Exports and growth: Running harder and falling behind

In his 2010 State of the Union address, President Obama pledged to double exports over the next five years, which would “support two million jobs.” How’s that working out? Not so well, despite claims to the contrary from the White House. In this year’s SOTU address, the president pointed to newly signed Free Trade Agreements (FTAs) with South Korea, Colombia and Panama as policies that will generate more exports, and they are, but the U.S trade deficit with those countries also increased last year. In short, it’s hard to argue that the Obama administration has taken any serious steps to make trade flows move from a minus to a plus in generating growth and employment in coming years.

Their rhetoric often suggests otherwise. Just last week, Deputy National Security Advisor for International Economic Affairs Michael Froman claimed that “last year our exports of goods alone to China exceeded $100 billion, and have been growing almost twice as fast as our exports to the rest of the world.” While this was a nice welcome for China’s Vice President Xi Jinping, who visits the White House today, it turns out that this nice round (and arbitrary number) was only reached if one is willing to overlook some key issues in trade data.

On the broader question of export growth, while exports to China and the world have been growing rapidly, the volume of U.S. imports increased much more rapidly – and this means that U.S. trade deficits with China and the world have increased rapidly over the past two years. This increasing trade deficit has generated a net loss in trade-related jobs with both China and the world as a whole. Thus, while export growth may have supported some new U.S. jobs, the growth in imports has displaced a much larger number of jobs. Between 2008 and 2010, the growth of U.S. trade deficits with China alone resulted in the loss of 453,100 U.S. jobs. A thorough jobs analysis of U.S. trade in the 2009-2011 period has not yet been completed. However, the U.S. trade deficit in non-oil manufactured goods, the most labor intensive portion of U.S. goods trade, increased by $129.3 billion in this period, displacing hundreds of thousands of U.S. manufacturing jobs.

