whatever. They don’t have anything to offer them. And so I think it’s intuitively understandable that a screaming, loud, wrong answer is more compelling than a calm, reasonable, accurate, right answer: Your life is going to be worse for the rest of your life.

Andrew Puzder fails every test for a Labor Secretary

President-elect Donald Trump announced that he plans to nominate fast food CEO Andrew Puzder to head the Department of Labor (DOL). Puzder, who makes millions as a low-wage employer, fails every test for a Labor Secretary. DOL’s mission is to improve the wages and working conditions of working Americans, but Puzder wants to keep wages low and threatens to replace his fast food chain’s employees with robots if the minimum wage rises enough to crimp his profits.

He’s opposed to the new overtime rule that gave the right to time and a half pay to millions of salaried employees earning less than $47,476 a year. Walmart has already raised its managers’ pay, as did about half of all big retailers, even before the rule was supposed to take effect on December 1. But Puzder wants to kill it so he can keep working low-paid employees without paying them a dime extra for their overtime hours.

Heed union leader’s truth-telling on Trump/Carrier deal and judge on policy, not theatrics

Last week I argued that the Trump-brokered deal with Carrier industries to keep 700 jobs in Indiana shouldn’t be treated as a triumph, but instead as a sellout of those unlucky workers who hadn’t managed to make themselves useful as PR props for Trump. And yesterday somebody with actual credibility on this—Chuck Jones, a union leader who represents the Carrier employees—buttressed this argument.

One key point here is pretty simple: “doing deals” company-by-company, rather than instituting good policy rules across-the-board, will do nothing for American workers except pit them against each other. The Trump administration’s effectiveness in helping American workers should be judged on policy, not theatrics.

The biggest reason why this is true is that deals don’t scale-up against a recovering economy. A quick example: in the first quarter of 2009 (the first three months of President Obama’s presidency) 2.5 million workers were laid-off. In the most recent three months, 1.5 million workers were laid-off. What does this tell us?

First, that even in normal economic times, there is a ton of churn in the economy. Why do these 700 workers go to the front of the line in getting help from Trump while the other 1.4993 million are left on their own? An ironic note here is pointed out by Harold Meyerson: Trump never would have even heard of the planned Carrier move without the union (and Chuck Jones).

North Carolina voters’ anger about privatized infrastructure projects should serve as a warning to policymakers

Donald Trump’s preliminary plans for an infrastructure spending bill include a heavy role for private sector financing. We have argued elsewhere that this raises troubling questions. If our arguments have not yet persuaded policymakers on the dangers of wholly outsourcing infrastructure investment to private developers, perhaps they will be convinced by the result of a public-private partnership (P3) in North Carolina—an exercise in privatization that may have helped swing that state’s gubernatorial race.

Prior to the election, there was some speculation about whether or not an unpopular public-private partnership (P3) infrastructure deal in Charlotte would affect its outcome. The Charlotte Observer explains why initial indications suggest that this unpopular toll road did indeed likely sink the incumbent Governor McCrory’s bid for reelection. The issue is simple: North Carolina voters saw that the P3, which was sold on the basis of having a more innovative and competitive private sector direction, instead just became pure crony capitalism. The company got profits and excessive control in dictating what should be publicly-accountable decisions about public investments. North Carolina residents got tolls and are likely on the hook for taxpayer-funded bailouts. All in all, it is a clear cautionary tale about relinquishing control of infrastructure investments.

The Charlotte P3 financed the building, operating, and maintaining of new tolled express lanes on I-77. With mayors and governors usually hoping that ribbon-cutting on new infrastructure projects will be a boon to their campaigns, it may be surprising that additional lanes to alleviate congestion in a growing region would help sink a campaign. However, as is always the case with P3s, the devil is in the details.

Public-sector compensation should be a model for the private sector—instead, it’s under attack

With a raised hand, my daughter’s teacher can magically line up 20 kindergarteners who are running circles around a loud gym. She’s at school when I drop my daughter off in the morning and still on the job—calling us and other parents from the subway—as my family sits down to dinner. She says she never wanted to do anything else in her life besides teach, and her enthusiasm is infectious: my daughter wants to be a teacher when she grows up.