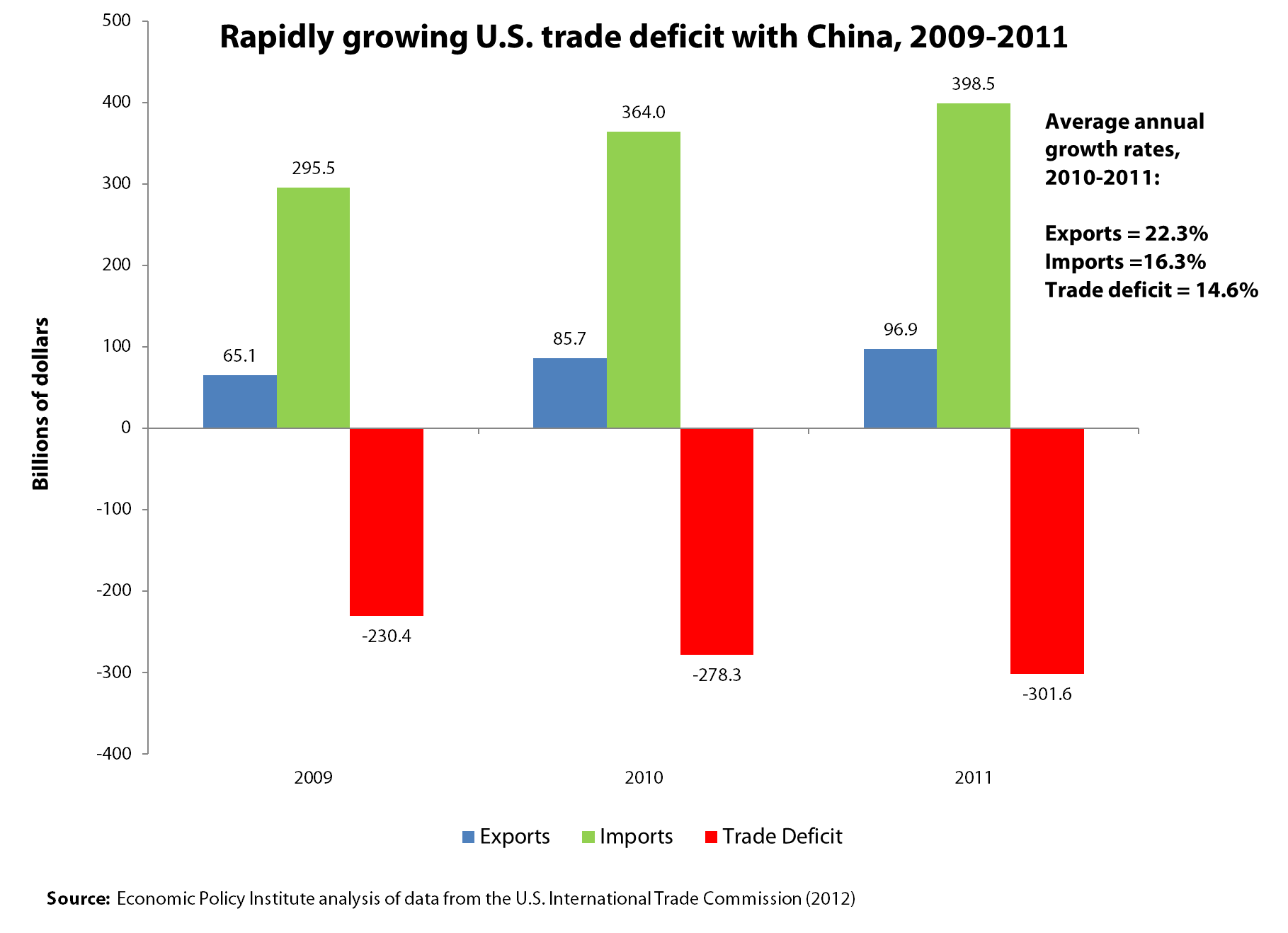

Exports to China increase at a relatively brisk pace of 22.3 percent on average over the past two years (since President Obama’s announced goal of doubling exports), as shown in the figure below. While this number sounds great in isolation, it was more than offset by the growth of imports from China, as shown in the figure; and U.S. trade deficits with China have soared.¹ So, even though exports to China are growing rapidly, the base (their initial level) is tiny compared with imports, which exceeded exports by more than 4-to-1 throughout this period. Therefore, in order to merely stabilize our trade deficit with China, exports would have to grow at least four times as fast as imports. In fact, imports from China grew nearly as fast as our exports to that country, and our bilateral deficit has increased 14.6 percent per year on average over the past two years.