I encourage my daughter’s aspirations, even though teachers are underpaid and their jobs are challenging, especially in today’s high-stakes testing environment. But teachers have good insurance if they get sick or become disabled, and they are able to enjoy their hard-earned retirements. Though they’re paid significantly less than other workers with bachelors’ or advanced degrees, they’re part of close-knit school communities where almost everyone from custodians to principals is paid a livable wage with good benefits.

What Ben Carson should learn about housing segregation

President-elect Donald Trump proposes to nominate Ben Carson to head the Department of Housing and Urban Development (HUD). Mr. Carson has expressed opposition to the Obama administration’s new HUD requirement that cities and suburbs develop plans to end their segregation or face possible loss of federal funds. He calls this “social engineering,” and says that such well-intentioned programs have unintended consequences that their proponents later come to regret. Instead, he says, emphasis should be placed on revitalizing distressed minority neighborhoods in central cities.

What Mr. Carson’s view ignores is that the racial segregation of every metropolitan area in the nation is also the result of “social engineering”—the purposeful efforts of federal, state, and local governments to create and enforce the residential separation of the races. What the Obama administration has begun are plans to undo this social engineering. Failing to continue these plans doesn’t avoid social engineering—it perpetuates it.

Overtime ruling is wrong on the precedent, as well as the facts

Judge Amos Mazzant, the judge who blocked enforcement of the Department of Labor’s new overtime rule, said many things that aren’t true in his opinion, including misstatements of historical fact such as when a minimum salary for exemption was first included in the regulations (it was right from the beginning, in 1938, not two years later). But Mazzant gets judicial precedent wrong, too.

The decisions of the 5th Circuit Court of Appeals control in Judge Mazzant’s Texas district. Importantly, the 5th Circuit ruled in 1966, in Wirtz v. Mississippi Publishers Corp, that the salary level test for exemption is rationally related to the determination of whether an employee is employed in a bona fide executive capacity. In a case against a publisher that claimed its executives were exempt even though it paid them less than the minimum salary for exemption, the Court of Appeals forcefully rejected the argument that the regulations are so ambiguous as to make the salary requirement arbitrary and capricious.

Memo to inflation hawks: We are not at full employment

Please don’t be distracted by the drop in the unemployment rate today to 4.6 percent—which, incidentally, fell largely because of a drop in labor force participation. The most accurate measure of labor market slack (and thus, the most accurate indicator of when the Federal Reserve should raise interest rates) continues to be nominal wage growth, and all signs point to an economy continuing to recover. Wage growth should be much faster in a full employment economy, according to the Fed’s stated targets for inflation, which, last I checked, remains at 2 percent and long-term trend productivity growth, which has been running about 1.5 percent. (The recent slowdown in productivity could arguably be because of the low cost of labor and, therefore, reduced incentives to invest in capital and would likely rebound as labor markets get genuinely tight and start pushing wage-growth up.) Taken together, we are looking at target wage growth above 3.5 percent.

But year-over-year nominal wage growth came in at 2.5 percent last month. The figure below shows some indications of a pickup in the last few months, but no one should be counting their chickens until they are hatched. At 2.5 percent, growth noticeably slowed compared to last month’s high water mark of this recovery at 2.8 percent, or the previous month’s 2.7 percent. Yes, wage growth is now faster than it was in the first 5+ years of the recovery, when it averaged 2.0 percent. But, it doesn’t reflect full employment wage growth, or even the wage growth we experienced before the Great Recession hit – by no means a full employment economy.

The injunction against overtime has real consequences for people’s lives

The decision of a judge in Texas to block the Department of Labor’s new regulations guaranteeing overtime pay to millions of workers is a legal travesty, so poorly reasoned that it invites questions about the judge’s motivation. The decision is more than just bad law, however, it is also a financial blow to people who had every reason to expect that their lives were about to be made a little easier.