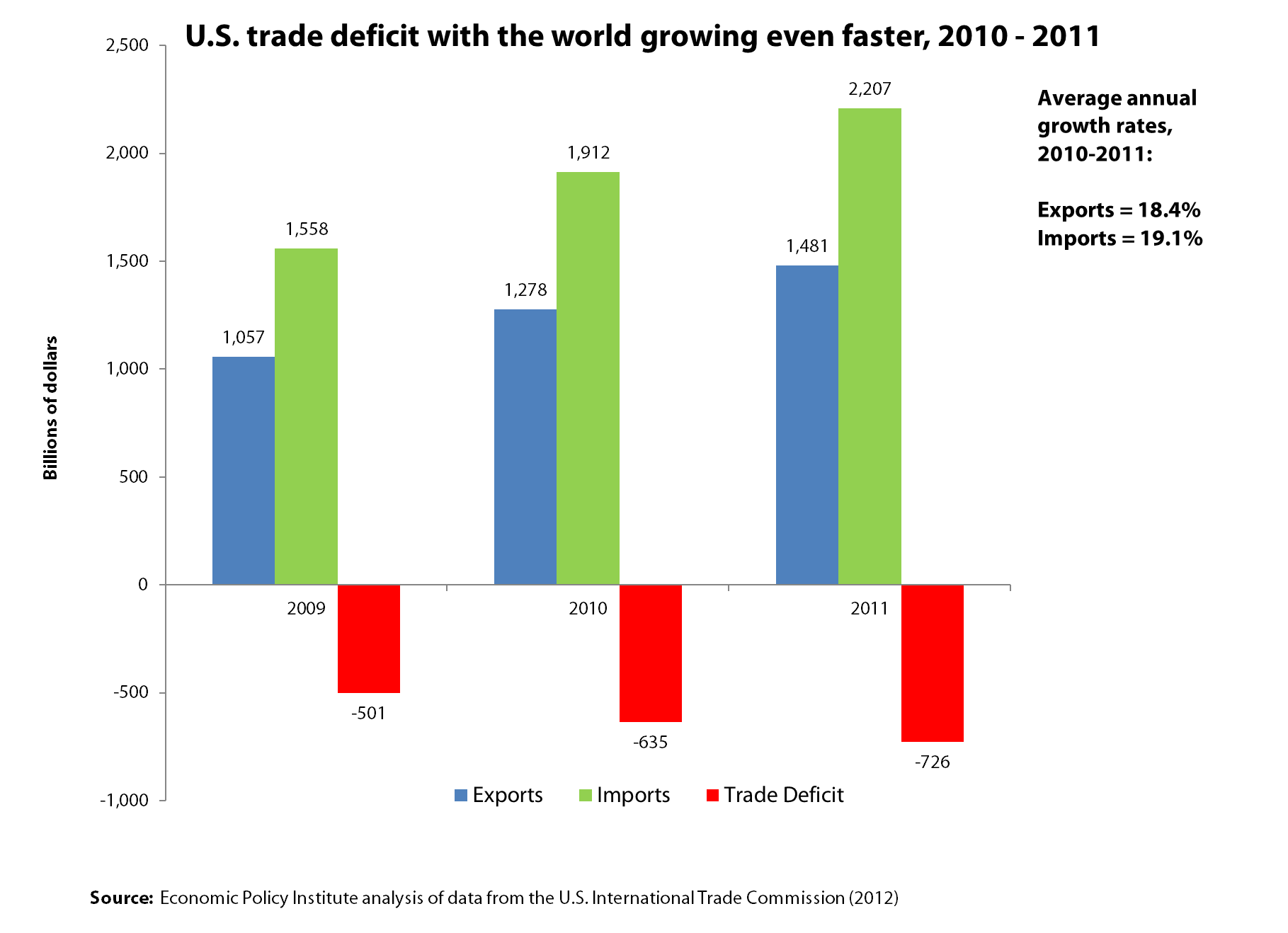

U.S. exports to the world have increased at a slightly slower rate of 18.4 percent per year over the past two years. Although this is slightly lower than the rate of growth of exports to China, at this rate, exports will double between 2009 and 2013, one year ahead of the goal set by President Obama. Time for a celebration and a tour of all those shiny new factories shipping exports to China, right? Not if we care about jobs. If imports and exports continue to grow at present rates, the U.S. global trade deficit will more than double by 2013 to more than $1 trillion. Millions more jobs will be lost, most of them in manufacturing. Again, the story is simple: Trade flows have two sides, imports and exports. Counting only one side tells you nothing about how policy has aided or hindered U.S. competitiveness in the global economy.

Readers will note that exports to China have grown only slightly faster than exports to the world over the past two years. Yet, Froman and other National Security staffers claim that our exports to China have grown twice as fast as those to the rest of the world; but this is because they looked at export growth going back to 2007, the year before the recession (and two years before any Obama administration policy could’ve ever had any effect). U.S. exports to the world collapsed in 2009 due to the financial crisis – international trade finance simply dried up. This was not a problem for Chinese importers – they were generating huge trade surpluses and had all the cash they needed to pay for imports from the United States. Much of what the U.S. exports to China are commodities and raw materials used to produce goods for export – four of the six most rapidly growing exports to China in 2011 were waste and scrap (steel and paper), raw agricultural products, chemicals and minerals and ores.

By including the big drop in U.S. exports to the world in 2009 (-18.7 percent), this four-year average rate of growth of total exports to the rest of the world is reduced to 7.1 percent. U.S. exports to China declined a paltry 2.6 percent in 2009, and the four-year average rate of growth was a healthy looking 13.0 percent.²

Lastly, take Froman’s claim that “last year our exports of goods alone to China exceeded $100 billion.” While U.S. exports did technically reach this (rather arbitrary) $100 billion benchmark in 2011, this is only true if one includes the $7 billion in re-exports (trans-shipments) for that year. Re-exports are goods that originate in other countries (e.g. Canada and Mexico) that are shipped through our ports to China without any value added in the U.S. – in short, it’s awfully hard to credibly call these “our goods.” Production of those goods supports no U.S. jobs and they should be excluded when analyzing bilateral trade flows. Domestic exports of U.S.-made goods to China were only $96.9 billion in 2011.

After two years, the net result of the president’s export campaign is that U.S. trade deficits with China and the world have increased by $71 billion and $225 billion, respectively. It’s time for the White House to acknowledge that rising imports and trade deficits are holding back the recovery and that we need to develop policies to address the root causes of these deficits. Perhaps the most important cause of our growing trade deficits, especially in manufactured goods, is currency manipulation by China and other Asian exporters. It’s time to get tough with currency manipulators.

References

U.S. International Trade Commission (U.S.I.T.C.). 2012. USITC Interactive Tariff and Trade DataWeb. Washington, D.C.: U.S.I.T.C. Available at: http://dataweb.usitc.gov/scripts/user_set.asp. Accessed December 13, 2012.

¹All trade statistics in this post are from the U.S. International Trade Commission, 2012. Bilateral trade statistics reported here are domestic exports and consumption. Re-exports (trans-shipments) are omitted from the totals shown in the first figure. Domestic exports to China in 2011 ($96.9 billion) were $7 billion less than total exports to that country of $103.9 billion, as reported by the White House.

²The three-year and two-year comparisons of average rates of growth of exports to China and the rest of the world do not support Froman’s claim that U.S. exports to China grew twice as fast as those to the rest of the world.

Enjoyed this post?

Sign up for EPI's newsletter so you never miss our research and insights on ways to make the economy work better for everyone.