The new rules, which were set to take effect today, on December 1, would have required employers to pay time and a half the regular rate of pay for each hour worked beyond 40 in a week to any employee paid less than $47,476 a year. Prior to the Obama rule, employees earning as little as $23,660 could be called “executive” or “administrative” and denied overtime pay even if they spent the majority of their workweek scrubbing floors or stocking shelves. There are 12.5 million salaried workers earning between $23,660 and $47,476, and every one of them would be entitled to overtime pay under the new rule.

People all across America who have been working 5, 10, or even 20 hours of overtime a week without any extra compensation had been told by their employers that that their long hours were about to end, thanks to the Department of Labor’s new overtime rules. Or they were told that they were going to be paid extra for their extra hours of work, or that, at least, they were going to get salary increases to make those kinds of long hours more financially rewarding. Now, many employers have put those plans on hold. At EPI we’ve heard from a number of the affected workers.

What to Watch on Jobs Day: The economy is still moving towards full employment. The Fed should keep their foot off the brake so it can get there.

Friday is the last Jobs Report before the Federal Reserve’s final meeting of the year, when they decide whether to hold the course or raise rates. Rumor has it that the Federal Reserve might act in anticipation of a sizeable (if inefficient) short-run fiscal boost that could come if the incoming administration passes a planned tax cut mostly for the wealthy. But, there’s no reason to pre-emptively slow the economy down, given that we’re starting from less-than-full employment. Besides, there will be time to slow it down if and when the tax cut happens. Right now the priority should be keeping the economy on track and moving it forward.

The economy has continued to approach full employment, and signs of tightening are beginning to shine through, but we’re not there yet. The overall unemployment rate has come down, but remains elevated for workers of color and fails to reflect the sheer numbers of workers on the sidelines waiting to get in the game. The prime-age employment-to-population ratio has only recently surpassed the lowest point of the last two business cycles, not yet reaching the lowest point of the last one. That said, the economy continues to proceed in the right direction. Nominal wage growth has finally picked up a bit in the last year as workers see a slight increase in their bargaining power reflected in their paychecks.

Staying the course is the best action. Labor market tightness, leading to stronger wage growth as employers need to increase wages to attract and retain the best workers, should be the goal of policymakers, not a perceived danger to be stomped out.

The moral of the Trump/Carrier deal is clear: if you’re useful to Trump, he might be willing to throw other workers overboard to help you

Donald Trump is getting lots of mileage out of the alleged deal that has been struck to keep a Carrier plant from moving to Mexico from Indiana. If any of the reporting about the deal is correct, however, Trump clearly sold out the working class that he claims his deal helped.

First, let’s be clear—if it’s true that 1,000 jobs are kept in the U.S. and these workers are not laid off, that’s great for them and any relief and gratitude they feel about this deal is justified. Losing a job is terrifying, particularly in a country where policy titled towards the already-rich keeps good jobs scarce and makes losing a job so economically devastating.

But, let’s also be equally clear that even if this was somehow a good deal from a public policy perspective, it’s an entirely not-scalable approach to solving the challenges of globalization. A world in which your job depends on whether or not you’re useful as a public relations prop for the President is not a recipe for broad-based security.Read more

Ruling against overtime is wrong in so many ways

Judge Amos Mazzant’s opinion to block the Department of Labor’s new overtime rule is poorly reasoned and factually inaccurate. Judge Mazzant does not know the history of the Fair Labor Standards Act and he appears not to understand Chevron deference, a rule constructed by the U.S. Supreme Court to guide judicial review of federal agency regulatory decisions.

Let’s begin with Judge Mazzant’s astonishing unfamiliarity with the FLSA. Judge Mazzant incorrectly implies on page 2 of his Opinion that the initial regulations that accompanied the enactment of the FLSA in 1938 did not include a salary test:

“The Department’s initial regulations, found in 29 C.F.R. § 541, defined ‘executive,’ ‘administrative,’ and ‘professional’ employees based on the duties they performed in 1938. Two years later, the Department revised the regulations to require EAP employees to be paid on a salary basis.”

In fact, it was not “two years later” but right from the get-go on October 20, 1938 that the Secretary defined the exemption for executive and administrative employees to require a minimum salary of “not less than $30 (exclusive of board, lodging, or other facilities) for a workweek.”

Already a big gap between Trump’s promises to the middle class and his policies

During his campaign, President-elect Donald Trump promised that he would take the side of American workers against economic elites when evaluating policy. Yet, the policy proposals he put forth during the campaign had nothing in them that would actually help working- and middle-class Americans. Now that more plans and potential cabinet appointments are coming into focus, it looks worse than many of us thought even before the election. Across a broad range of crucial issues, the incoming Trump administration appears likely to betray the promises he made to the American middle class. Here’s a rough sketch of how.

Taxes

Trump’s tax policy proposals are crystal clear about who will benefit the most—and it’s not working- or middle-class families. Despite crowing during the campaign about raising taxes on “hedge fund guys,” the tax plan Trump released raises one small tax on hedge fund guys (eliminating the so-called carried interest loophole), and then gives them a hundred times more back in the form of lower taxes everywhere else. The top 1 percent will get 47 percent of the total benefits in the Trump tax plan, while the bottom 60 percent will get just 10 percent. Worse, large numbers of working-class taxpayers will see tax increases under Trump. Yes, increases. Because that money is needed to make sure that private equity managers can see their top tax rates moved down to 15 percent.

Trump’s infrastructure plan is not a simple public-private partnership plan, and won’t lead to much new investment

President-elect Donald Trump has indicated that one of his first priorities will be a plan to boost infrastructure investment. Normally, this would be welcome news for those of us who have been arguing for years that increased public investment—including but not limited to infrastructure investments—should be a top-tier economic priority. Further, it also seems like a rare opportunity for bipartisanship—after all, Hillary Clinton made infrastructure investment a priority of her campaign’s policy platform, as well.

The still-sketchy details of Trump’s plan, however, are a cause for concern. What we know is that the plan is to provide a tax credit equal to 82 percent of the equity amount that investors commit to financing infrastructure. In the coming days, this will invariably be described as creating public-private partnerships (P3s). P3s are a standard model for financing infrastructure that can in theory be used with little downside compared to direct public provision. However, this description of the Trump plan is both not that comforting and incorrect. It’s not comforting because the real-world record of P3s is much spottier than textbook models would suggest. And it’s not accurate because Trump’s plan isn’t as simple as encouraging new P3s. It is instead (at least in its embryonic form), simply a way to transfer money to developers with no guarantee at all that net new investments are made.

Let’s start with describing what a textbook P3 would look like and what the rationale for using it would be. P3s are long-term contracts between the state and private companies to build and maintain infrastructure. They can be thought of as sitting somewhere between standard public provision and full privatization of infrastructure. Say that a state or local government wants to build a new road, but is constrained for some reason (usually simpleminded anti-tax politics) from raising the money to publicly finance it. It’s important the democratically elected and accountable government ensure the project is in the public interest. Having done this, the government can then negotiate with private financiers and developers to get the project built. To reduce costs and provide incentives for development, tax breaks are sometimes provided to holders of bonds issued by the private entities, and the private entities also receive a revenue stream of some kind in exchange for their investment. Often this is an explicit user fee, like a toll for using a road.

CBO inflates its estimates of employer compliance costs

CBO released a report on the economic impact of repealing the Department of Labor’s new overtime rule, which raises the salary level for exemption from $23,660 a year to $47,476, thereby making about 4 million employees newly eligible for overtime pay and strengthening the right to overtime pay for about 8.5 million more. CBO concludes that repealing the new rule would have no appreciable effect on employment, would cut the pay of about 900,000 salaried employees who would lose the right to be paid for overtime they actually work, and would increase employer profits.

CBO’s analysis differs in significant ways from the Department of Labor’s, which predicted much greater pay raises for newly eligible workers and much lower compliance costs for employers. CBO exaggerates the extent to which repealing the rule would increase employer profits because it inflates the compliance costs that employers would avoid if the rule were repealed.

How will a Trump administration lift wages for the vast majority of Americans?

President-elect Donald Trump succeeded, in part, through an appeal to working class voters who have seen their incomes stagnate or fall for decades, the jobs they depended on moved off-shore, and their hopes for a secure retirement dwindle.

Trump correctly told them that U.S. trade treaties contributed to these problems and that the Trans-Pacific Partnership would only make matters worse. However, these trade treaties are just one way that policy has indeed been rigged to suppress wages for the vast majority of Americans. Millions of working Americans of all races are struggling, while the benefits of growth have gone only to people at the very top of the income ladder.

Working class Americans want what everyone wants: good jobs and hope for a better future. Now, the Trump administration and a GOP congress will have to deliver. How will a Trump administration lift wages for low and middle income Americans? As EPI has been promoting for decades, there are specific policies that will raise wages. The only way to raise wages for the vast majority of American workers is to give workers more power. For far too long, employers have held all the cards.

Trump has called for a higher minimum wage. A truly bold increase in the minimum wage would lift pay for the bottom quarter or more of the workforce.

The TPP is a back door for dumped and subsidized imports from China; it would enhance, not limit, China’s influence in the region

President Obama has built his closing case for the Trans-Pacific Partnership on a political argument, saying “…we can’t let countries like China write the rules of the global economy. We should write those rules.” But it is both arrogant and wrong to think that the United States has the power to shape the rules governing China’s relationship to TPP signatories. As of today, China has already established deeper trade ties than the United States with the TPP nations. Further, congressional approval of the TPP would actually lock in those advantages for China. China has a large trade surplus with the TPP countries, and crucial terms of the agreement (specifically weak rules of origin (ROO) requirements, which we’ll talk about in detail below) would provide a back-door guarantee for China and other non-TPP members to duty-free access to U.S. and other TPP markets. This would be especially significant for autos and auto parts, as well as other key products. TPP exporters are not going to turn away from their suppliers in China just because they signed a trade deal with the United States.

The United States has a massive trade deficit with China that has taken on added significance in the light of the proposed TPP agreement between the United States and 11 other Pacific Rim countries. While China is not party to the TPP, it is a major force behind a larger East Asian co-production system that uses unfair trade (dumping, subsidies, excess capacity, export restrictions, and more), coupled with currency manipulation and misalignment, to make U.S. goods more costly and thus less competitive in China, the TPP and in other markets.

The United States also had a large trade deficit with the TPP countries in 2015 that cost 2 million U.S. jobs. Flawed trade and investment deals, such as the North American Free Trade Agreement (NAFTA), plus the currency manipulation and unfair trade by some TPP members account for many of those lost jobs (note that Mexico and Canada are TPP countries). In addition, analysis developed here demonstrates that a substantial share of these TPP job losses can be directly linked to trade between China and the other members of the TPP. Specifically, most of the TPP countries run large trade deficits with China while running large, offsetting trade surpluses with the United States. Thus, it appears that at least some TPP producers are buying parts and components from China and re-exporting them in the form of finished goods to the United States.

Setting a higher bar for the economy—and policymakers

There was some good news in this morning’s Employment Situation Report. The economy added 161,000 new jobs in October—enough to bring in players off the bench. Perhaps most significantly, nominal wage growth increased 2.8 percent over the year, another step-up over the pace of growth in recent years and a sign of a tightening labor market, where workers may be starting to gain some leverage. All in all, last month was a solid step closer to full employment, but we still have not reached it yet. It’s important to remember that these positive highlights don’t mean we are at full employment. That’s why the Federal Reserve made the right decision to leave rates alone earlier this week. The economy continues to move in the right direction, but considerable slack remains and the recovery has yet to be fully realized in all parts of the economy or for all workers.

This month and this year, the economy has hit some milestones, but I’d argue that those are relatively low bars for success. For example, for the first time this recovery, the prime-age employment-to-population ratio (EPOP) exceeded its low point of the last two business cycles. As seen in the figure below, prime-age EPOP hit 78.2 percent in October, just surpassing its level in February 1993 of 78.1 percent. Is it good that the prime-age EPOP is rising? Yes, but, prime-age EPOPS remain below the low point of the last recession, let alone levels that could constitute a full employment economy. That’s what I mean by a “low bar.” But, the uptick last month is a good sign and I look forward to continued progress on this key measure.